Can I Claim Child Care Expenses Without Receipts

Jan 01 2009 Favorite Answer Yes you can still still claim those child care expenses on your taxes. What payments can you claim.

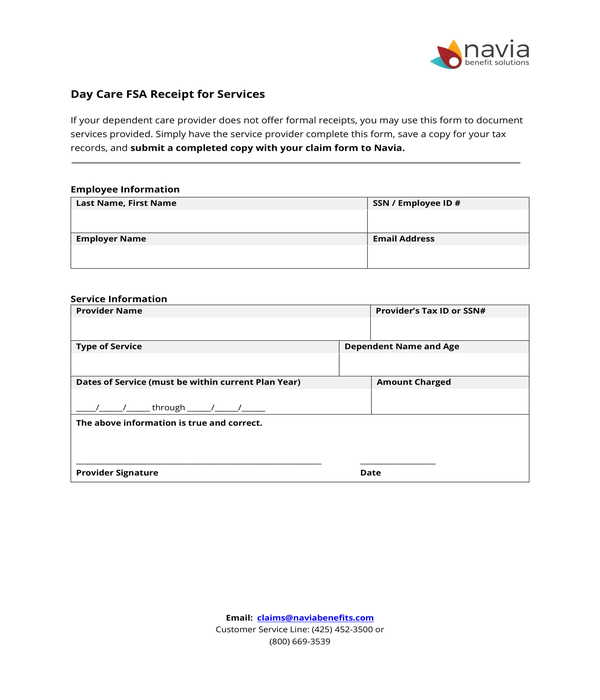

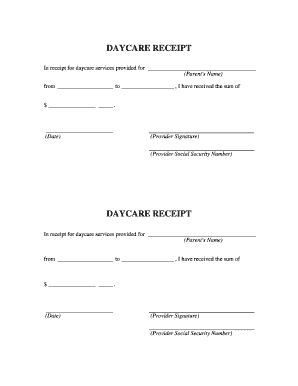

Free 5 Daycare Receipt Forms In Pdf

Free 5 Daycare Receipt Forms In Pdf

Aug 19 2020 The IRS allows you to deduct certain childcare expenses on your tax return.

Can i claim child care expenses without receipts. Examination of these returns may result in the following. Take the smallest of all these amounts. As I mentioned any changes other then medical receipts or unused rrsps can be claimed carried forward however for childcare it must be entered in the year that you have paid it.

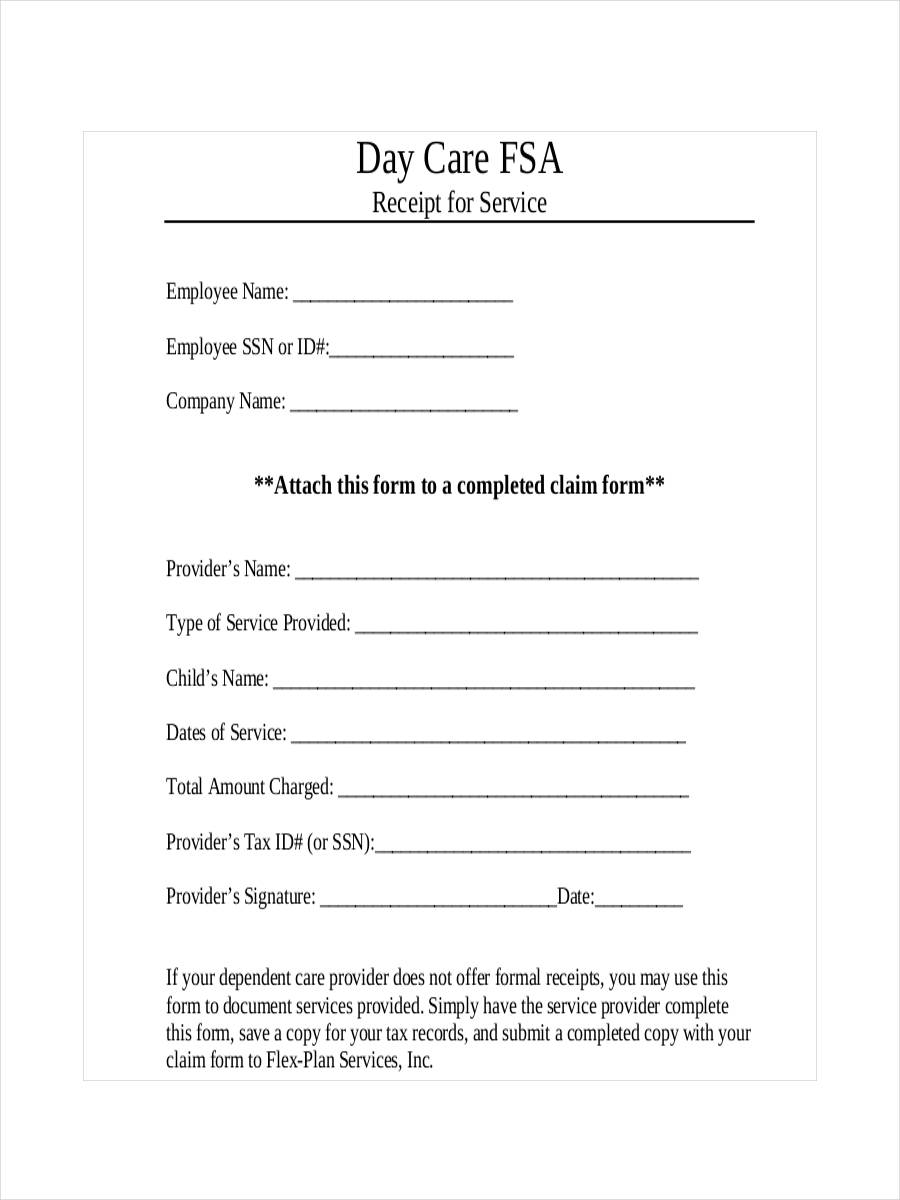

Sep 28 2020 You can claim child care costs paid to day nursery schools and daycare centers caregivers such as nannies overnight boarding schools and camps that provide lodging day camps and day sports schools. Dec 04 2019 Child care expenses including babysitters and daycare are tax deductible but there are limitations on who can claim the expenses. By federal law daycare providers are required to provide their clients with either their SSN or EIN Employer Identification Number no later than Feb 2 2014 for this year.

To be eligible the primary purpose of the day camp or day sports school must be to provide child care. To claim an expense you must have a record of that expense eg a receipt or Inland Revenue may not allow the expense to be claimed. The amount you can claim will depend on what receipts you have kept and to what extent you use it for income producing purposes.

May 31 2019 So if you are the custodial parent then YES you can claim the dependent care credit every year If you are not theres still good news. Jun 08 2019 How can I claim child care credit with no EIN or social. 1Get your receipts together.

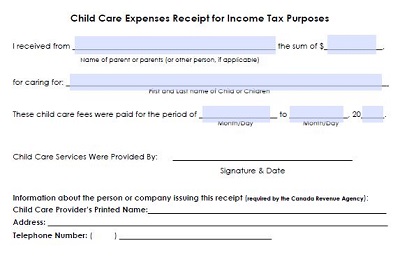

If you are in the situation where you are wondering what you can claim without receipts you can claim less than 300 without proof of purchase. They must provide you with their Social Insurance Number SIN on the receipt and without this receipt you cant make a claim. Youll likely need to complete a claim form provided by your employer and provide receipts or proof of payments.

National Resource Center for Health and Safety in Child Care and Early Education provides links to individual states child care regulations as well as licensing and child care-related contacts. The first step in making a proper claim is getting a receipt for your childcare expenses from your childcare provider. Mar 15 2021 You cant use expenses paid or reimbursed with these benefits to claim the childcare credit.

This guide will focus on the income and expenses of a child care provider. Subtract the Box 10 amount from the amount of the child and dependent care credit you can claim. If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a tax credit.

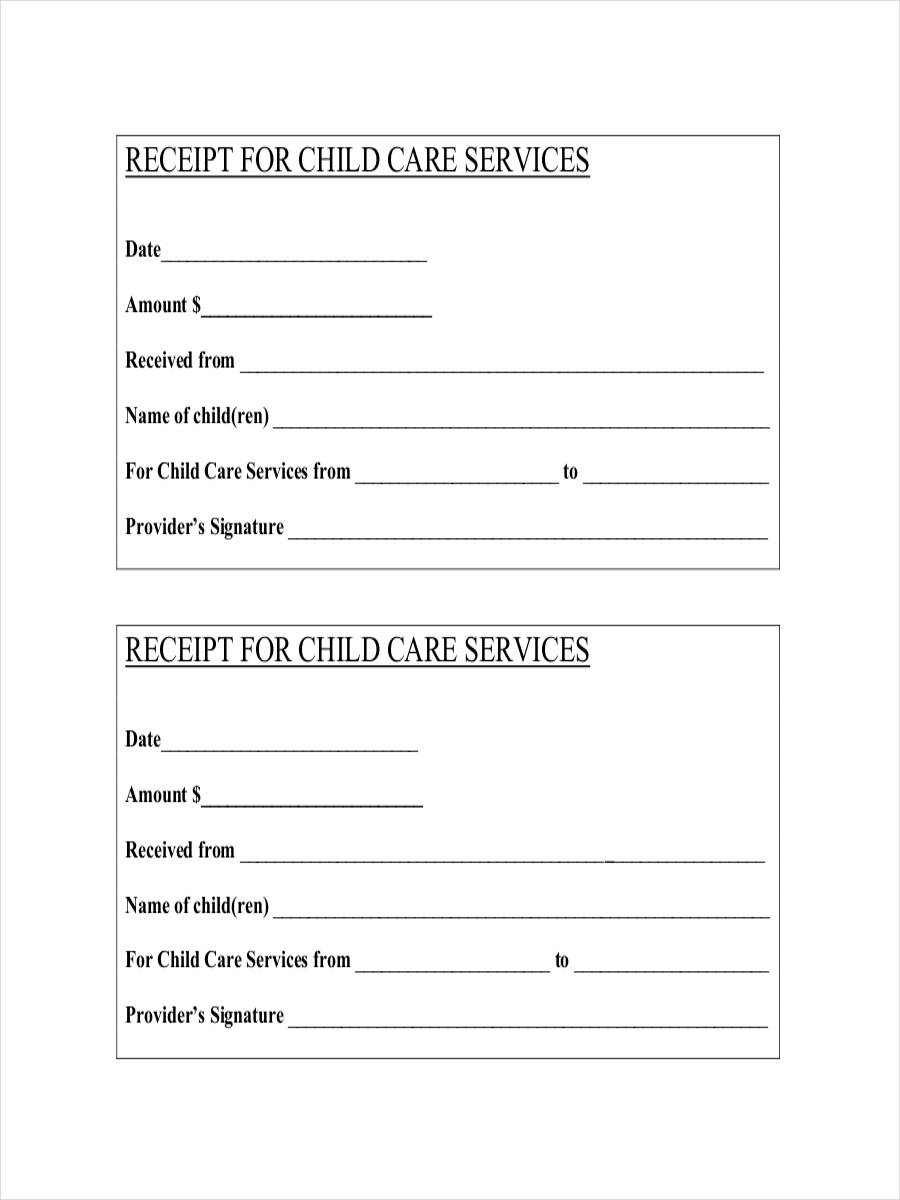

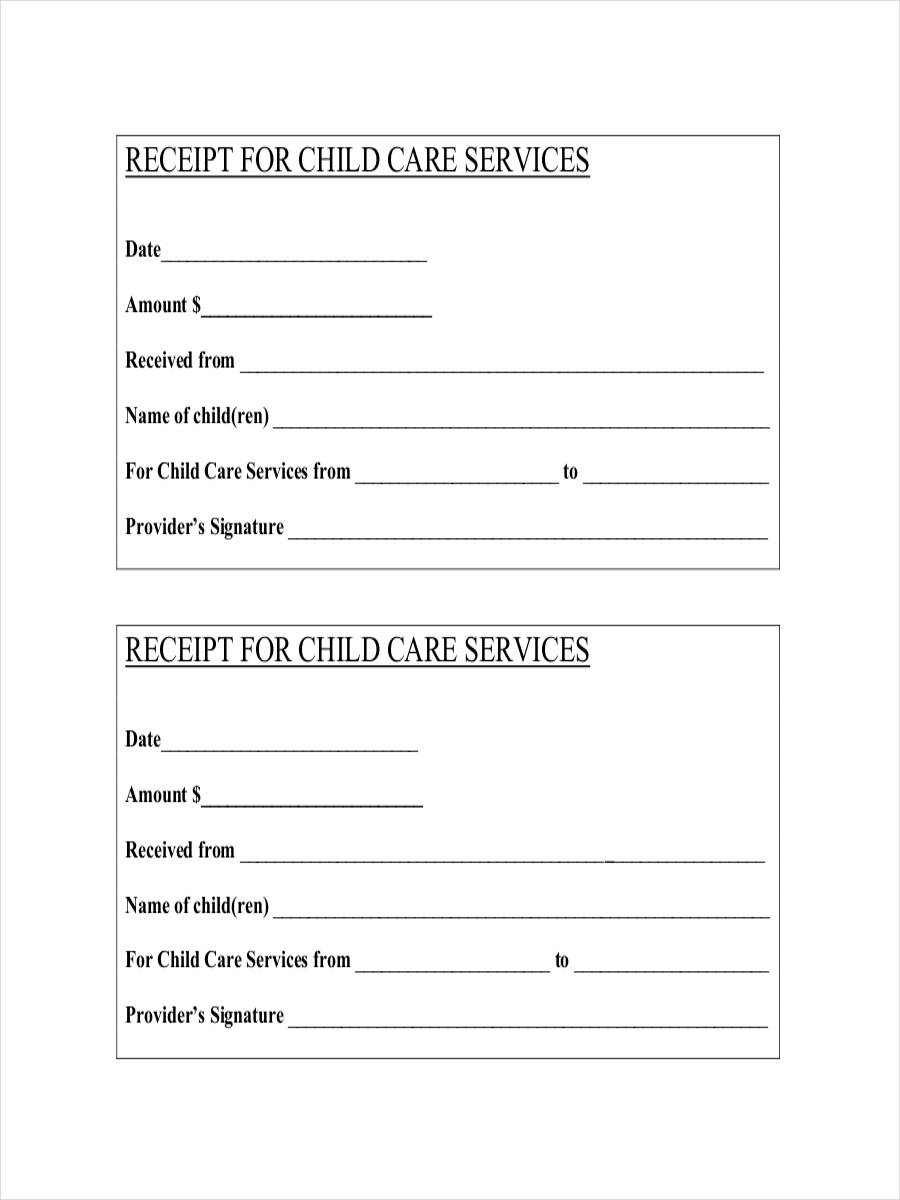

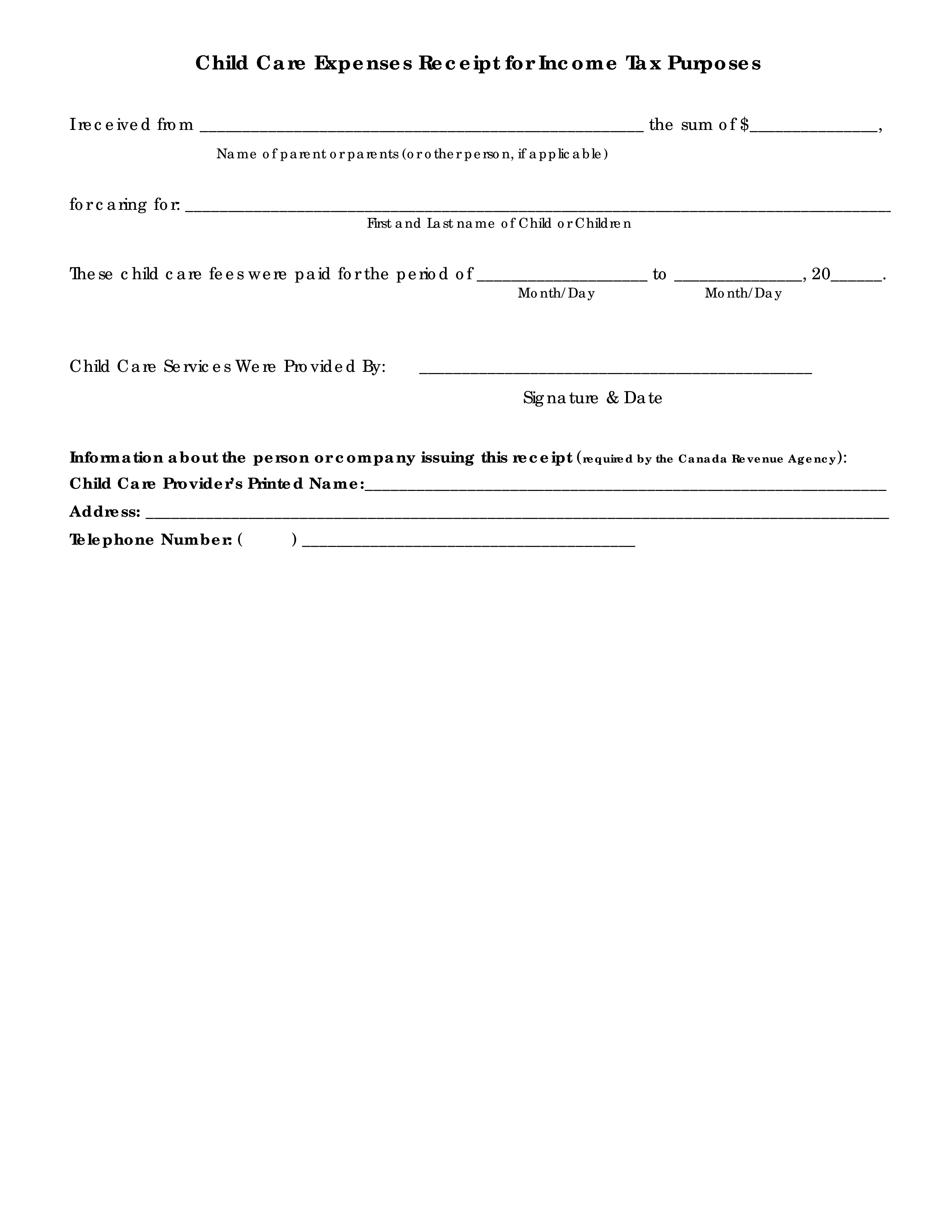

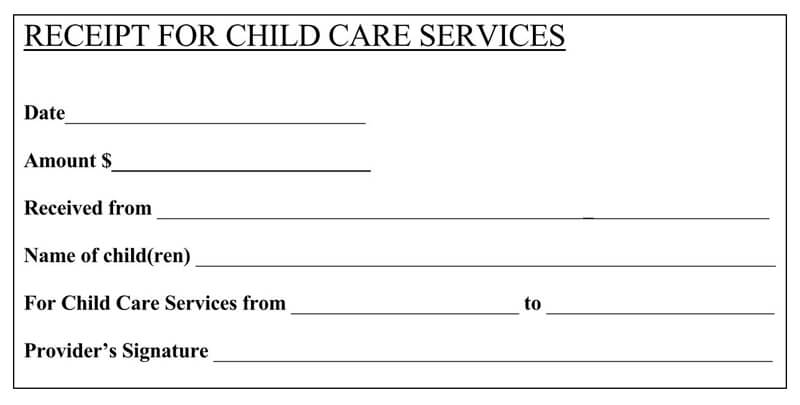

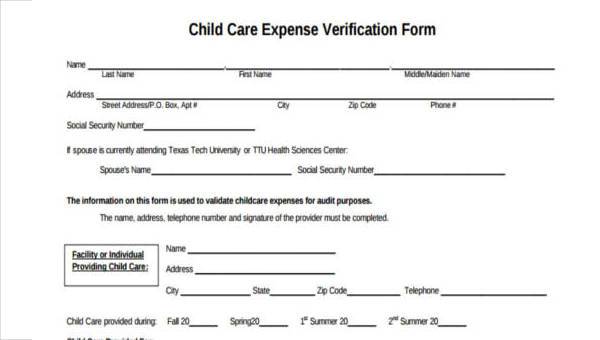

Nov 15 2019 Now that you have your Dependent Care FSA up and running and enjoying the tax-free benefits its time to get reimbursed for your dependent care expenses. Like any salary receipt example acceptable receipts for daycare expenses very from state to state. Who can claim child care expenses.

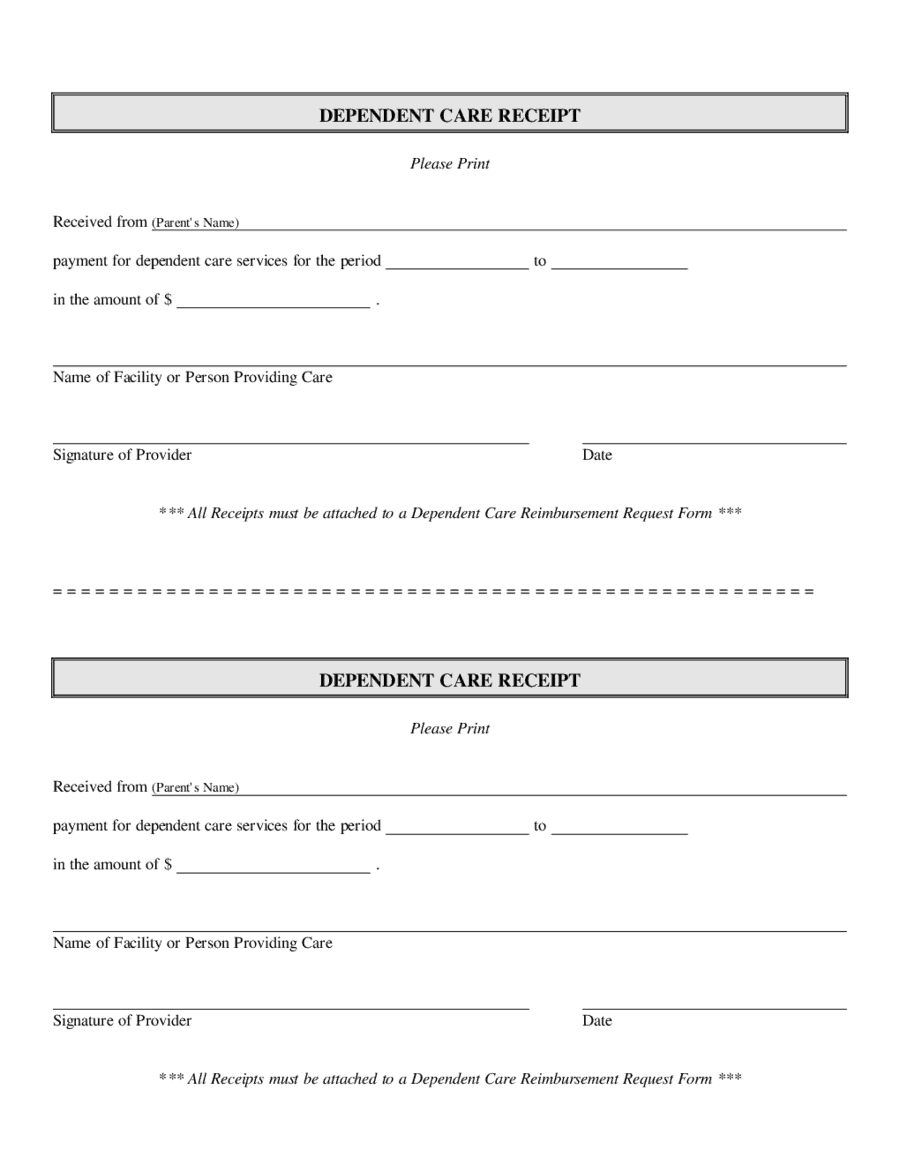

Date of the expense or service start and end dates. This is why I have given you the information on the changes that need to be made. If your employer gives you money to pay child care expenses or if you have money withheld from your pay on a pre-tax basis you must subtract this money received from your allowable expenses.

2Who makes the claim. In Canada if you pay an individual person such as a nanny or. For whom can you claim child care expenses.

Compare your claimed expenses with your earned income and if youre married your spouses earned income. Definition of an eligible child. You may need to include.

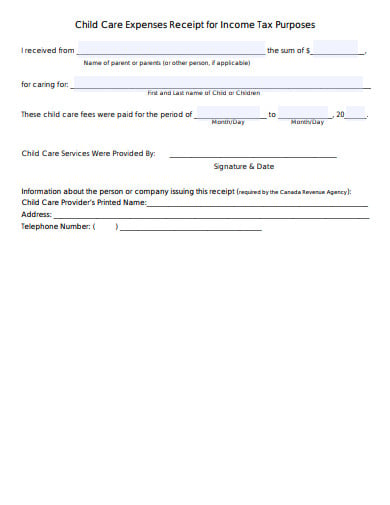

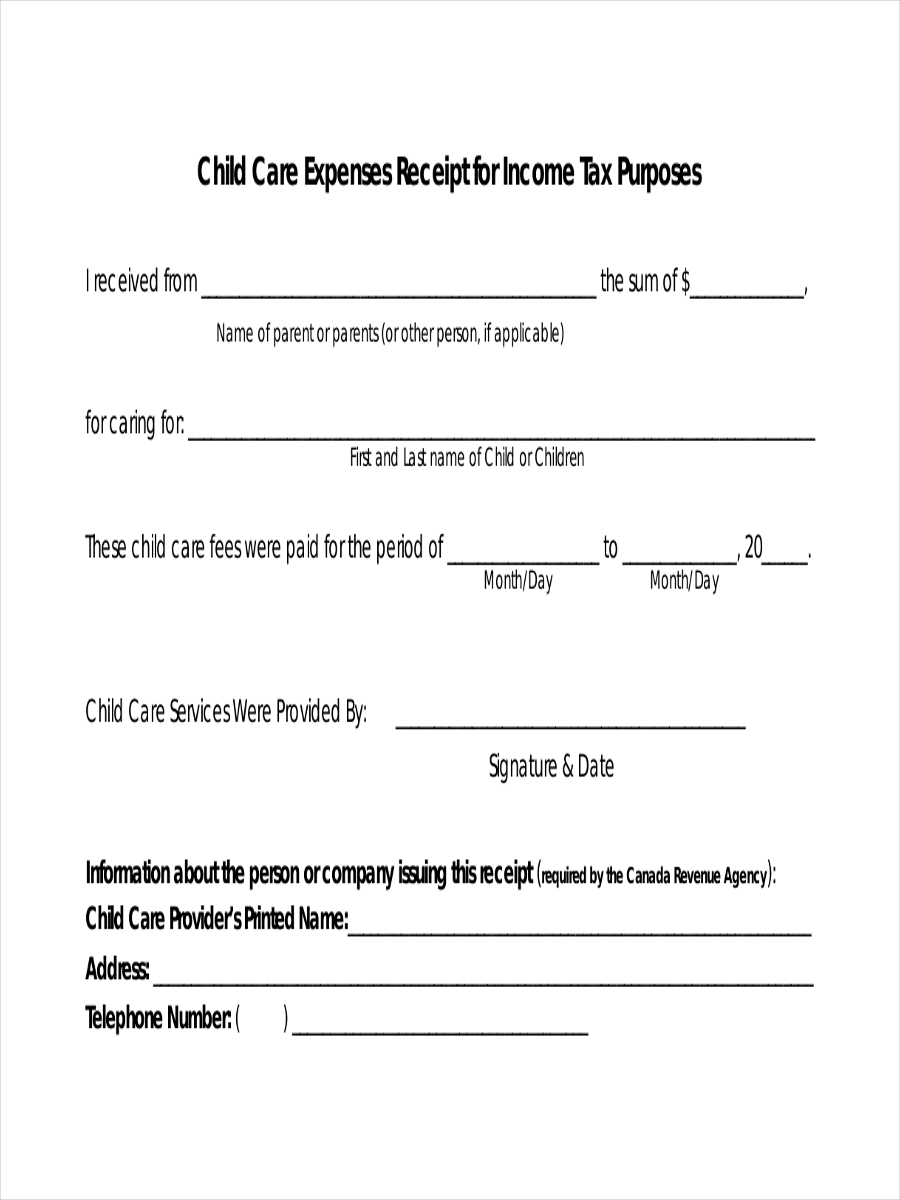

Information about child care services receipts and more. The daycare providers social security number in order to claim for daycare expenses in the filing of taxes. When your W-2 shows dependent care benefits you must complete Form 2441 Form 1040 Part III.

What payments can you not claim. The full name and contact details of the daycare provider with accompanying signature. The general rule is that a taxpayer must actually make the payment as well as be legally liable to pay it to get the deduction.

In most cases the IRS will not audit child care expenses on your child but it will be a. Deduct expenses from what youve earned from your business during the year. For example in a two-parent household only the spouse or common-law partner with the lower net income can claim child care expenses.

At the end of the year your business accounts will need to be completed totalling up all your income and expenses. Basically a daycare receipt must have. Find out who between you and your spouse or common-law partner if any can claim child care expenses.

If your ex works she can claim that credit based on the money you paid.

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Telecharger Gratuit Child Care Expense

Telecharger Gratuit Child Care Expense

10 Free Daycare Receipt Templates Word Pdf

10 Free Daycare Receipt Templates Word Pdf

Unique Childcare Receipt Child Care Invoice Template Child Care Care Child Childcare Invoice Receipt Tem Childcare Receipt Template Invoice Template

Unique Childcare Receipt Child Care Invoice Template Child Care Care Child Childcare Invoice Receipt Tem Childcare Receipt Template Invoice Template

Here Is A Pretty Receipt For Year End Daycare Services That Can Be Used For Your Daycare Business You Need To Free Child Care Starting A Daycare Daycare Forms

Here Is A Pretty Receipt For Year End Daycare Services That Can Be Used For Your Daycare Business You Need To Free Child Care Starting A Daycare Daycare Forms

Free 7 Expense Receipt Templates In Ms Word Pdf

Free 7 Expense Receipt Templates In Ms Word Pdf

Browse Our Printable Receipt For Child Care Services Template Child Care Services Receipt Template Childcare

Browse Our Printable Receipt For Child Care Services Template Child Care Services Receipt Template Childcare

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

Free 9 Daycare Receipt Examples Samples In Pdf Doc Google Docs Google Sheets Excel Word Numbers Pages Examples

4 Dependent Care Receipt Templates Word Excel Templates

4 Dependent Care Receipt Templates Word Excel Templates

30 Sample Receipt For Child Care Services Pdf Word Template Republic

30 Sample Receipt For Child Care Services Pdf Word Template Republic

Dependent Care Receipt Fill Out And Sign Printable Pdf Template Signnow

Dependent Care Receipt Fill Out And Sign Printable Pdf Template Signnow

6 Nanny Receipt Templates In Pdf Free Premium Templates

6 Nanny Receipt Templates In Pdf Free Premium Templates

Child Care Receipt Template Fill Online Printable Fillable Blank Pdffiller

Child Care Receipt Template Fill Online Printable Fillable Blank Pdffiller

Free 5 Expense Receipt Examples Samples In Pdf Doc Examples

Free 5 Expense Receipt Examples Samples In Pdf Doc Examples

Free 8 Sample Child Care Expense Forms In Pdf Ms Word

Free 8 Sample Child Care Expense Forms In Pdf Ms Word

Free 7 Expense Receipt Templates In Ms Word Pdf

Free 7 Expense Receipt Templates In Ms Word Pdf

21 Daycare Receipt Templates Pdf Doc Free Premium Templates

21 Daycare Receipt Templates Pdf Doc Free Premium Templates

Explore Our Sample Of Child Care Expense Receipt Template Child Care Services Receipt Template How To Get Money

Explore Our Sample Of Child Care Expense Receipt Template Child Care Services Receipt Template How To Get Money