Unreimbursed Employee Business Expenses 2020

Oct 19 2020 Updated 918 AM ET Mon October 19 2020. He incurred 155300 of unreimbursed expenses consisting of 25300 for mileage 440 miles.

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Can I Deduct Unreimbursed Employee Business Expenses In 2019

Ordinary expenses are those that are common and accepted in your trade business or profession while necessary expenses are appropriate and helpful to your business.

Unreimbursed employee business expenses 2020. The TCJA eliminates it for tax years 2018 through 2025. Jan 03 2021 The deduction for unreimbursed employee business expenses was one of those that were affected. The IRS classifies employee expenses as ordinary and necessary expenses.

A necessary expense is one that is appropriate and helpful to your business. An ordinary expense is one that is common and accepted in your industry. Deduct unreimbursed employee business.

Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. Unreimbursed Employee Expenses.

2020 Schedule M1UE Unreimbursed Employee Business Expenses 9995 201641 Before you complete this schedule read the instructions to see if you are eligible. Cluding unreimbursed employee expenses. Unreimbursed employee expenses are those expenses for which the employer has not paid you back or given you an allowance for.

However you may be able to deduct certain unreimbursed employee business expenses if you fall into one of the following cat-egories of employment listed under Unreimbursed Em-ployee Expenses next or are an eligible educator as de-fined under Educator Expenses later. You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year for carrying on your trade or business of being an employee and ordinary and necessary. 2020 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee-basis state or local government officials and employees with impairment-related work expenses Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040-SR or 1040-NR.

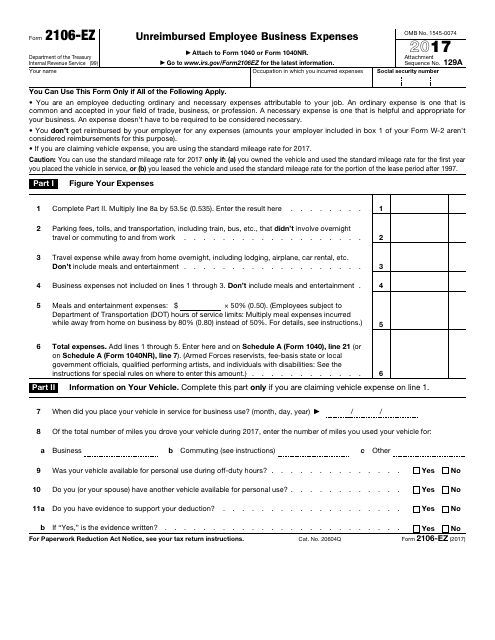

You can only deduct unreimbursed expenses that are ordinary and necessary to your work as an employee. About Form 2106-EZ Unreimbursed Employee Business Expenses. Jun 17 2020 Employees who are still working from their couches cant take a write-off on their 2020 federal return yet a handful of states will allow you a tax deduction for costs employers wont reimburse.

Which Expenses are Deductible in 2020. Accessed April 22 2020. 2 days ago This article was published by the IRS.

Your Expenses Column A Column B Continued. You might even be able to go back and file an amended return to claim it if you failed to do so when you. IRS Tax Tip 2020-155 November 16 2020.

Some costs that you may be able to deduct include. Jan 31 2020 These expenses used to be summarized on Form 2106 Unreimbursed Employee Business Expenses and deducted on Schedule A Itemized Deductions to the extent that they and similar expenses exceeded 2 of the taxpayers adjusted gross income. Only 50 of his meal expenses are deductible.

Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. They must complete Form 2106 Employee Business Expenses. Oct 06 2020 The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020.

Yes it doesnt seem fair that your employer can deduct the amounts they reimburse to you as a business expense but. Captain Harris a member of the Army Reserve traveled to a location 220 miles from his home to perform his work in the Reserves in April 2020. You can still claim this deduction if you havent yet filed your 2017 tax return however.

The Tax Cut and Jobs Act TCJA eliminated unreimbursed employee expense deductions for all but a handful of. Uniforms required by the employer that are not suitable for street wear Small tools. You can no longer deduct miscellaneous employee business expenses subject to the 2 adjusted gross.

An expense is ordinary if it is common and accepted in your trade business or profession. Review the General Guidelines for Unreimbursed Expense Documentation for a complete list. If both spouses are eligible and file a joint return they can deduct up.

Union dues agency fees or initiation fees. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. 575 cents a mile 300 for meals and 1000 for lodging.

Returns were allowed to include any unreimbursed work expenses as part of their miscellaneous. Qualified educators can deduct up to 250 of unreimbursed business expenses.

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Unreimbursed Business Expenses W2 Employees Does Your Employer Have An Accountable Plan

Unreimbursed Business Expenses W2 Employees Does Your Employer Have An Accountable Plan

What Is Form 2106 Ez Unreimbursed Employee Business Expenses Appcraver

What Is Form 2106 Ez Unreimbursed Employee Business Expenses Appcraver

What Law Firms Should Know About Employee Deductions Under The Trump Tax Bill Saville Dodgen Company

What Law Firms Should Know About Employee Deductions Under The Trump Tax Bill Saville Dodgen Company

2106 Employee Business Expenses 2106 Schedule1

2106 Employee Business Expenses 2106 Schedule1

Council Post When And Why Your Small Business Needs An Accountant Accounting Accounting Services Accounts Payable

Council Post When And Why Your Small Business Needs An Accountant Accounting Accounting Services Accounts Payable

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Tax Prep Checklist Tracker Printable To Stay Organized By Howtofire Tax Prep Tax Prep Checklist Prepping

Tax Prep Checklist Tracker Printable To Stay Organized By Howtofire Tax Prep Tax Prep Checklist Prepping

Unreimbursed Employee Expenses

Unreimbursed Employee Expenses

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

How Tax Reform Changed Deducting Unreimbursed Employee Expenses

How Tax Reform Changed Deducting Unreimbursed Employee Expenses

Re On 2020 Home Business Software Tt Does Not

Re On 2020 Home Business Software Tt Does Not

Elusive Employee Business Expense Tax Deduction In 2020 Tax Deductions Business Expense Deduction

Elusive Employee Business Expense Tax Deduction In 2020 Tax Deductions Business Expense Deduction

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

How The New Tax Law Affects Unreimbursed Business Expenses For Pastors The Pastor S Wallet

Employee Paid Business Expenses The Cpa Journal

Employee Paid Business Expenses The Cpa Journal

How Pastors Church Employees Can Get A Tax Break For Their Unreimbursed Business Expenses The Pastor S Wallet

How Pastors Church Employees Can Get A Tax Break For Their Unreimbursed Business Expenses The Pastor S Wallet