Sba Disaster Loan Application Processing Time

The type of loan program you apply for and the amount of money you wish to receive will be considered. Apply directly to SBAs Disaster Assistance Program at.

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

However this time frame isnt set in stone as there are numerous factors that can play a role in the SBA loan timeline.

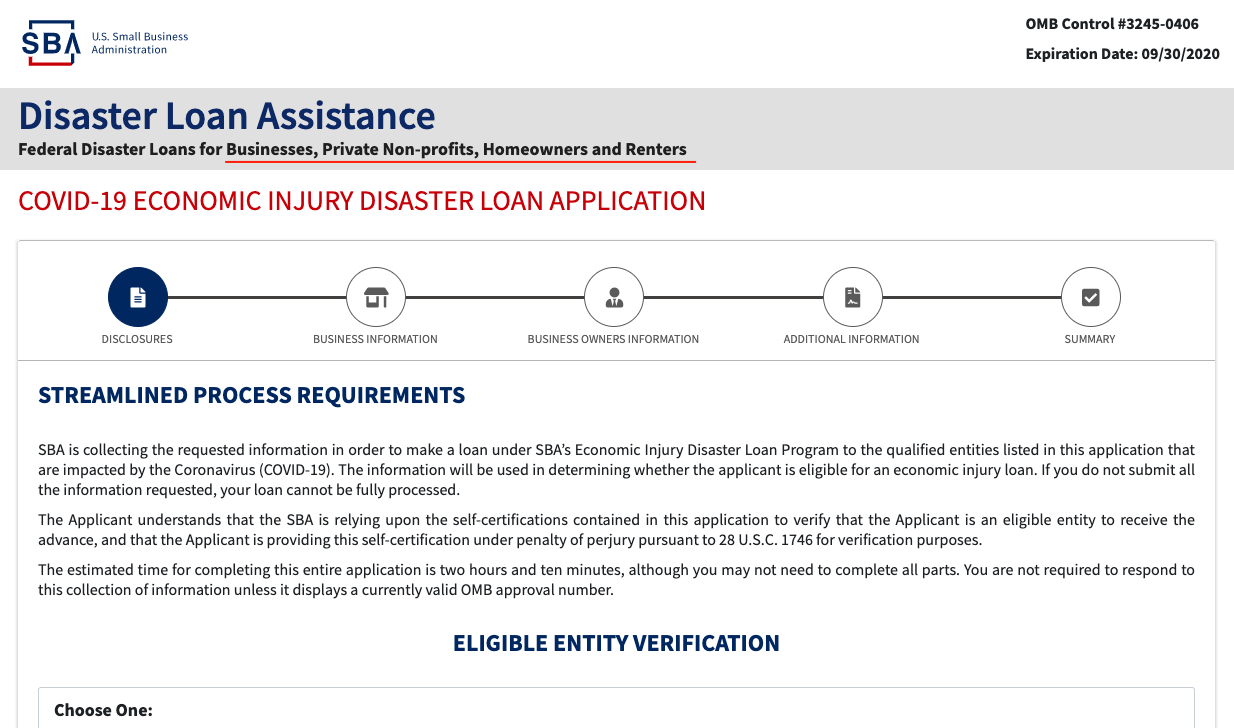

Sba disaster loan application processing time. The Office of Disaster Assistances mission is to provide low-interest disaster loans to businesses of all sizes private non-profit organizations homeowners and renters to repair or replace real estate personal property machinery equipment inventory and business. The online process will assign the applicant with an application number confirmation of submissions and the ability to sign in for status updates on their application. I have a business partner but heshe does not want to be included on the COVID- 19 EIDL.

The anticipated process time for an application is three weeks and then it will take an additional week before funds are available to the borrower. IRS Tax Form 4506-T for Applicant Business. Application or Loan Number 10.

As stated the SBA loan approval process from application to closing is about 60 to 90 days. The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters. A loan officer works with you to provide all a loan determination.

But that doesnt include the time it takes for the lender to approve the loan which could tack on another few weeks. This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. Our goal is to arrive at ecision on your application within 4 weeks.

EST for an increase to my EIDL loan. I just received an email from SBAs Application Processing Department regarding a request I made on April 6 202 pm. Approval by Loan Officer Stage.

DisasterLoansbagov There is no cost to apply There is no obligation to take the loan if offered The maximum unsecured loan amount is 25000 Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster but the loans cannot be. The SBA promises a turnaround time of 36 hours for their express loans. Disaster Assistance Processing Disbursement Center.

SBA disaster loans offer an affordable way for individuals and businesses to recover from declared disasters. SBA can make a loan while your insurance recovery is pending. These are the steps the SBA is taking during the EIDL loan underwriting phase which happens as your EIDL loan application says processing.

The SBA anticipates the money will be distributed 3 days after that three-week loan officer review and approval period. However historically disaster loans have taken approximately three weeks from time of application until completion of loan officer assessment submission of any additionally required documentation and final loan approval. Generally the best option is to call SBA an inquire about the status of the EIDL application however in most cases if the loan is approved the loan agreement would be posted on portal within 2-3 days after the request and id validation was done.

SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. Small Business Administration Disaster Assistance Processing Disbursement Center 14925 Kingsport Road Fort Worth Texas 76155. So instead of 60-90 days youre looking at 30-60 days for the.

Disaster Loans en Espanol Required Information to Complete the Application After a Presidential disaster declaration you must first register with the Federal Emergency Management Agency FEMA. During processing after reviewing any insurance or other recoveries. COVID-19 Economic Injury Disaster Loan.

Disaster Loans The Three-Step Process. A Tier 2 representative will be able to see that whether the loan application is approved on their screen. Include a complete copy including all schedules of the most recently filed 2019 Federal Tax Return for the business.

1-800-877-8339 or e-mail disastercustomerservicesbagov. Call 1-800-659-2955 TTY. The SBA provides low-interest disaster loans to help businesses and homeowners recover from declared disasters.

The EIDL loan application is passed onto the Senior Loan. A loan officer will contact you to discuss the. Loan may be repaid at any time with no pre-payment penalties.

They requested the following.

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Covid 19 Disaster Loan Application Problem Use Chrome Not Safari

Sba Covid 19 Disaster Loan Application Problem Use Chrome Not Safari

How To Apply For The Sba Economic Injury Disaster Loan Eidl Revised Practice Financial Group

How To Apply For The Sba Economic Injury Disaster Loan Eidl Revised Practice Financial Group

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Sba Economic Injury Disaster Loan Process Loudoun County Economic Development Va

Here S Information About Applying For Disaster Loans From The Federal Sba Vaildaily Com

Here S Information About Applying For Disaster Loans From The Federal Sba Vaildaily Com

Small Business Relief Sba Eidl Disaster Loan Assistance Update August 28 2020 Score

Small Business Relief Sba Eidl Disaster Loan Assistance Update August 28 2020 Score

How To Get An Sba Disaster Loan Eidl Bench Accounting

How To Get An Sba Disaster Loan Eidl Bench Accounting

Sba Defers Existing Disaster Loans Until End Of 2020 Nawrb

Sba Defers Existing Disaster Loans Until End Of 2020 Nawrb

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Disaster Loan Process Walkthrough For Home Service Businesses Youtube

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Reopens Online Applications For Disaster Loans Newsday

Sba Has Slashed The Maximum Available On Economic Injury Disaster Loans Newsday

Sba Has Slashed The Maximum Available On Economic Injury Disaster Loans Newsday

Paycheck Protection Program Ppp Sba Disaster Loan Assistance Youtube

Paycheck Protection Program Ppp Sba Disaster Loan Assistance Youtube

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Information And Instructions For Using Sba Disaster Loan Application Program Portal Senb Bank

Information And Instructions For Using Sba Disaster Loan Application Program Portal Senb Bank

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

11 Steps To Apply For The Coronavirus Disaster Loan Finder Com

Understanding The Sba Economic Injury Disaster Loan Application Process Startup Junkie

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal

Sba Disaster Loans For Coronavirus Hit Delays Website Crashes Washington Business Journal