Can I Print My Own 1099 Forms 2019

Confirm your printer settings then select Print. 1099-DIV for investment distributions and dividends.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

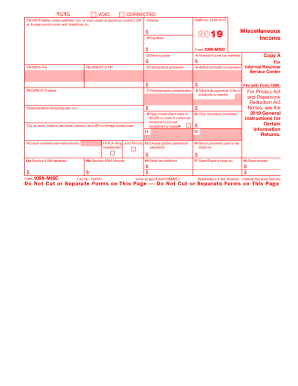

Not all Forms 1099 are printable through the IRS website because not all printed copies may be scanned and 1099s must be scanned to be accepted by the IRS.

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

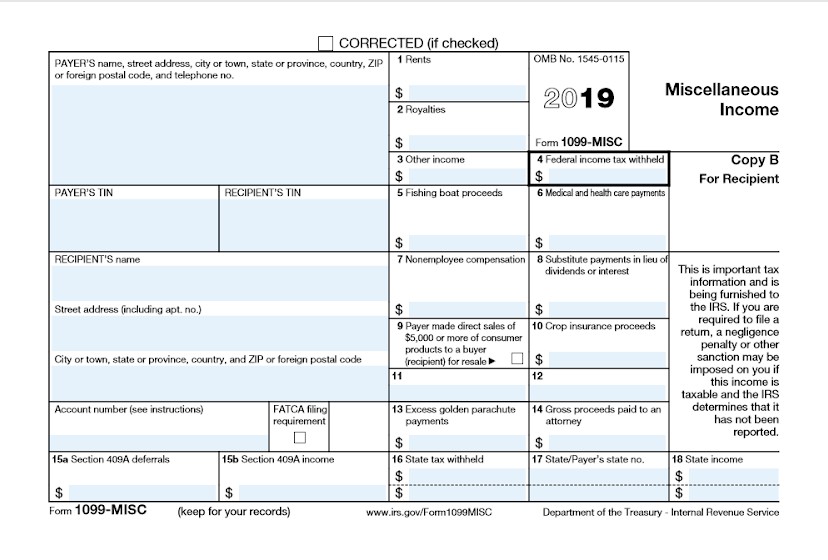

Can i print my own 1099 forms 2019. Fill out securely sign print or email your 2019 Form 1099-MISC - IRSgov instantly with SignNow. State youre filling in. Click on column heading to sort the list.

Enter a term in the Find Box. If you dont have access to a printer you can save the document on your. Printable from laser and inkjet printers.

Load your IRS-approved 1099 Copy A forms red pre-printed forms in your printer. You can order physical blank 1099 forms online or from an office supply store. This means that if you contracted with multiple companies and made 600 or more from each company you will receive multiple 1099s one from each company.

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income SSI. You then print it out yourself and mail it. If you e-Filed your 1099s you do not need to print these since Patriot is filing them with the IRS for you.

Pre-printed 1099-NEC kits are compatible with QuickBooks Online QuickBooks Online Payroll QuickBooks Desktop 2020 or later and QuickBooks for Mac 2020 or later. For Internal Revenue Service Center. You can certainly use the Adobe pdf blank 1099-MISC form available from the IRSgov website to print Form 1099-MISC and give copies B C to your independent contractors as well as others to whom you need to legally issue 1099s such as.

How do I get a copy of my 2019 1099 - Answered by a verified Social Security Expert We use cookies to give you the best possible experience on our website. Click on the product number in each row to viewdownload. An accountant can take your payroll information and file W-2 forms and 1099 forms for you in addition to helping you complete your business tax return.

Payroll software or a payroll processing service has all the information for filing W-2s and 1099 forms and they can file for you online. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. See IRS Publications 1141 1167 and 1179 for more information about printing these tax forms.

Additionally you must use perforated paper for some copies of forms that youre sending to employees. Common Types of Form 1099. You need to purchase the 1099 forms.

Select Print 1096s instead if printing form 1096. You may be able to enter information on forms before saving or printing. 1099-R for retirement account distributions from.

You then fill out and print both forms yourself and mail it out. For State Tax Department. You cant print them on plain white paper.

Once the form is accomplished push Carried out. A replacement SSA-1099 or SSA-1042S is typically available for the previous tax year after February 1. Select all vendors you wish to print 1099s for.

You can use plain white paper to print W-2 Copy A and W-3 forms. Select a category column heading in the drop down. You did not receive your Form 1099.

Follow the on-screen directions for obtaining copies of Forms 1099 that are not printable. Use the following instructions to print your Forms 1099-MISC and 1099-NEC. Youll need at a minimum Form 1099-MISC and Form 1096.

Department of the Treasury - Internal Revenue Service. Find out how to print. Department of the Treasury - Internal Revenue Service.

Specify the date range for the forms then choose OK. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. 1099-INT for bank account interest.

Step 5 Follow screen directions to print Form 1099. In the Choose a filing method window select the Print 1099-NEC or Print 1099-MISC button. This is the IRS copy.

1099-MISC for contracting and freelance work gambling and prize winnings and more. Instead the company who contracted you furnishes the form in January of the year after you complete the contract. After you print the A copy just reprint it with the proper form in the printer.

For Form 1099s Copy A uses red ink and must be ordered from the IRS or purchased from a tax supply vendor. All other parts of Form 1099 can be printed on plain white paper. Put an digital signature in your Form 1099-MISC with all the help of Indicator Instrument.

As a freelancer you do not generate your own 1099. Can i print my own 1099 forms 2019 can you print 1099 forms online can you print out 1099 forms free printable 1099 forms irsgov how can i get 1099 forms online. Select the Print 1099 button.

Distribute the prepared variety by way of e mail or fax print it out or help save with your device.

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Misc Forms

How To Fill Out And Print 1099 Nec Forms

How To Fill Out And Print 1099 Nec Forms

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Printable 1099 Misc Forms Fill Out And Sign Printable Pdf Template Signnow

Printable 1099 Misc Forms Fill Out And Sign Printable Pdf Template Signnow

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them