How To Submit Power Of Attorney To Irs

Submit a power of attorney. The individual you authorize must be a person eligible to practice before the IRS.

Https Www Irs Gov Pub Irs Prior I8821 2021 Pdf

Before obtaining an online power of attorney the tax professional must always obtain written authorization from the taxpayers.

How to submit power of attorney to irs. See Form POA-1 Power of Attorney for more information and instructions. A copy of the power of attorney must be submitted with the tax return. This power of attorney is being filed.

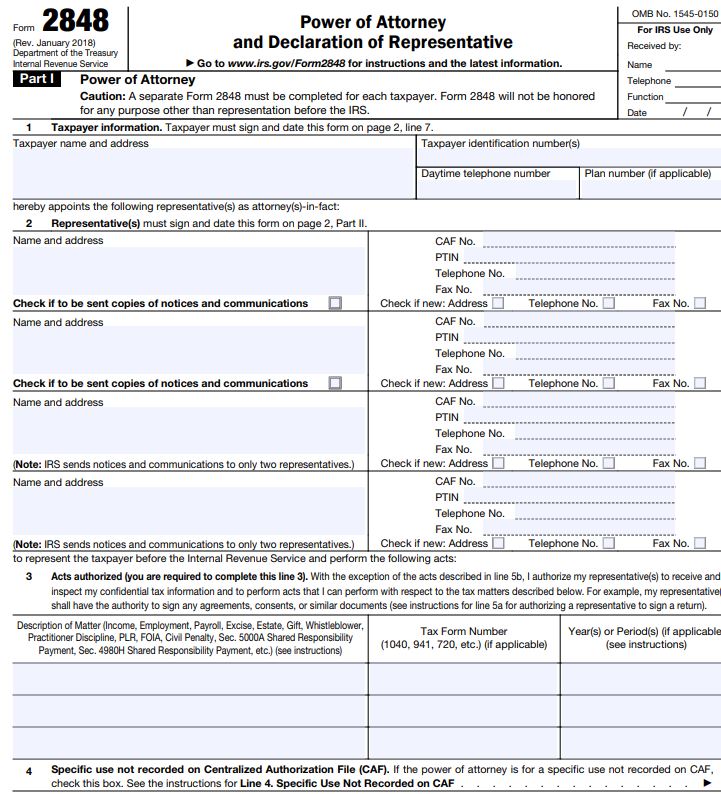

Note that these instructions differ if you are applying as a Third Party or as a taxpayer for his own account. Documents Authorizing Power Of Attorney. IRS Form 2848 is used to file for IRS power of attorney.

About Form 2848 Power of Attorney and Declaration of Representative. The steps will let you know where this information is different. To establish a power of attorney relationship you must fill out and submit the correct FTB form.

Visit power of attorney vs. The following documentation provides information on how to submit a power of attorney via the Georgia Tax Center. Individual or Fiduciary Power of Attorney Declaration FTB 3520-PIT Form.

When completing the online Form 2848 the tax professional represents to the IRS that he or she already has signed. Form 2848 should be completed with the exact information requested. Select the Type of power of attorney form from the list add a description then browse to locate the document to upload.

Use Form 2848 to authorize an individual to represent you before the IRS. Click the Add Attachment button to upload the POA form. Refer to IR-2021-20 for information about a new electronic submission option for Form 2848.

Answer a few questions about the form that will be submitted. All you need is an Online Services account. If efiling you would attach the form 2848 to the form 8453.

After registering with e-services creating the power of attorney is simple. How to Submit a Power of Attorney 5 Georgia Department of Revenue April 13 2018 8. You can use Form 2848 Power of Attorney and Declaration of Representative for this purpose.

You would include a copy of the form 2848 if you are filing a paper version. If you need to revoke an IRS power of attorney agreement or withdraw a representative you must write REVOKE across the top of the first page with a current signature and date below the annotation. Tax information authorization for more information.

Reporting Agent Authorization Form RD-1063 Form RD-1063allows a business taxpayer to designate a company as a reporting agent to access tax information and perform the. Individuals includes sole-proprietors estates and trusts. Upload a completed version of a signed Form 8821 or Form 2848.

If a representative only needs to review tax information a taxpayer can establish a Tax Information Authorization TIA relationship. The authorization to share information and to allow someone else to deal with the IRS for you is made on Form 2848. 1 Your tax information is.

This form is used by the taxpayer to authorize an individual to represent them before the IRS. If your return is signed by a representative for you you must have a power of attorney attached that specifically authorizes the representative to sign your return. A written document creating a lawful power of attorney also referred to as general power of attorney designating authority to prepare and file a tax return on behalf of the taxpayer.

How to Revoke a Power of Attorney. Do not submit a form online if youve already submitted it by fax or mail. If your agent e-files your return he or she should attach.

Choose the correct form. To do this you can use Form 2848. You can only submit one form at a time.

Check the box on line 4. If you want someone to talk to the department for you you will need to send us a power of attorney. Power of Attorney and Declaration of Representative.

The following methods may be used to authorize power of attorney. Common Reasons for Power of Attorney POA Rejection Avoid problems when filing Form 2848 Form 8821 and Form 706. Although the process of filing for IRS power of attorney is rather simple the steps that you take when completing Form 2848 are.

The document will appear in your Attachments list. Submit the completed Form RD-1062to the Department employee handling your inquiry. Sign and date the form.

Log in with your Secure Access unique username password and security code. Third Party Authorization Purpose. Taxpayers or their representatives may now submit Form POA-1 Power of Attorney online.

Check the box on line 5a titled Sign a return and write the following statement on the lines provided. Submit a power of attorney if you want to authorize an individual to represent you before the IRS. You may authorize a student who works in a qualified Low Income Taxpayer Clinic LITC or Student Tax Clinic Program STCP to represent you under a.

Submit Forms 2848 and 8821 Online You can safely upload and submit your clients third party authorization forms. You can also file a new Form 2848. Frequently Used Forms and Publications Links to frequently used forms and publications.

How to Submit a Power of Attorney.

Irs 9325 2017 2021 Fill And Sign Printable Template Online Us Legal Forms

Irs 9325 2017 2021 Fill And Sign Printable Template Online Us Legal Forms

Tops W 3 Tax Form Lttr 2 Part Carbonless 10 Continuous Forms Tax Forms Blank Form Form

Tops W 3 Tax Form Lttr 2 Part Carbonless 10 Continuous Forms Tax Forms Blank Form Form

Purpose Of Irs Form 2848 How To Fill Instructions Accounts Confidant

Purpose Of Irs Form 2848 How To Fill Instructions Accounts Confidant

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

All About Irs Form 2848 Smartasset

All About Irs Form 2848 Smartasset

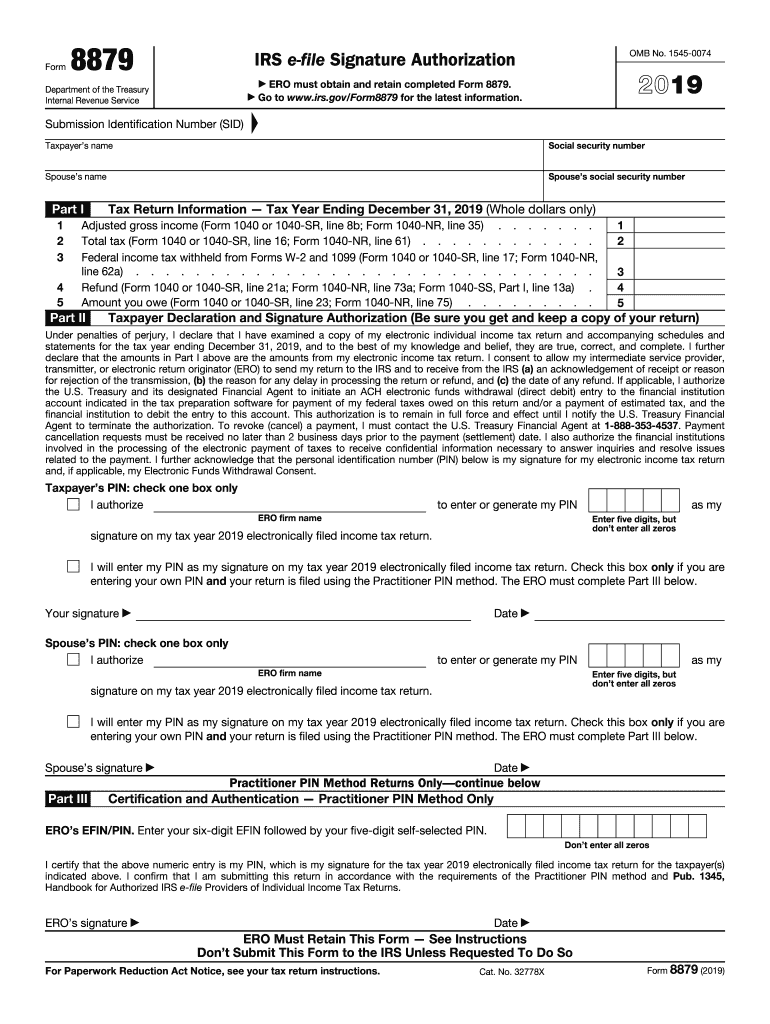

Irs 8879 2019 2021 Fill And Sign Printable Template Online Us Legal Forms

Irs 8879 2019 2021 Fill And Sign Printable Template Online Us Legal Forms

Submit The Irs W 2 Form Online Get Fillable And Printable Wage And Tax Statement Template With Detailed Instructions W2 Forms Tax Forms Power Of Attorney Form

Submit The Irs W 2 Form Online Get Fillable And Printable Wage And Tax Statement Template With Detailed Instructions W2 Forms Tax Forms Power Of Attorney Form

Rejected Offer In Compromise How To Negotiate With The Irs Offer In Compromise Negotiation Irs

Rejected Offer In Compromise How To Negotiate With The Irs Offer In Compromise Negotiation Irs

Image Result For 4506 T Irs Forms Power Of Attorney Form What Is A 1099

Image Result For 4506 T Irs Forms Power Of Attorney Form What Is A 1099

Submit The Irs Form 1099 Misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions E Fillable Forms Irs Forms Tax Forms

Submit The Irs Form 1099 Misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions E Fillable Forms Irs Forms Tax Forms

Free Missouri Power Of Attorney Form To Download Professional And Printable Templates Samples Charts For Power Of Attorney Form Power Of Attorney Attorneys

Free Missouri Power Of Attorney Form To Download Professional And Printable Templates Samples Charts For Power Of Attorney Form Power Of Attorney Attorneys

Form 433 A Due Diligence Checklist Locker Storage Checklist Make More Money

Form 433 A Due Diligence Checklist Locker Storage Checklist Make More Money

Irs Rolls Out Online Option For Submitting Authorization Forms

Irs Rolls Out Online Option For Submitting Authorization Forms

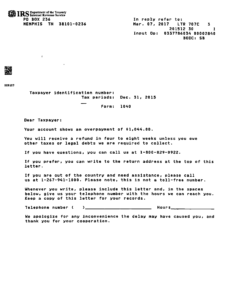

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

Https Www Irs Gov Pub Irs Prior I2848 2018 Pdf

Irs 8879 S 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs 8879 S 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs Ein Online Application Know The Benefits And Make Your Application Business Bank Account Filing Taxes Irs

Irs Ein Online Application Know The Benefits And Make Your Application Business Bank Account Filing Taxes Irs

Missing Receipts And Irs Audits What Should I Do Irs Receipts Tax Prep Checklist

Missing Receipts And Irs Audits What Should I Do Irs Receipts Tax Prep Checklist