The Three Most Common Forms Of Business Organizations

C-corporation S-corporation and Limited Liability Company. There are three types of corporations.

Get Our Image Of Sample Partnership Agreement Between Two Companies Separation Agreement Template Separation Agreement Agreement

Get Our Image Of Sample Partnership Agreement Between Two Companies Separation Agreement Template Separation Agreement Agreement

A C corporation an S corporation and an LLC or limited liability corporation.

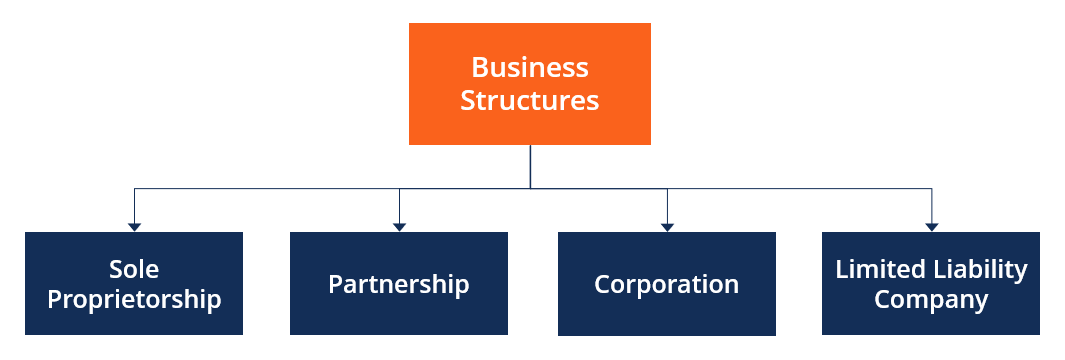

The three most common forms of business organizations. Click card to see definition. A C-corporation is a corporation that is taxed separately from its owners. It is important that the business owner seriously considers the different forms of business organizationtypes such as sole proprietorship partnership and corporation.

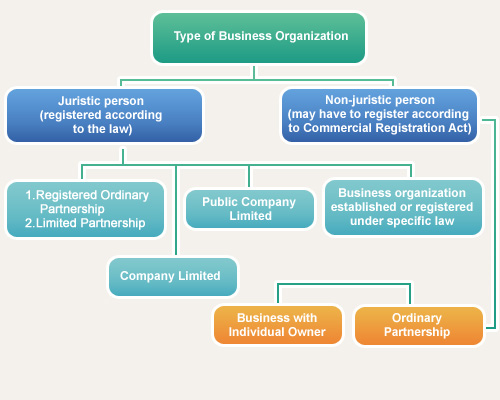

AA sole proprietorship. A corporation is by far the most structured and regimented of all the business entity types. Common Types of Business Organizations.

The owner f view the full answer. 100 1 rating 1. It is a costly process to form a corporation.

A corporation is a business organization that acts as a unique and separate entity from its shareholders. Both are legal entities that are formalized with the filing of articles of incorporation with the state. Is a business owned by only one person.

3 commom forms of business organization is. Click again to see term. Operating as a corporation allows the owners of a.

Most common form of business organization in the United States. A corporation is considered an entirely separate entity from its owners with legal rights and responsibilities. Which organizational form is most appropriate can be influenced by tax issues legal.

There are three main forms of corporations. Unincorporated business owned and run by a single person who has rights to all profits and unlimited liability for all debts of the firm. There are two types of corporation the S corporation and the C corporation.

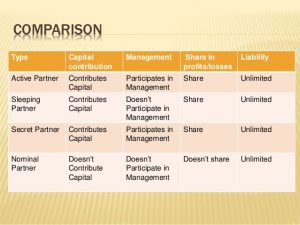

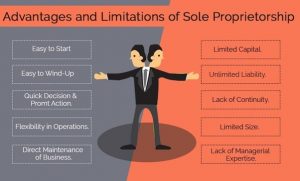

The three most common legal forms of business organization are the sole proprietorship partnership and corporation. It is easy to set-up and is the least costly among all forms of ownership. Tap card to see definition.

SOLE PROPRIETORHIP Sole proprietorship is a business owned and operated by an individual for his or her own profit. It gives the owners limited liability encouraging more risk-taking and potential investment. A corporation pays its own taxes before distributing profits or dividends to shareholders.

It is considered as the most common form of business ownership.

5 Steps Guide To Setting Up Your Business Infographic Business Setup Business Infographic Online Marketing Services Infographic

5 Steps Guide To Setting Up Your Business Infographic Business Setup Business Infographic Online Marketing Services Infographic

Pin On Infografias Social Media

Pin On Infografias Social Media

Various Forms Of Power In An Organization Organizational Behavior Power Organization

Various Forms Of Power In An Organization Organizational Behavior Power Organization

What Is The Difference Between Accounting Bookkeeping Bookkeeper Accountant Bookkeeping And Accounting Bookkeeping Accounting

What Is The Difference Between Accounting Bookkeeping Bookkeeper Accountant Bookkeeping And Accounting Bookkeeping Accounting

12 Essential Features Of International Business Business International Competition

12 Essential Features Of International Business Business International Competition

A Visual Guide To Your Company S Organizational Structure Organizational Structure Org Chart Organizational Chart Design

A Visual Guide To Your Company S Organizational Structure Organizational Structure Org Chart Organizational Chart Design

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

7 Self Employment Tax Forms For Home Business Owners Small Business Tax Tax Forms Business Budget Template

7 Self Employment Tax Forms For Home Business Owners Small Business Tax Tax Forms Business Budget Template

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Cs Foundation Detailed Explanation Of Forms Of Business Organization Business Organization Business Sole Proprietorship

Best Gst Registration At Kolkata Business Insurance Professional Liability Limited Liability Partnership

Best Gst Registration At Kolkata Business Insurance Professional Liability Limited Liability Partnership

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Public Limited Registration Public Limited Company Private Limited Company Bookkeeping Services

Public Limited Registration Public Limited Company Private Limited Company Bookkeeping Services

Types Of Businesses Overview Of Different Business Classifications

Types Of Businesses Overview Of Different Business Classifications