1099 C Business Credit Card

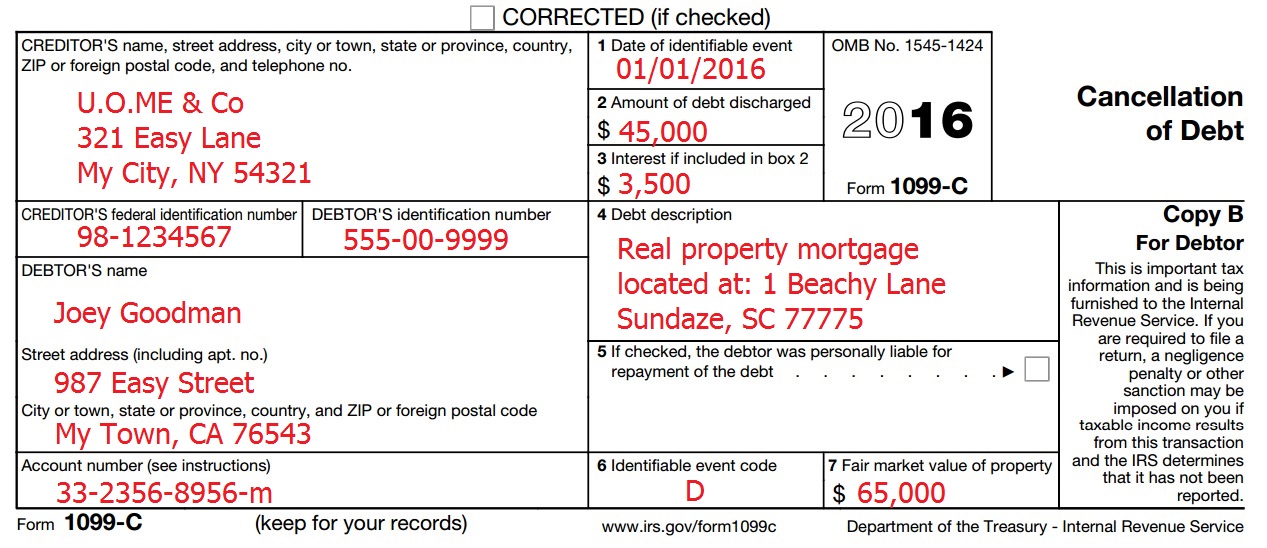

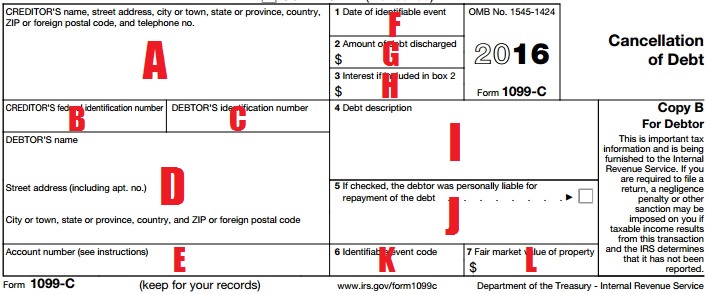

Typically by the time a creditor forgives a debt youve engaged in at least one of the following activities. Form 1099-C entitled Cancellation of Debt is one of a series of 1099 forms used by the Internal Revenue Service IRS to report various payments and.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

What Is Form 1099-C.

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

1099 c business credit card. A 1099-C reports Cancellation of Debt Income CODI to the IRS. The most disturbing part of this process is if the creditor had issued you the 1099-C for cancellation of debt in the year the debt was actually canceled you might not have had to pay any taxes on the forgiven debt if you had been insolvent at the time. Many consumers arent aware that forgiven credit card debt may be taxable income and it shows up on an IRS 1099-C form The content on this page is accurate as of the posting date.

The form reports Cancellation of Debt Income. A business extends money to you when you borrow which might come in the form of a loan disbursement or a credit card purchase. What do I do with this 1099c.

The company was closed in 2013 with a final return. The 1099-C is an IRS form sent when credit card or other consumer debts are forgiven or canceled by creditors or debt collectors. Please review our list of best credit cards or use our CardMatch tool to find cards matched to your needs.

About Form 1099-C Cancellation of Debt File Form 1099-C for each debtor for whom you canceled 600 or more of a debt owed to you if. Its not considered income or. See the Specific Instructions for Form 1099-C later.

Credit card payments are reported using Form 1099-K. However some of our partner offers may have expired. Persons who each receive a Form 1099-C showing the full amount of debt.

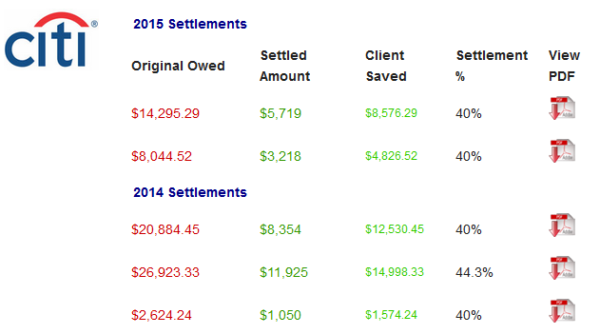

The business had no assets or property when closed. Forgiven debt totaling more than 600 of the original debt is considered income by the IRS and potentially subject to taxes on federal income tax returns. Interest included in canceled debt.

The 1099-C is a tax form sent by the credit card company with whom the debt was settled and is a very important tax form. It came in the EIN of the business not with my SSN. However the activity that led to the 1099-C probably does impact your credit.

Copies of the form are sent to both the business and to the IRS. The 1099-C form shouldnt have any impact on your credit. According to the IRS if a debt is canceled forgiven or discharged you must include the canceled amount in your gross income and pay taxes on that income unless you qualify for an exclusion or exception.

The content on this page is accurate as of the posting date. The Law Internal Revenue Code section 6050W c 2 requires that banks and merchant services must report annual gross payments processed by credit cards andor debit cards to the IRS as well as to the merchants who received them. I just now received a 1099c for the credit card that wasnt paid in 2012.

An identifiable event has occurred. You will meet your Form 1099-A filing requirement for the debtor by completing boxes 4 5 and 7 on Form 1099-C. The final return was already filed.

You are an applicable financial entity. You may file Form 1099-C only. The IRS views that forgiven debt as taxable income.

Yes the business did not pay a credit card bill. Please review our list of best credit cards or use our CardMatch tool to find cards matched to your needs. However some of our partner offers may have expired.

Form 1099-C Reference Guide for Box 6 Identifiable Event Codes Amount of canceled debt. However if you file both Forms 1099-A and 1099-C do not complete boxes 4 5 and 7 on Form 1099-C. In any case you must enter into an agreement to pay that money back.

If you are set up to accept payment cards as a form of payment you will receive a Form 1099-K for the gross amount of the proceeds for the goods or services purchased from you through the use of a payment card in a calendar year. When a settlement is accepted by a credit card company a certain amount of debt is forgiven by the credit card company. Even when reported on your tax return a 1099-C does not automatically clear an unpaid balance from your credit report.

When To Use Tax Form 1099 C For Cancellation Of Debt Zipbooks

Irs Courseware Link Learn Taxes

Irs Courseware Link Learn Taxes

1099 C Surprise Canceled Debt Often Taxable As Income Creditcards Com

1099 C Surprise Canceled Debt Often Taxable As Income Creditcards Com

Why Did I Receive A 1099 C Tax Form From My Credit Card Company Navicore Navicore

Why Did I Receive A 1099 C Tax Form From My Credit Card Company Navicore Navicore

:max_bytes(150000):strip_icc()/1099c-5606545f559b4f28883a0de35905889b.jpg) Form 1099 C Cancellation Of Debt Definition

Form 1099 C Cancellation Of Debt Definition

1099 C Defined Handling Past Due Debt Priortax

1099 C Defined Handling Past Due Debt Priortax

How A Separate Credit Card Can Make Business Expenses Easier Money Under 30

How A Separate Credit Card Can Make Business Expenses Easier Money Under 30

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Cancellation Of Debt Form 1099 C What Is It Do You Need It

Cancellation Of Debt Form 1099 C What Is It Do You Need It

1099 C Cancellation Of Debt Form And Tax Consequences

1099 C Cancellation Of Debt Form And Tax Consequences

1099 C Defined Handling Past Due Debt Priortax

1099 C Defined Handling Past Due Debt Priortax

Cancellation Of Debt Questions Answers On 1099 C Community Tax

Cancellation Of Debt Questions Answers On 1099 C Community Tax

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Irs Courseware Link Learn Taxes

Irs Courseware Link Learn Taxes

Tax Bill Suprise For Old Debt The Irs Is Now On Your Side Clean Slate Tax

Tax Bill Suprise For Old Debt The Irs Is Now On Your Side Clean Slate Tax