Sole Proprietorship Form Of Business Is Complicated To Set Up

In this form of business ownership an individual proprietor owns the business manages the business and is responsible for all of the business transactions and financial liabilities. This means that if you start working as a freelancer without forming an LLC or corporation youll automatically operate as a sole proprietor.

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Use this form to -.

Sole proprietorship form of business is complicated to set up. The company and the owner dont exist apart from each other. From a tax standpoint a sole proprietorship is the easiest structure to set up. The business exists until the retirement or death of the owner.

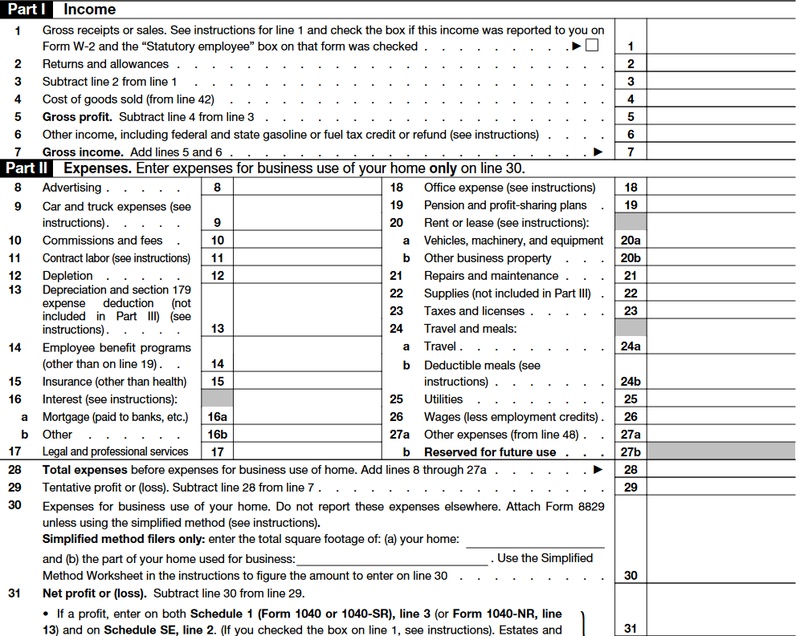

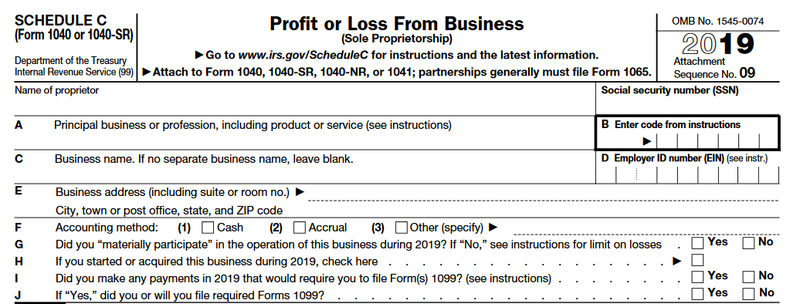

Instead you simply attach a Schedule C to your 1040 and file it with the IRS. The definition of a Sole Proprietorship for tax purposes is that you own an unincorporated business by yourself. Its Simple to Set Up.

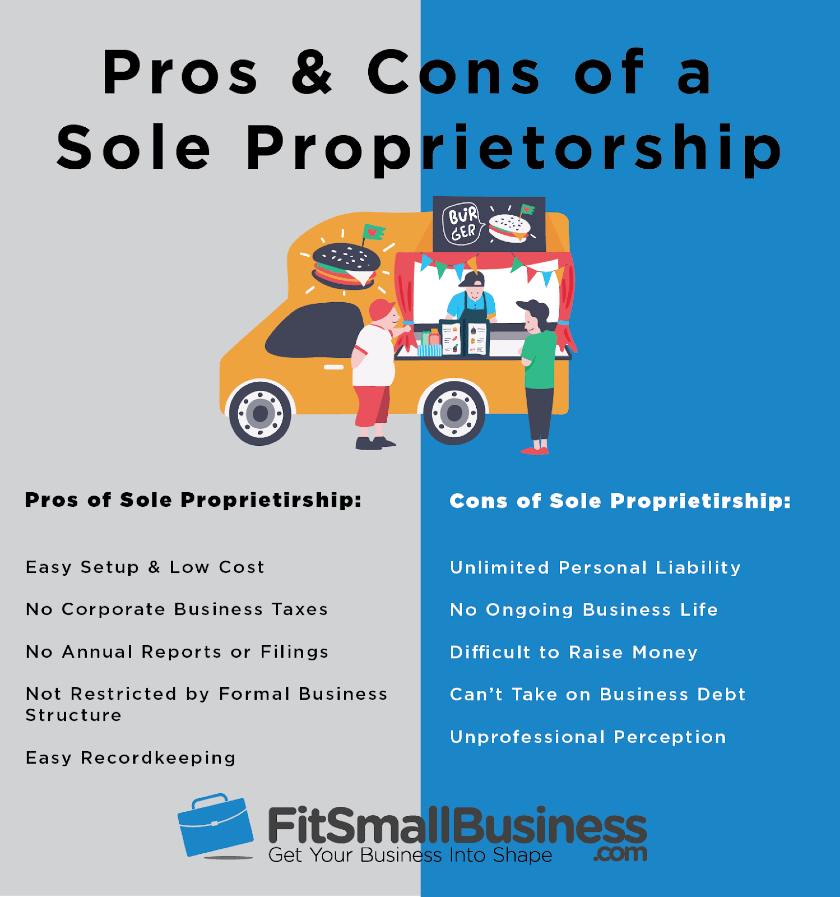

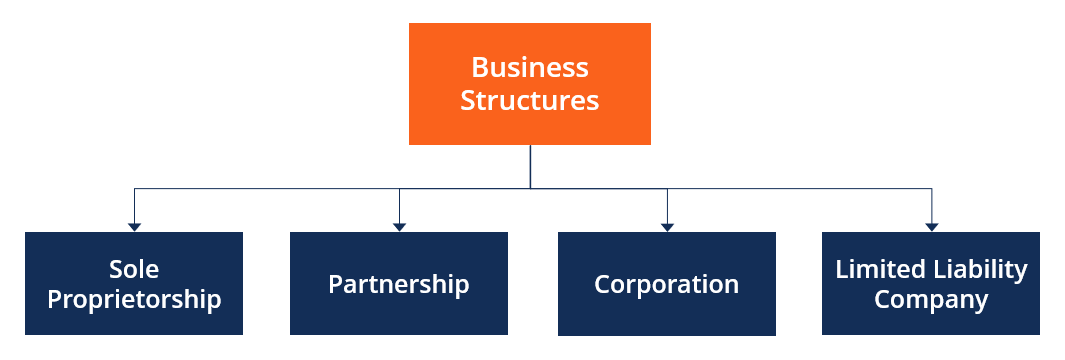

A sole prop is a type of unincorporated business that is owned and run by one person. Another advantage is that setting up this type of business structure is usually very simple as few legal forms are involved and the cost to set up a sole proprietorship is minimalif there is a cost at all. In contrast an LLC or a corporation provides more liability protection but also may require more paperwork and costs.

Forms for Sole Proprietorship. A sole proprietorship is easy and cheap to form and run so its a fantastic choice. In other words the proprietorship is not separate from its owner.

If there is more than one owner your business cant be a sole proprietorship. Its arguably the most straightforward business structure and is simple to set up and manage. They usually have fewer financial resources and fewer ways to get funds from lenders or investors.

Sole proprietorship is the default business entity for freelancers. Many solopreneurs set up their businesses as a Sole Proprietorship. A sole proprietorship or sole prop is a form of business in which an individual starts a business under his or her own name.

Which of the following is a disadvantage of a sole proprietorship. A sole proprietorship is easy to set up and inexpensive to maintain but has unlimited liability for its owners. It is not considered a separate entity like a corporation but an extension of a single owner or individual.

Report wages tips and other compensation and withheld income social security and Medicare taxes for employees. A sole proprietorship is an unincorporated business without a legal distinction between the company and the individual who owns and runs it. A proprietorship business is the simplest form of business that comes into existence at the will of the proprietor the proprietor is liable to the business creditors and all the risk associated with it he alone is also entitled to the profits.

And if someone sues your business theyre suing you the business owner personally. When you run a sole proprietorship youre liable for everything the business is liable for. That is the business is not a separate entity from you.

The most common form of business ownership is a sole proprietorship. A sole proprietorship is a business owned and operated by one person. Some new ecommerce businesses with low startup costs and a low risk of liability use.

The main disadvantage of this form of business is that there is no legal distinction between you and the business leaving you. Gains losses and other taxed or taxable items from your business are all combined. Its a one-person business.

Heres an article on the differences for Alabama businesses. All assets and income of the business belong to the proprietor. A sole proprietorship or partnership is simple to set up and less costly to administer as compared to a company.

No formalities are required unless you hire employees or set up a retirement plan which triggers some recordkeeping and tax filing requirements and dealing with taxes is fairly simple. In a sole proprietorship you are the business. This is a quick summary of how to set up a sole proprietorship or partnership.

In a Sole Proprietorship you are the sole owner of the entire business and you have total control over it. The downside of doing business as a Sole Proprietorship is that you dont have any legal protection. The sole proprietor form of business ownership is the most common form in the United States and also the simplest.

A ________ is a partnership in which each partner has unrestricted accountability only for his or her own actions and at least some degree of responsibility for the partnership as. W-2 Wage and Tax Statement and W-3 Transmittal of Wage and Tax Statements. A sole proprietorship consists of an individual or a married couple.

If your business owes someone money you owe them that money personally. This is because as a sole proprietor you dont have to file a separate business tax return. Setting up a sole proprietorship differs from state to stateand even city to cityso you will want to check the laws in your area.

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

5 Sole Proprietorship Pros And Cons

5 Sole Proprietorship Pros And Cons

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

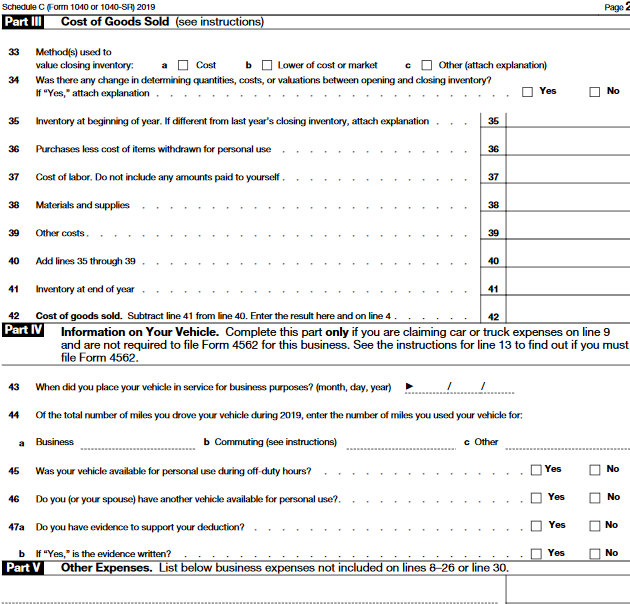

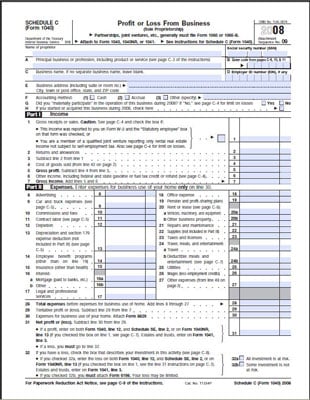

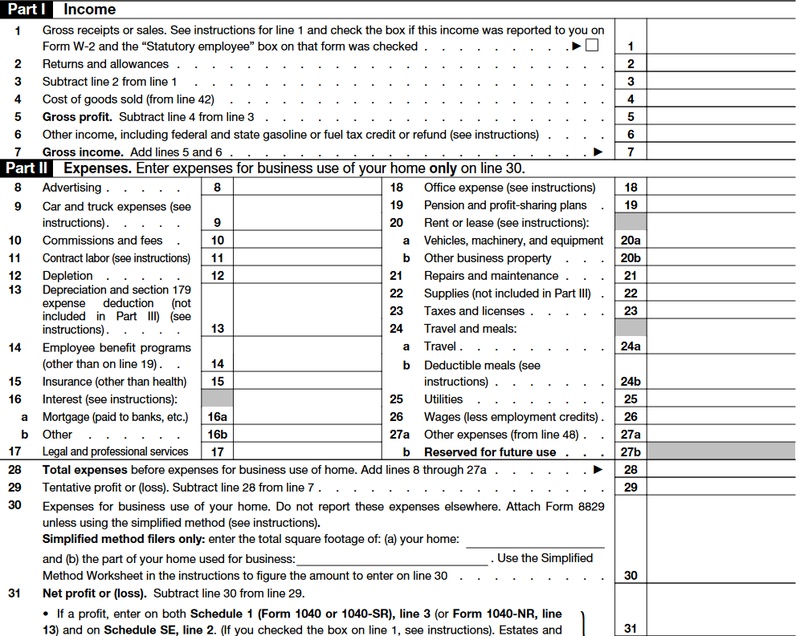

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

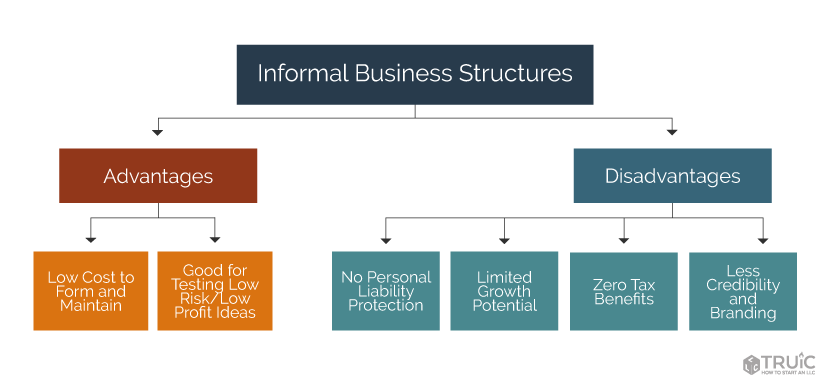

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

The Federal Tax Forms For A Sole Proprietorship Dummies

The Federal Tax Forms For A Sole Proprietorship Dummies

Pros And Cons Of A Sole Proprietorship

Pros And Cons Of A Sole Proprietorship

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietor Tax Forms Everything You Ll Need In 2021 The Blueprint

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic