Does A Company That Is Incorporated Get A 1099

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. Sole proprietor Do send 1099-MISC.

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

It depends on the type of payment.

Does a company that is incorporated get a 1099. If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year. Attorneys fees even if the lawyer is incorporated. Or Ltd are also exempt from 1099 requirements with the exception of those you pay for medical or health care or law firms that youve hired for legal services.

The IRS considers trade or business to include. Alas there are some exceptions to this rule. Unincorporated contractor or partnershipLLP Do send 1099.

Most payments to incorporated businesses do not require that you issue a 1099 form. Typically youll receive a 1099 because you earned some form of income from a non-employer source. According to the IRS 1099 instructions attorney fees for legal services must be reported on a Form 1099 regardless of whether the law firm or legal service is incorporated or not.

There are a few exceptions to that rule however. You made the payment to someone who is not your employee. Ironically the government doesnt trust that lawyers will report all of their income so even if your lawyer is incorporated you are still required to send them a Form 1099 if you paid them more than 600.

When a business pays an independent contractor for services performed in the course of that business the service recipient must file Form 1099 MISC if the payment is 600 or more for the year unless the service provider is a Corporation. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. Corporations are exempt recipients but a 1099-MISC may be required under certain circumstances.

Those corporations that have filed a S-Corp election with the IRS. If the following four conditions are met you must generally report a payment as nonemployee compensation. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return.

For contractors that operate and file taxes as corporations such as a C-corp. Most Limited Liability Companies ARE NOT INCORPORATED so you need to issue 1099s to them. You should get the form.

For tax purposes theyre treated as corporations so in general they dont get a 1099. We have attached a blank W-9 for your convenience. This exception also applies to limited liability companies that elect to be treated as corporations.

You still need to issue 1099s for. Heres another way to remember. In this case a manager or member of a company can file a 1099 for that person since for tax purposes the LLC is treated as a person.

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. Generally speaking a business is not required to file a 1099 regarding contractors to. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC.

As a general rule a business doesnt need to issue a 1099 to a corporation or an LLC organized as a corporation. You may begin to receive these documents as. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

An LLC that elects treatment as an S-Corporation or C-Corporation Do NOT send 1099. The business serves as the issuer of the Form 1099 and uses it as a means of showing expenses to the IRS while the contractor is the payee using the form as a means of demonstrating their taxable income. But not an LLC thats treated as an S-Corporation or C-Corporation.

How do you know if they are incorporated. 1 Operating for gain or profit A non-profit organization including 501 c3 and d organizations. Lawyers get the short end of the stick.

However a few exceptions exist that require a. Those whos names contain Corporation Company Incorporated Limited Corp Co Inc. The business owner is responsible to issue the proper 1099 to those paid through Venmo.

Send a W-9 to the CompanyIndividual - the form has a box for the Company to check if they are incorporated.

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

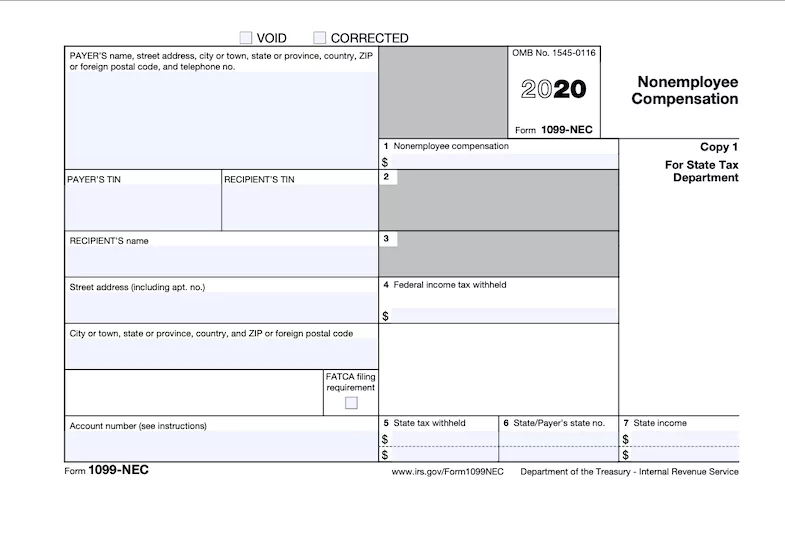

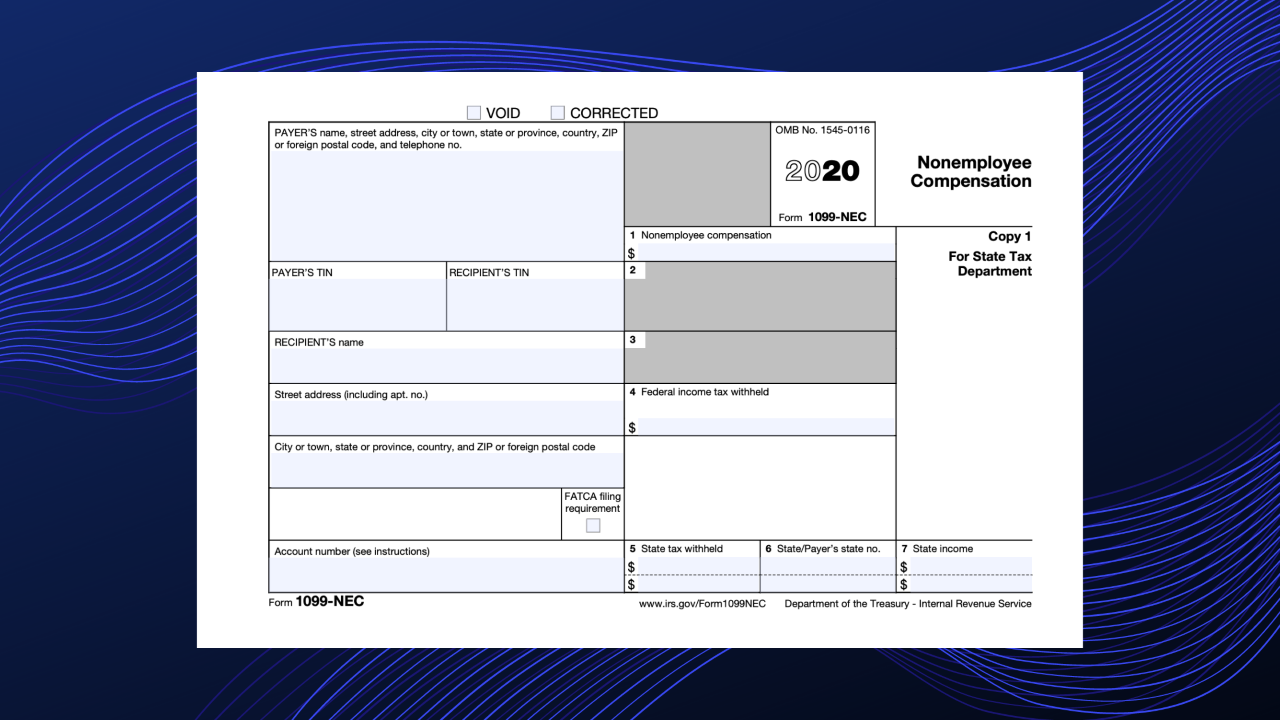

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

1099 Int Software To Create Print And E File Irs Form 1099 Int Letter Of Employment Tax Forms 1099 Tax Form

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

The 1099 Decoded The What Who Why How 1099s Small Business Finance Small Business Bookkeeping Business Tax

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C