How Much Does It Cost To Register For Vat In South Africa

COIDA Returns Letter of Good Standing. Zero tax return Unemployed no local or foreign income R 45000.

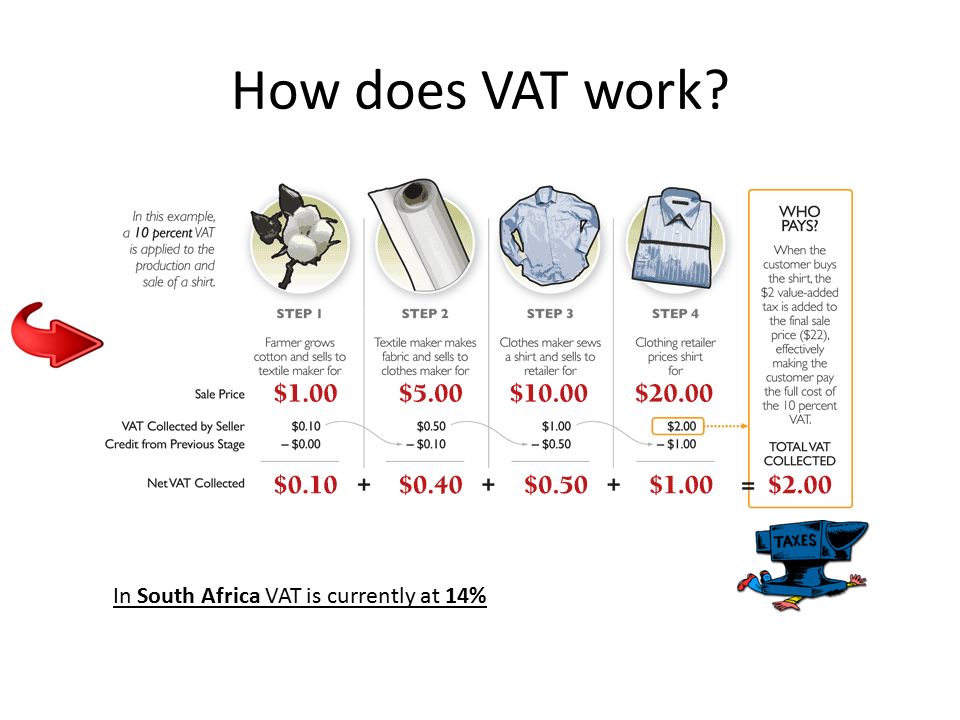

Value Added Tax Grade Ppt Video Online Download

Value Added Tax Grade Ppt Video Online Download

Once off before transfer of the property.

How much does it cost to register for vat in south africa. Gaining a Sole Proprietor Certificate in South Africa The Sole Proprietorship Certificate registration costs between R 590- R990 between EUR 30-50. It should not be confused with Income Tax. Thats all you have to do.

The cost of VAT is then added to the purchase. How Does VAT Work in South Africa. Login to eFiling 2.

South African Companies that are registered for VAT must charge an additional 15 on the prices of their products and services. Follow the easy steps below to register for VAT on eFiling. How to register for VAT on eFiling.

The aim of a Shelf Company is getting a legally registered company in South Africa along with its registration number as soon as possible. Employer Tax PAYE SDL UIF with SARS and Dept of Labour R2 75000 Apply Now. Then you can make a payment of R1500 down 55 from our normal price of R2750 After that youll just have to submit a copy of your company documents.

That is if your annual sales fall below R1 million. Basic tax return Employment income only R 115000. That is the CIPC fee of R50 for reserving the name and R125 for registration of a company.

Value-Added Tax is commonly known as VAT. Value-Added Tax is commonly known as VAT. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors.

If you have a capital-intensive business your cash flow will take a lot of strain if youre not a VAT vendor. Register your company profile with us and one of our expert consultants will be in touch with you to take you through the membership process. Tax returns for South African citizens living and working in South Africa.

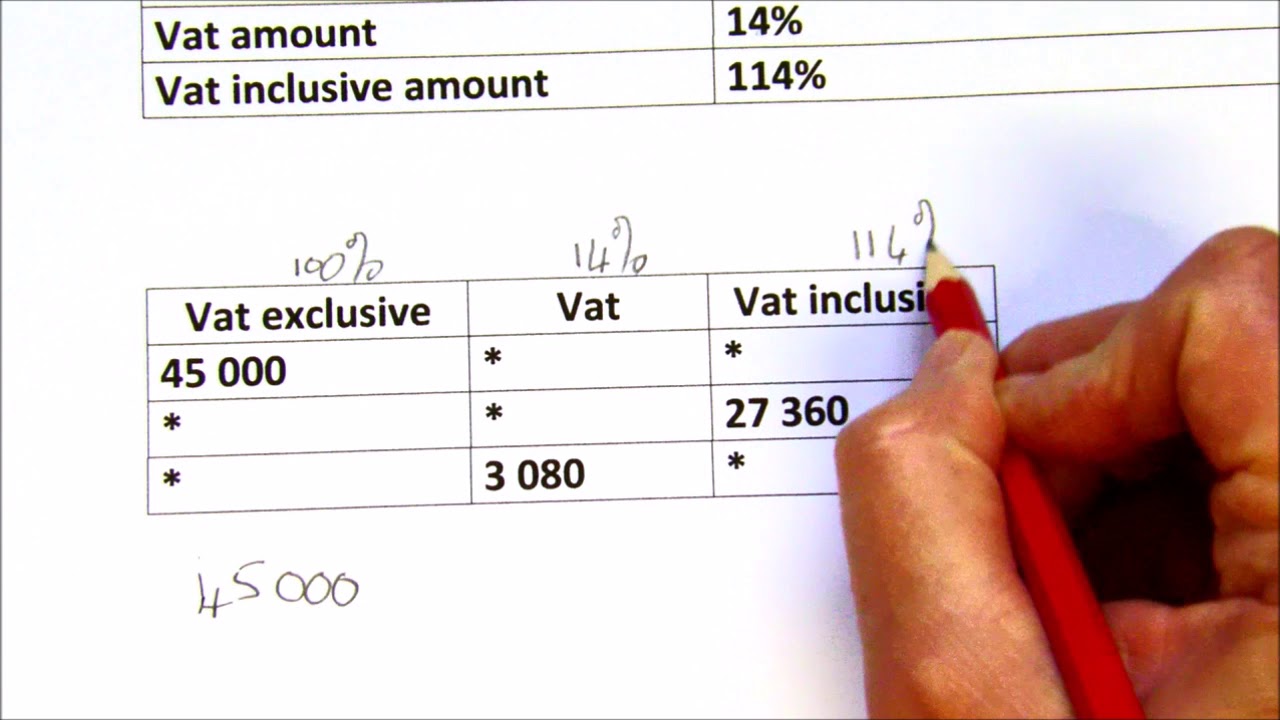

So a Shelf Company is just a Pty company that has already been registered using a generic Company name which means that you can start using it ASAP and dont have to wait for registration. VAT is an indirect tax on the consumption of goods and services in the economy. VAT is calculated by multiplying the VAT rate 15 in South Africa by the total pre-tax cost.

If you have a new company you can voluntarily register for a VAT number for your business. If you dont register a name youll end up with a company called something like K202000123407. The amount payable for rates and taxes vary from one local authority to another in accordance with the valuation of the property.

Name contact details. For instance if you sell a product of R100 you need to add R15 to the price 10015 so the inclusive price which your customers have to pay is R115. By joining GS1 South Africa members are afforded a licence to use our unique identification numbers.

Any income other than employment income. As of March 1st 2010 the minimum threshold for voluntary VAT registration was R50 000 in sales accrued over a period of 12 months. On the Individual portfolio select Home to find the SARS Registered Details functionality.

With this certificate you obtain a registered trading name and a personal tax number. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million. The company can register for E-filing through their Fiscal Representative and the deadline for payment is the last day of the month following the period end.

Two years later it was increased to 14 and it remained that way until 2018 when new changes were introduced. R75 of goods R1125 VAT R8625 total. This licence is renewable annually by means of paying the membership licence fee.

Its nothing intrusive - Its just so we can get to know you better eg. Revenue is raised for government by requiring certain businesses to register and to charge VAT on the taxable supplies of goods and services. R1 50000 Apply Now.

On the Tax Practitioner and Organisations eFiling profiles the SARS Registered Details functionality is under the. R1 25000 Apply Now. VAT is an indirect taxation on the value added to goods and services by Suppliers and Vendors in the economy.

CIDB Registration - Grade 2 - 9. The VAT rate in South Africa has faced several increments over the years since its introduction in 1991. Cost VAT excl Register for SARS e-filing and obtain a tax number.

Make provision for approximately. A machine of R1O 000 will cost you an extra R1 400 in VAT which you can only claim back if youre VAT registered. Youll a get short form to fill in.

Navigate to SARS Registered Details functionality. PLEASE SELECT YOUR REGISTRATION NEEDS VAT Excluded Tick applicable blocks VAT Registration R 1900-00 CC Company Tax Registration R32500 if not yet registered this is required for a VAT registration PAYE R 750-00 UIF R 550-00 MembersDirectors Personal Tax Registration Cost R325 per person. There is a limited range of goods and services which are subject to VAT at the zero rate or are exempt from VAT.

COIDA Registration Letter of Good Standing. General Business If you want the company to have a name then the minimum cost is R175. R3 50000 Apply Now.

R 7 50000 per property. R75 of goods x 15 VAT R1125 VAT. If you are registered for VAT you need to add 15 VAT to your selling price.

CIDB Registration - Grade 1. Initially it was levied at a statutory rate of 10 in 1991. It can help to have glossy brochures and business cards - and a VAT registration number.

VAT on sales or revenue is called Output VAT.

Vat Certificate Maharaj Attorneys

Vat Certificate Maharaj Attorneys

Filing Vat Return Online At Simplysolved Ae Enterprise Business Social Security Card Bookkeeping

Filing Vat Return Online At Simplysolved Ae Enterprise Business Social Security Card Bookkeeping

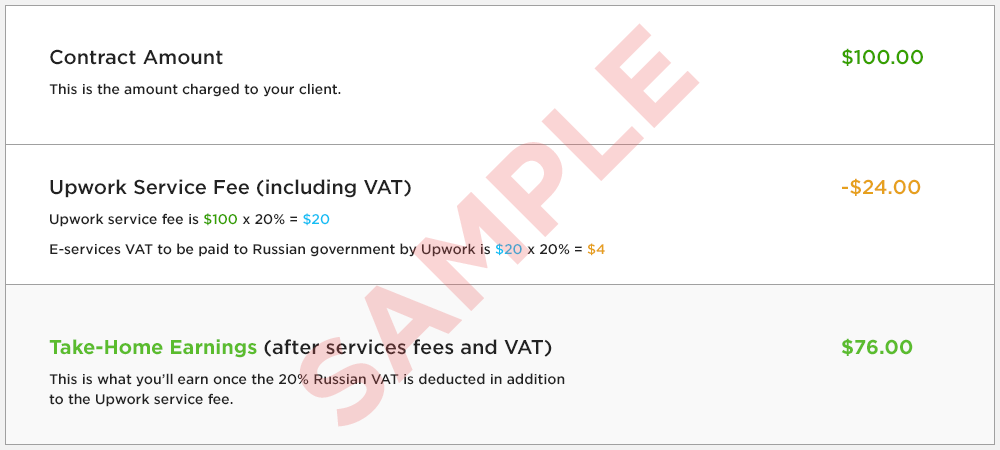

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

How To Register For Vat On Efiling

How To Register For Vat On Efiling

How To Calculate Vat In South Africa To Meet Sars Requirements Briefly Sa

How To Calculate Vat In South Africa To Meet Sars Requirements Briefly Sa

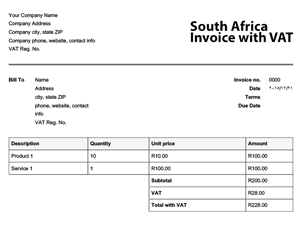

South Africa Tax Invoice Template Service Invoice Template Invoice Template Word Invoice Format In Excel

South Africa Tax Invoice Template Service Invoice Template Invoice Template Word Invoice Format In Excel

Claiming Customs Vat In South Africa Macro Clearing South Africa Africa Custom

Claiming Customs Vat In South Africa Macro Clearing South Africa Africa Custom

Best Branding South Africa Branded Promo Gifts Clothing Best Branding South Africa The Balm Promo Gifts Lip Balm

Best Branding South Africa Branded Promo Gifts Clothing Best Branding South Africa The Balm Promo Gifts Lip Balm

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

Truck Wash Price List South Africa

Truck Wash Price List South Africa

Exclusive And Inclusive Vat Youtube

Exclusive And Inclusive Vat Youtube

How To Register For Vat On Efiling

How To Register For Vat On Efiling

Example Of A Completed Sadc Certificate Certificate Certificate Of Origin Africa Development

Example Of A Completed Sadc Certificate Certificate Certificate Of Origin Africa Development

Pin By Oonie On Oonie S Website Customers Financial Year End Accounting Services Tax Consulting

Pin By Oonie On Oonie S Website Customers Financial Year End Accounting Services Tax Consulting

Our Team Will Evaluate Your Transactional Sales And Purchases Create An Accurate Vat Report That Can Be Traced To All Your Documents Finance Investing Solving

Our Team Will Evaluate Your Transactional Sales And Purchases Create An Accurate Vat Report That Can Be Traced To All Your Documents Finance Investing Solving

Import Duty And Vat Calculator Export Duties Imports

Import Duty And Vat Calculator Export Duties Imports

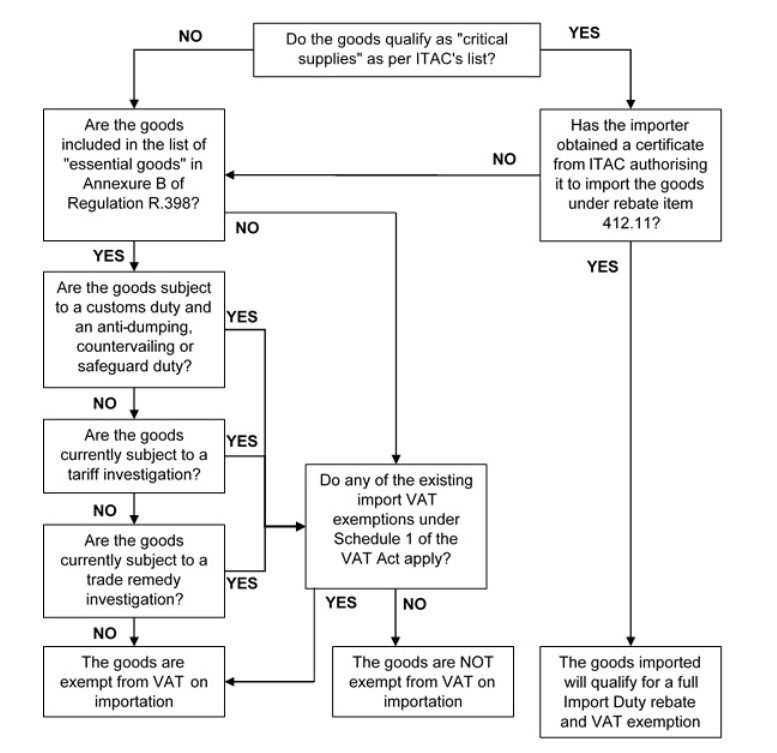

South Africa Announces Vat Exemption And Customs Duty Rebate On Importation Of Essential Goods Ey Global

South Africa Announces Vat Exemption And Customs Duty Rebate On Importation Of Essential Goods Ey Global

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

Free South Africa Invoice Template With Vat Online Invoices

Free South Africa Invoice Template With Vat Online Invoices