How Do I Get My 1099 G From Unemployment Online

Myunemploymentwisconsingov Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax forms. If you see a 0 amount on your 2020 form call 1-866-401-2849 Monday through Friday from 8 am.

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

No other 1099Gs will be mailed.

How do i get my 1099 g from unemployment online. The 1099-G tax form is commonly used to report unemployment compensation. After you have successfully logged into your IDES account navigate to the dropdown menu titled Individual Home in orange. 1099-Gs for years from 2018 forward are available through your online account.

Instructions for the form can be found on the IRS website. You can view 1099-G forms for the past 6 years. Why is the amount in box one of my 1099G.

You can also download your 1099-G income statement from your unemployment benefits portal. To access the 1099-G information individuals should log into HiRE and go to the left navigation options. These forms are available online from the NC.

Go to Services for Individuals Unemployment. Log in to your UI Online account. We just need to have the 1099-G so we can do.

The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. How to Get Your 1099-G online. Remember even if you were unemployed you still have to file income taxes.

To access this form please follow these instructions. If you were a phone filer it will be mailed to you. We will mail you a paper Form 1099G if you.

You may download a copy of your current IRS Form 1099-G through your online account at desncgov at no charge. This can be handled after logging into your claim under View and Maintain Account Information and selecting Payment Method and Tax Withholding Options. We tried logging onto her account to see if we could print it out but it keeps saying this social security number was used for a previous account or some nonsense.

You can access your Form 1099G information in your UI Online SM account. For additional questions please review our 1099-G frequently asked questions here. Pacific time except on state holidays.

To view and print your statement login below. You can opt to receive your 1099-G electronically by providing your consent through the BEACON portal or mobile app. How to Access Your 1099-G Form Online Log in to your IDES account.

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021. Click on View 1099-G and print the page. Click on the down arrow to select the right year.

Please note that your 1099-G reflects the total amount paid to you in 2020 regardless of the week that payment represents. It will be available to view in early February on the Online Claims System in the tab titled 1099G Tax forms toward the bottom of the page. You can log into CONNECT and click on My 1099G49T to view and print the forms.

Unemployment is taxable income. To view and print your current or previous year 1099-G tax forms online logon to the online benefits services website. Applicant Services 1099 Information The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021.

Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online. You may choose one of the two methods below to get your 1099-G tax form. If you do not have an online account with NYSDOL you may call.

Click on View and request 1099-G on the left navigation bar. Look for the 1099-G form youll be getting online or in the mail. Written requests for a hard copy of your 1099-G form from 2018 2019 2020 or 2021 may be.

She had a few months of unemployment but does NOT have her 1099-G statement from UIA. We do not mail these forms. Where to find your 1099G info Your 1099G tax form will be mailed to you by Jan.

How to requestRequest your unemployment benefits 1099-G. Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020. You must update your mailing address by updating your personal information in the BEACON portal on the Maryland Unemployment Insurance for Claimants mobile app or by contacting a Claims Agent at 667-207-6520.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. What Do I Do If I Forgot My Uplink.

The Small Business Accounting Checklist Infographic Bookkeeping Business Small Business Accounting Small Business Finance

The Small Business Accounting Checklist Infographic Bookkeeping Business Small Business Accounting Small Business Finance

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Double Check For Missing Or Incorrect Forms W 2 1099 Before Filing Taxes Mychesco

Double Check For Missing Or Incorrect Forms W 2 1099 Before Filing Taxes Mychesco

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Detr Advises And Encourages Claimants Regarding 1099 G Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Account Ability 1098 1099 3921 3922 5498 W2 Forms Envelopes Tax Forms Tax Refund W2 Forms

Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

Self Employed Tax Preparation Printables Instant Download Small Business Expense Tracking Accounting In 2021 Tax Prep Checklist Tax Preparation Small Business Tax

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

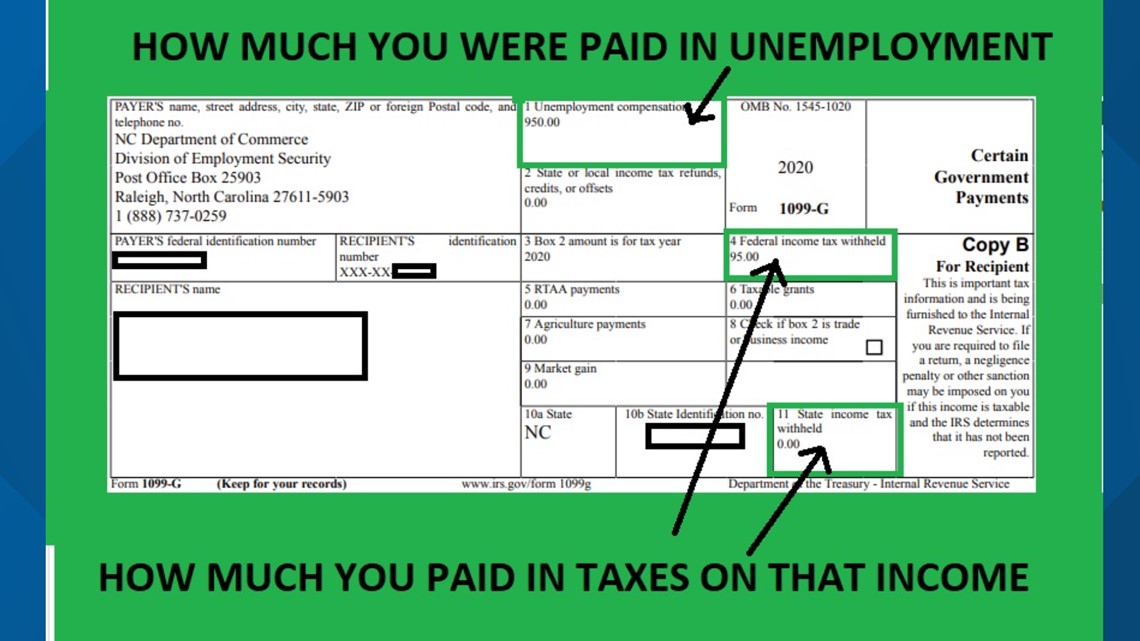

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Weareiowa Com

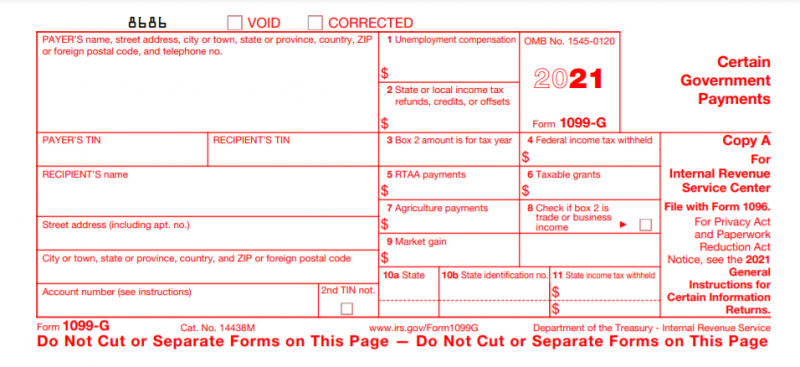

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Why Middle Income New Yorkers Are Turning Down Affordable Housing 6sqft Affordable Housing Income Affordable

Why Middle Income New Yorkers Are Turning Down Affordable Housing 6sqft Affordable Housing Income Affordable

Best Tax Return Apps For Ipad Digital Trends Ipad Apps Taxact Digital Trends

Best Tax Return Apps For Ipad Digital Trends Ipad Apps Taxact Digital Trends

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information