How To Register My Business With Sars

General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C. Once youre registered SARS will automatically issue you with a tax reference number.

Your tax registration numbers.

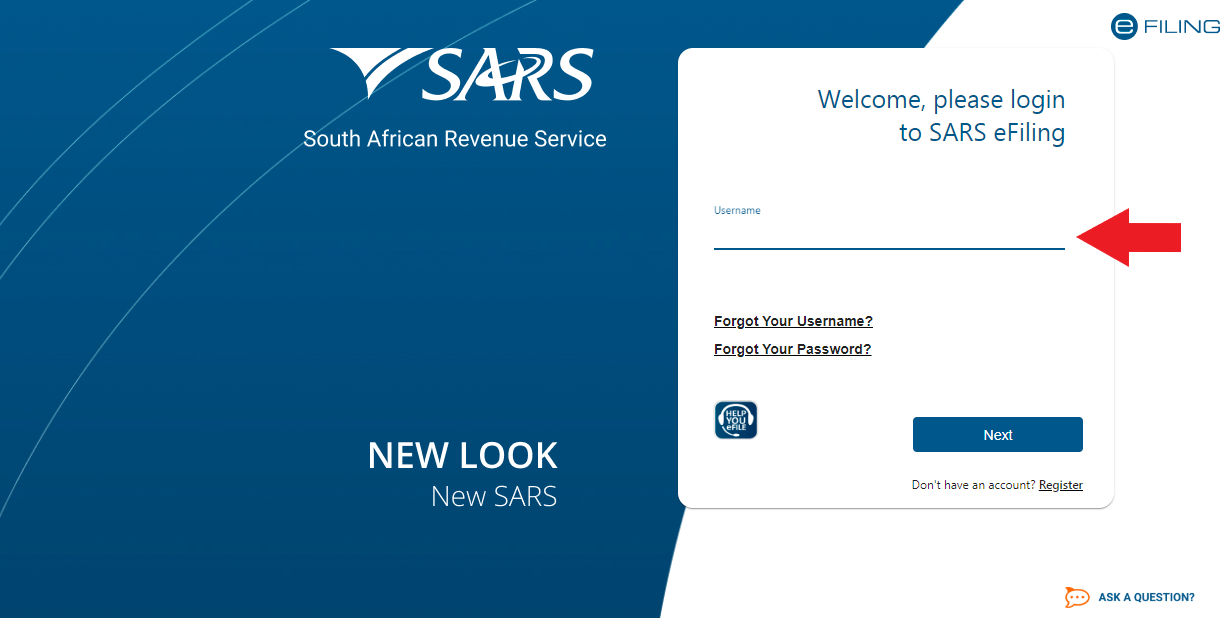

How to register my business with sars. We offer the following services. Well show you how to register a company profile on eFiling. Once youre on the site simply click Register Now to get started.

For the owners of private companies registering a new company through the CIPC website often leads to automatic SARS registration. Login to SARS eFiling 3. You need to be registered for eFiling and have one tax type activated on your eFiling profile in order to activate the TCS service.

For more information on Employees tax see the. Follow these easy steps. If you register your company in this way you will shortly receive an email from SARS informing you of your new company tax number.

Followed by the Online Application FormThe first step is to register your company at the CIPC with one of our consultants. For CIPC registered companies you are not required to perform a separate SARS tax registration for Income Tax as your company will automatically be registered via a direct interface with CIPC. Below is a list of documents needed to register as a taxpayer in SA or change your registered particulars.

Alternatively you can do this via MobiApp which can be downloaded on the Play Store or App Store. Go to the Organizations main menu 4. Should you need to register for tax manually with SARS you should use Form IT77C.

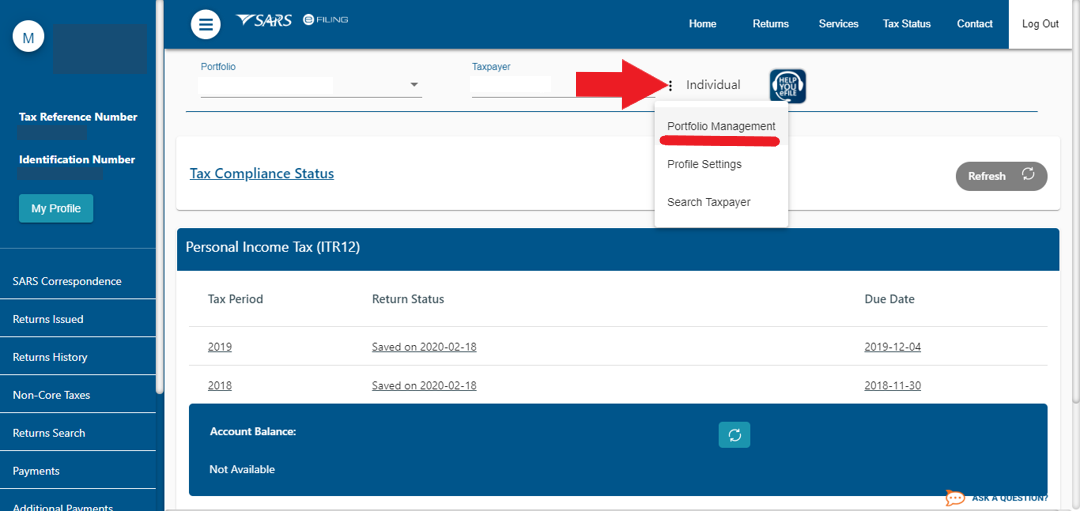

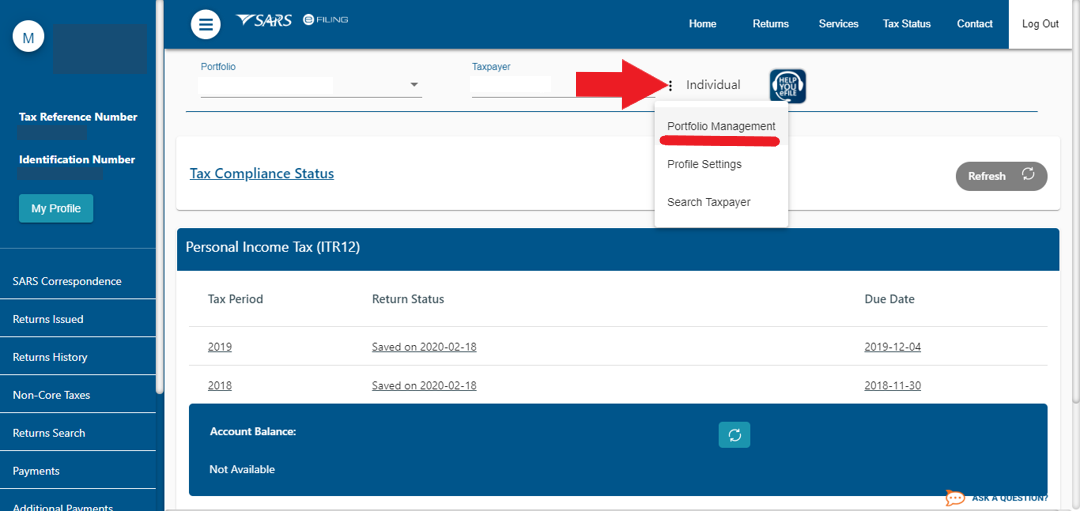

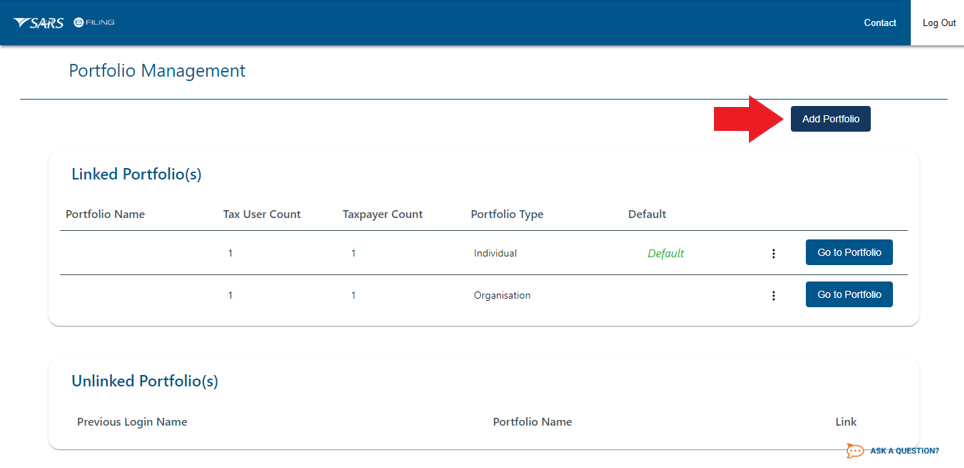

You can apply here. Going to the Portfolio. Keeping my business details up to date.

Complete the EMP101e Payroll taxes - Application for Registration taxes form. More info on each service are listed below. VAT vendors can also request and obtain a VAT Notice of Registration on eFiling.

EFilers will register as Please select and click on the appropriate option below. PAYE Pay as you earn. A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000.

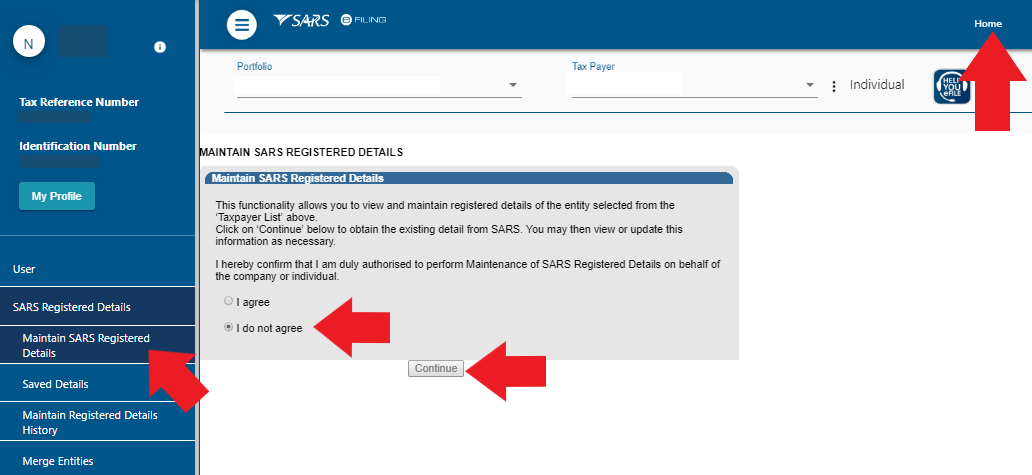

Get started by logging in. How to register for PAYE on eFiling. You can verify and update the RAV01 details by.

You can register once for all different tax types using the client information system. Lets take a closer look at PAYE UIF SDL to see which are relevant to you. All South African companies are required by law to be registered at the South African Revenue Services SARS for income tax.

You will be prompted to capture or edit the details of the directors. Click Save to confirm the information. REGISTER FOR SARS EFILINGLONG AWAITED EASY 3 STEP PROCESSAvoid the lines to SARS and do it right the first timeI take you step by step to log into e-filing.

Click SARS Registered details on the side menu 5. For assistance in completing the form see the Guide for completion of Employer Registration application. In the required field enter the identification number of the companys incorporator and director s.

Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. All you need is internet access. To complete the registration process you will need at hand.

An individual if they are operating in their personal capacity. Once logged in select register a new company. Select Notice of Registration 6.

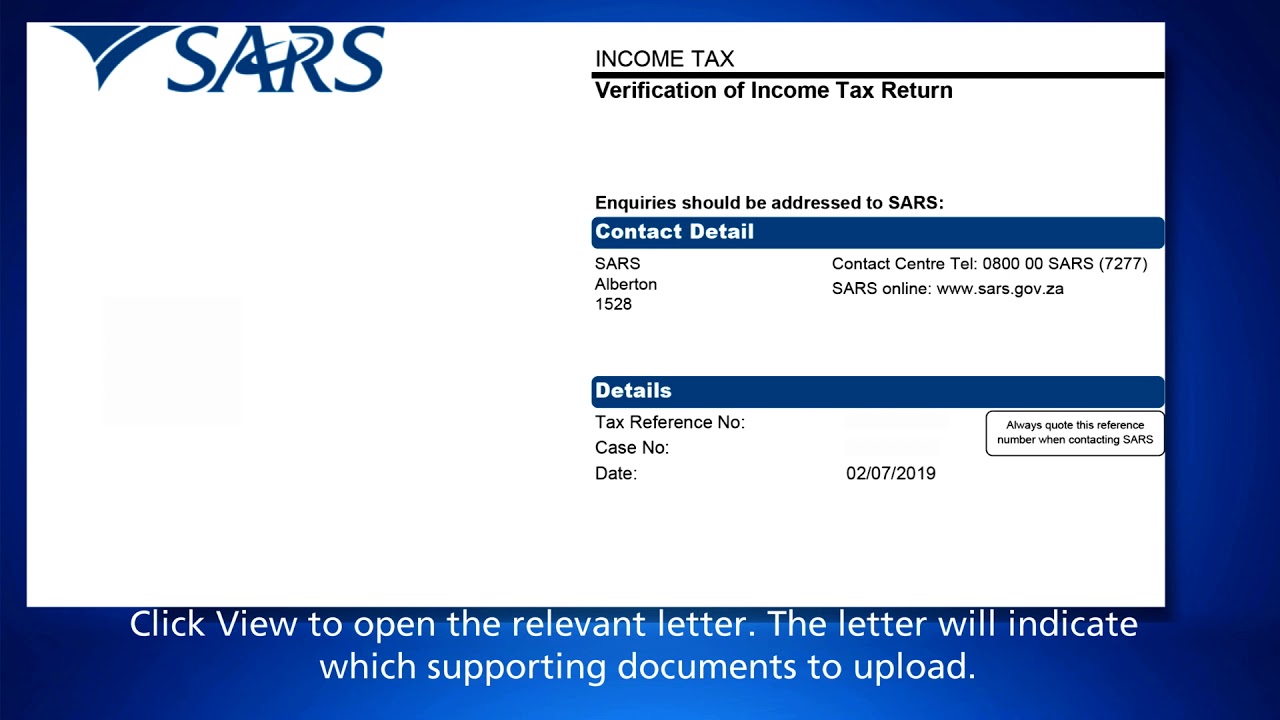

SARS requires you to provide them with several legal documents before you start the tax number registration process. Before completing your ITR14 make sure that that the contact address banking and public officer details of the company are correct by verifying and updating it if required on the Registration Amendments and Verification Form RAV01. This document asks for details such as your companys.

General disclaimerThese tutorial videos are provided to help taxpayers understand their obligations and entitlements under the tax Acts administered by the C. Make sure you have Adobe Flash installed and enabled on your computer or laptop. The easiest way to register with SARS is to visit the eFiling website.

In order to register as an employer with SARS you would need to change your SARS eFiling profile from an Individual to an Organisation Profile and do the necessary registration on the RAV01. Registering as an Employer. 1 Logon to eFiling If you are not yet an eFiler register at wwwsarsefilingcoza.

VAT is an indirect tax on the consumption of goods and services in the economy. What Documents Do I Need To Apply For A Tax Number At SARS.

Sars Efiling How To Register Youtube

Sars Efiling How To Register Youtube

How To Access My Compliance Profile

How To Access My Compliance Profile

How To Add Banking Details To Sars Efiling Taxtim Sa

How To Add Banking Details To Sars Efiling Taxtim Sa

How To Register For Sars Efiling Youtube

How To Register For Sars Efiling Youtube

Sars Efiling How To Submit Your Itr12 Youtube

Sars Efiling How To Submit Your Itr12 Youtube

How To Register For Paye On Efiling

How To Register For Paye On Efiling

How To Authorise A Tax Practitioner To Do Your Sa Taxes

How To Authorise A Tax Practitioner To Do Your Sa Taxes

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Update Your Sars Registered Details On Sars Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register For Vat On Efiling

How To Register For Vat On Efiling

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

How To Use Sars Efiling To File Income Tax Returns Taxtim Sa

Register On Sars Efiling Business Tax Types Youtube

Register On Sars Efiling Business Tax Types Youtube

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Documents Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

Sars Organisation Option How To Add Your Business On Efiling Youtube

Sars Organisation Option How To Add Your Business On Efiling Youtube

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa

How To Register Your Company For Sars Efiling Taxtim Sa