What Name Goes On A 1099

Theres no reporting threshold for this one. 1 A company name or persons name.

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

Use Form W-2 to report these payments.

What name goes on a 1099. The phrase 1099 employee generally describes a person who in the eyes of the IRS is an independent contractor also called self-employed or a freelancer. If you are a worker earning a salary or wage your employer reports your annual earnings at year-end on Form W-2However if you are an independent contractor or self-employed you should receive a Form 1099-NEC 1099-MISC in prior years from each business client that pays you at least 600 during the tax year. Ronald Green Y Drywall LLC Or should I only enter their name.

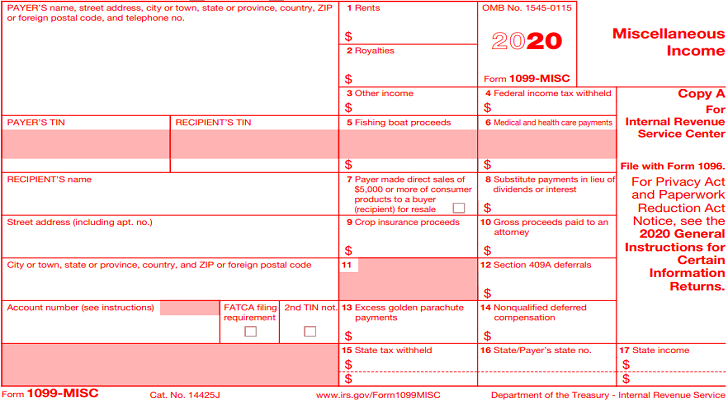

Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file. I tried putting the entire first and last or the company name in the first name field the Factoring Company name in the last name field and the DBA in the company name field. Reports the acquisition or abandonment of secured property This basically means that you walked away from property relinquishing it to the lender in lieu of paying a debt.

This information is vital in filling out Form 1099-MISC. Before you fill out Form 1099-MISC you need to gather some information. If the recipient is a single-member LLC what should I enter for their name.

Earnings on a 1099-MISC may be. This should be your full name. For example make sure your 1099 form includes the full name of the contractor.

Im filling out Form 1099-MISC by hand. Jane Doe on line one. On their W-9 they entered their SSN as instructed not their LLCs EIN.

For Example - If an IC using an EIN gave me a W9 that says. You dont need to provide a biz name UNLESS you are a incorporated independent contractor. Non-employee workers can include a subcontractor attorney or accountant.

Your TIN Taxpayer Identification Number Recipients TIN. You can use individual name listed as the name shown on the tax return. Your contractor will use this to report on their taxes the amount your business compensated him.

Individuals name on 1st line of 1099 and business name on 2nd line. You dont want the contractor to have to pay taxes on 6000 when they only earned 600. You should have the following on hand to fill out the 1099-MISC form.

Line 2 Business name. John Doe dba XYZ ContractinJohn Doe doing business as XYZ Contracting If he did not provide you with his name then simply list the company name and the EIN number which you were provided on the 1099 form. This form is NOT used for employee wages and salaries.

Or do I list the company name. For the EIN ICs do I list their actual name on the name line of the 1099 Misc I issue them. This includes the workers name and taxpayer identification number.

You must send a 1099-NEC form to any non-employees to whom you paid 600 or more during the year. Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. Youll receive this form even if you gave up some but not all ownership interest in the property.

If the individual also filled in his name then you would fill in the 1099 form as. If the W9 has an individual name listed as the name shown on the tax return and a business name as the business name what name should be listed on the 1099 or should both be included. As of 2015 several versions of Form 1099 are used depending on the nature of the income transaction.

The ubiquity of the form has also led to use of the phrase 1099. I thought if we used their Social Security number on Form 1099-MISC then their first name should be listed on line 1 of the name section. If changing from sole proprietor to corporation or if company has changed hands issue separate 1099s.

Should I enter both their name business name. 3 A Factoring Company that I actually pay so the 1099 is mailed to the Factoring Company. If you do not have a business you.

Payers thats you name address and phone number. For example if you are a freelance writer. File Form 1099-MISC for each person you have given the following types of payments to during the tax year.

Form 1099-MISC Miscellaneous Income is an information return businesses use to report payments eg rents and royalties and miscellaneous income. Line 1 Name. NEC stands for non-employee compensation and Form 1099-NEC includes information on payments you made during the previous calendar year to non-employees.

At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest. Earnings reported by brokerages on a 1099-DIV or 1099-INT often go on the first page of your 1040 tax form Smith says. It is confusing because the W9 allowed for a blank for each and the 1099 MIsc form only allows for one line.

If you have a business name trade name DBA name or disregarded entity name fill it in here. Double-check the spelling TIN number and the payment amount. If this was helpful please press the Accept button.

Originally Posted by dtarrant. If we used their EIN number then their dba name would be listed first and then their individual name listed next. One notable use of Form 1099 is to report amounts paid by a business including nonprofits to a non-corporate US resident independent contractor for services in IRS terminology such payments are nonemployee compensation.

It should match the name on your individual tax return.

Reporting Payments To Independent Contractors If You Pay Independent Contractors You May Have Small Business Accounting Tax Organization Independent Contractor

Reporting Payments To Independent Contractors If You Pay Independent Contractors You May Have Small Business Accounting Tax Organization Independent Contractor

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Deciphering Form 1099 B Novel Investor

Deciphering Form 1099 B Novel Investor

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is Irs Form 1099 Misc Smartasset

What Is Irs Form 1099 Misc Smartasset

Irs Form 1099 R What Every Retirement Saver Should Know Fox Business Irs Forms Retirement How To Plan

Irs Form 1099 R What Every Retirement Saver Should Know Fox Business Irs Forms Retirement How To Plan

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster