Qualified Business Income Deduction Simplified Worksheet Instructions

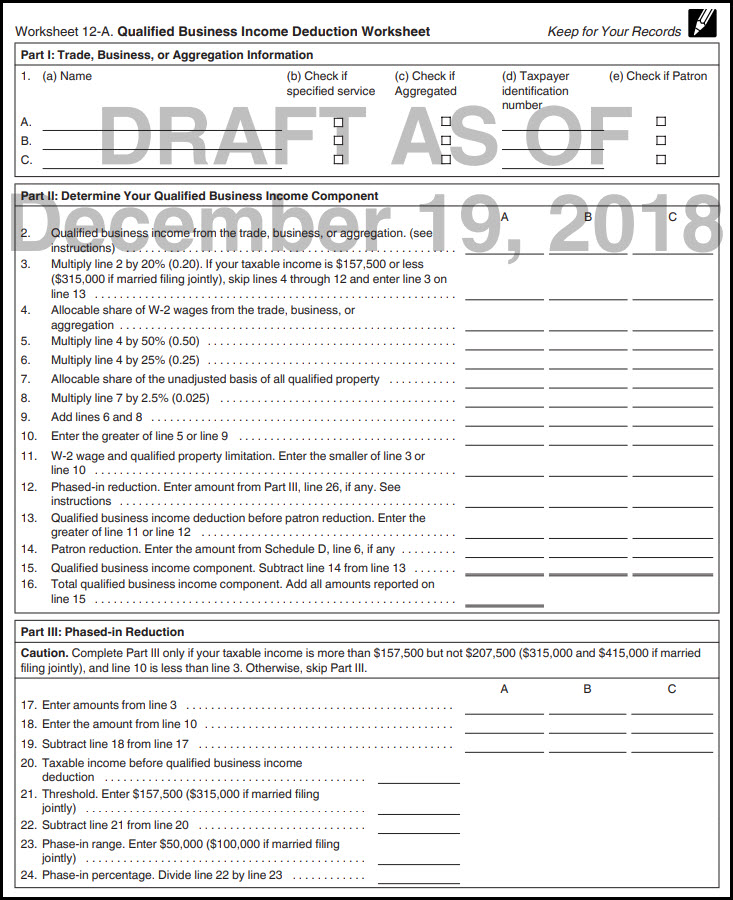

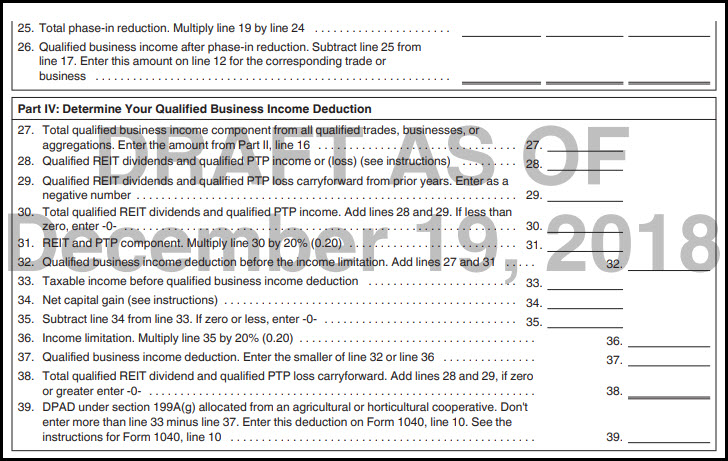

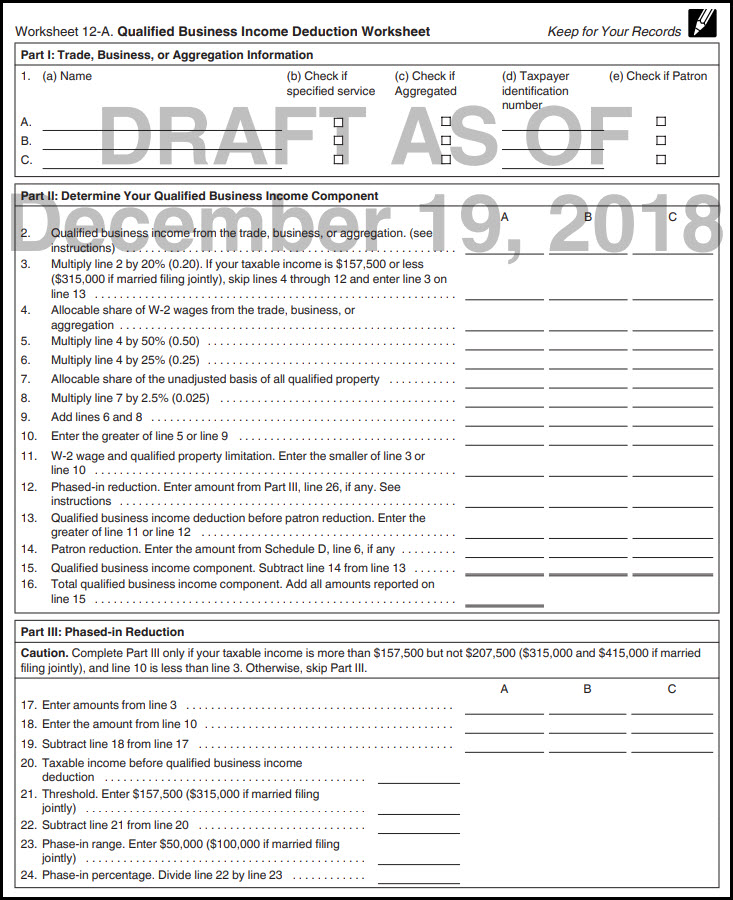

You can link multiple activities to the same QBI component worksheet to aggregate them. For 2018 the IRS did not issue a tax form for taxpayers to compute the IRC Section 199A qualified business income deduction.

If you have qualified business income.

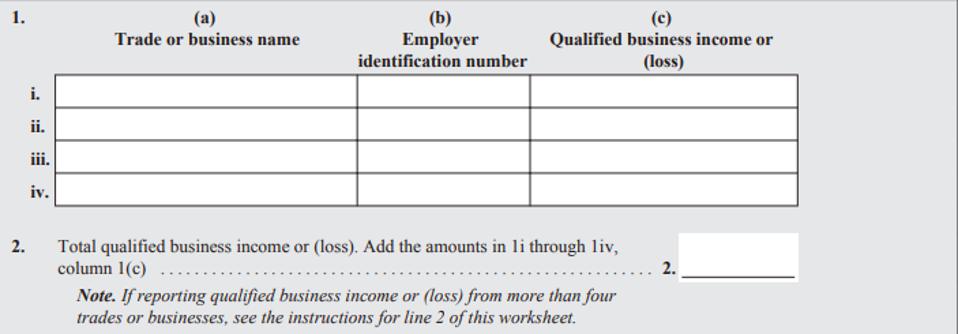

Qualified business income deduction simplified worksheet instructions. Once completed you can sign your fillable form or send for signing. This is your Qualified Business Income Deduction finally. 1 a Trade or business name b.

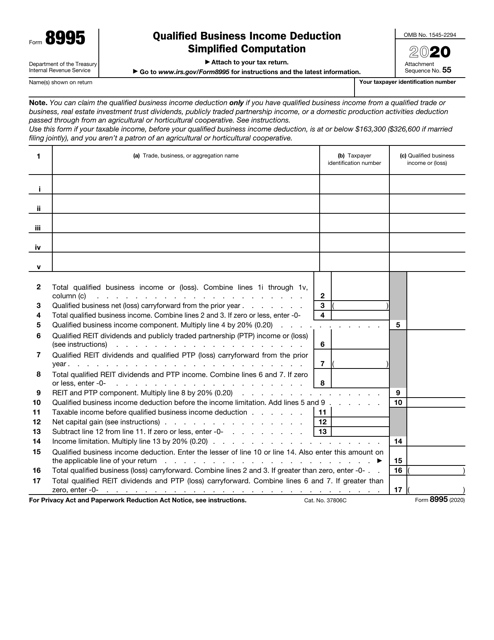

If you are claiming the QBI deduction for 2020 you will need to fill out either Form 8995 Qualified Business Income Deduction Simplified Computation or Form 8995-A Qualified Business Income Deduction. Qualified Business Income Deduction Simplified Computation Attach to your tax return. The IRS estimates that almost 237 million taxpayers may be eligible to claim the deduction.

Check the Specified service trade or business SSTB box if applicable. Scroll down to the Qualified Business Income Deduction section. Use Form 8995 or 8995-A.

You simply multiply QBI 60000 by 20 to figure your deduction 12000. This worksheet is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified Business Income QBI deduction. Have taxable income less than 157500 315000 if Married Filing Jointly.

Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends. Have qualified business income. If taxable income exceeds the limit for your filing status then a special formula is used to figure the deduction.

Go to wwwirsgovForm8995 for instructions and the latest information. The Worksheet will compare your family taxable income with your business profit. This component is not limited by W-2 wages or the UBIA of qualified property.

You can claim the qualified business income deduction. Enter the income and expenses on screen 18 following your normal workflow. When the taxpayers income including taxpayers that are considered Specified Service Businesses is below 157500 or 315000 for Married Filing Jointly the QBID will be the lesser of 1 20 of the net Qualified Business Income or Loss from all sources plus 20 of any qualified REIT dividends and Publicly Traded Partnerships PTP income or loss recognized on the tax return or 2 20 of the taxpayers taxable income minus the net capital gains and qualified.

You have qualified business income defined below Your 2018 taxable income does not exceed 157500 315000 if married filing jointly and You are not a patron in a specified agricultural or horticultural cooperative. Link each property to a QBI component worksheet by double-clicking in box K. All forms are printable and downloadable.

40000 business profit 2826 one half of Social SecurityMedicare tax 37174. Depending on the taxpayers taxable income the amount of PTP income that qualifies may be limited depending on the PTPs trade or business. Use Form 8995 to figure your qualified business income deduction.

This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. Use Qualified Business Income Deduction - Simplified Worksheet included in the Instructions for Form 1040 if. QBI Entity Selection Calculator.

Plus ii 20 of the aggregate amount of qualified real estate investment trust REIT dividends and qualified. The combined qualified business income amount means for any tax year an amount equal to. At the bottom of the Schedule E review each property in the Qualified Business Income Deduction Info smart worksheet.

Information about Form 8995 Qualified Business Income Deduction Simplified Computation including recent updates related forms and instructions on how to file. For more information relating to SSTBs click here. Section 199A provides a deduction of up to 20 percent for an individuals domestic qualified business income from their taxable income.

Qualified Business Income Deduction Simplified Worksheet 2018 This worksheet is for taxpayers who. Names shown on return. The qualified business income deduction QBI is a tax deduction that allows eligible self-employed and small-business owners to deduct up to 20 of their qualified business income.

Your taxpayer identification number. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. Are not a patron in a specified agricultural or horticultural cooperative.

I the deductible amount for each qualified trade or business of the taxpayer defined as the lesser of a 20 of the taxpayers QBI or b the greater of two W-2 wage limits one of which also looks to the unadjusted basis of certain tangible depreciable qualified property. Use Form 8995 if your taxable income is less than the income threshold in the table above. Individual taxpayers and some trusts and estates may be entitled to a deduction of up to 20 of their net QBI from a trade or business including income from a pass-through entity but not from a C corporation plus 20 of qualified real estate investment trust REIT dividends and qualified publicly traded partnership PTP income.

Some taxpayers were able to use the worksheet 2018 Qualified Business Income Deduction-Simplified Worksheet in the Instructions to the 2018 Form 1040. It will multiply the lower of these two numbers by 20 and put the result on Form 1040 line 9. Review the QBI Simple or QBI Complex worksheet thats generated.

Use Form 8995 to figure your qualified business income QBI deduction. Provides individuals with a new tax deduction for qualified business income. Fill Online Printable Fillable Blank IRS Form 1040 Qualified Business Income Deduction Simplified Worksheet 2018 Form Use Fill to complete blank online IRS pdf forms for free.

Https Exactax Com Documents Workshops 2018 20exactax 20workshop Pdf

Https Www Irs Gov Pub Newsroom Tcja Training Provision 11011 Qbid Pdf

Irs Form 8995 Download Fillable Pdf Or Fill Online Qualified Business Income Deduction Simplified Computation 2020 Templateroller

Irs Form 8995 Download Fillable Pdf Or Fill Online Qualified Business Income Deduction Simplified Computation 2020 Templateroller

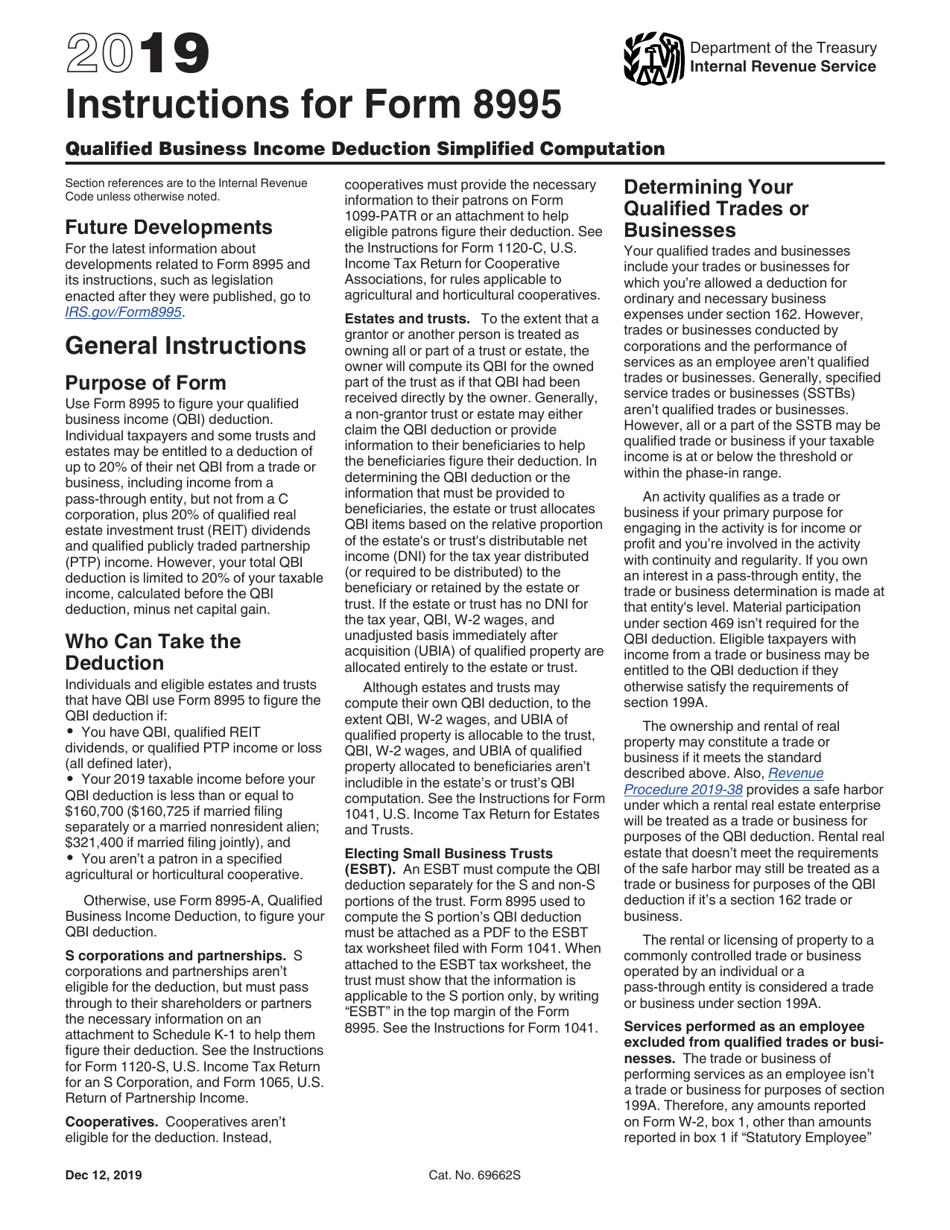

Download Instructions For Irs Form 8995 Qualified Business Income Deduction Simplified Computation Pdf 2019 Templateroller

Download Instructions For Irs Form 8995 Qualified Business Income Deduction Simplified Computation Pdf 2019 Templateroller

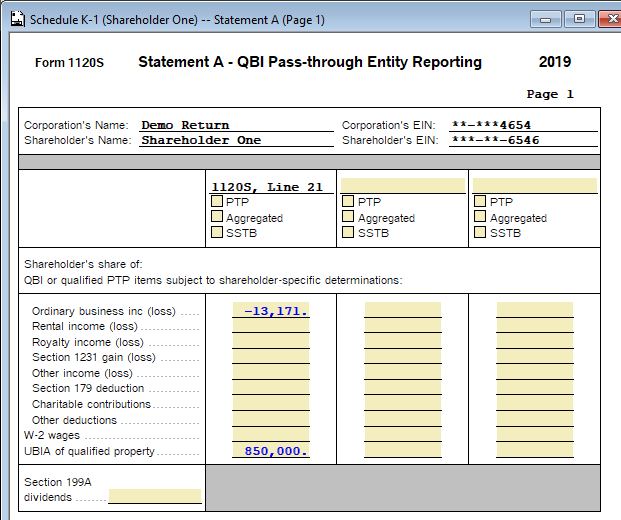

How To Enter And Calculate The Qualified Business Intuit Accountants Community

How To Enter And Calculate The Qualified Business Intuit Accountants Community

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

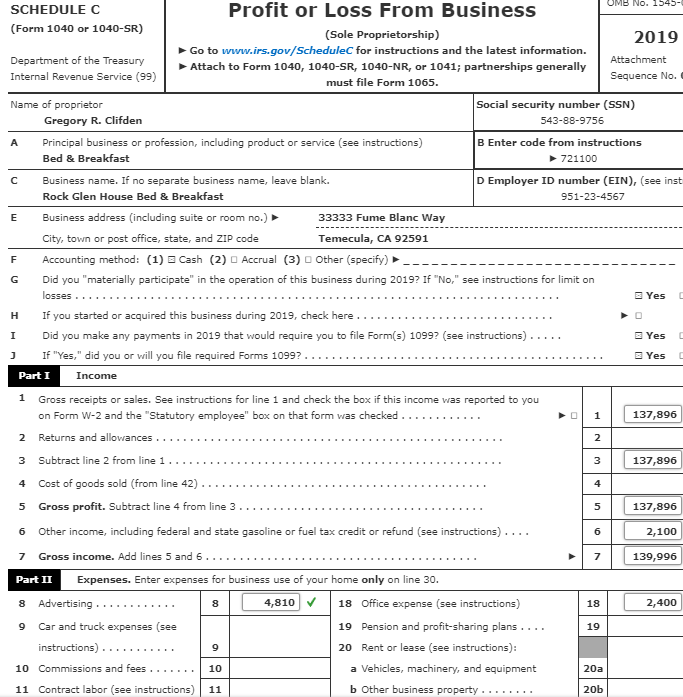

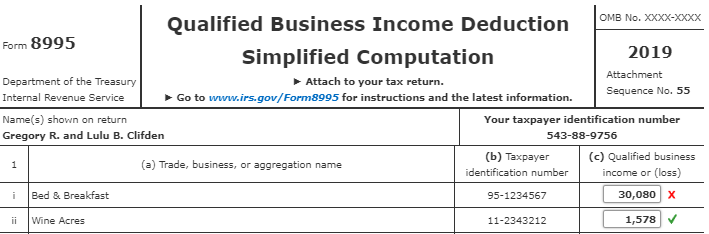

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Section 199a Deduction Qbi And Retirement Accounts White Coat Investor

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Solved I Am Having Trouble Calculating Qbi For The Bed An Chegg Com

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Income Tax Deduction Worksheet Promotiontablecovers

Irs Form 8995 Download Fillable Pdf Or Fill Online Qualified Business Income Deduction Simplified Computation 2020 Templateroller

Irs Form 8995 Download Fillable Pdf Or Fill Online Qualified Business Income Deduction Simplified Computation 2020 Templateroller

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

How To Use The New Qualified Business Income Deduction Worksheet For 2018 Youtube

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Qbi Deduction Frequently Asked Questions Qbi Schedulec Schedulee Schedulef W2

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Proconnect Tax Online Complex Worksheet Section 19 Intuit Accountants Community

Taxes From A To Z 2019 Q Is For Qualified Business Income

Taxes From A To Z 2019 Q Is For Qualified Business Income