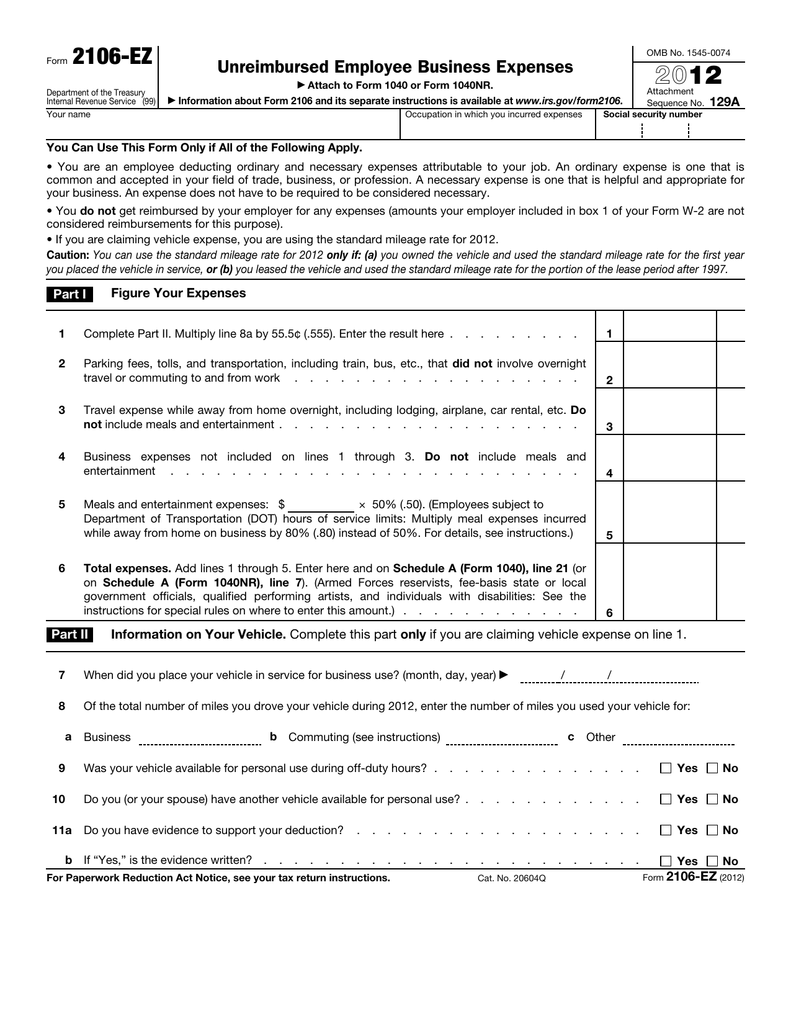

Unreimbursed Business Expenses Form 2106

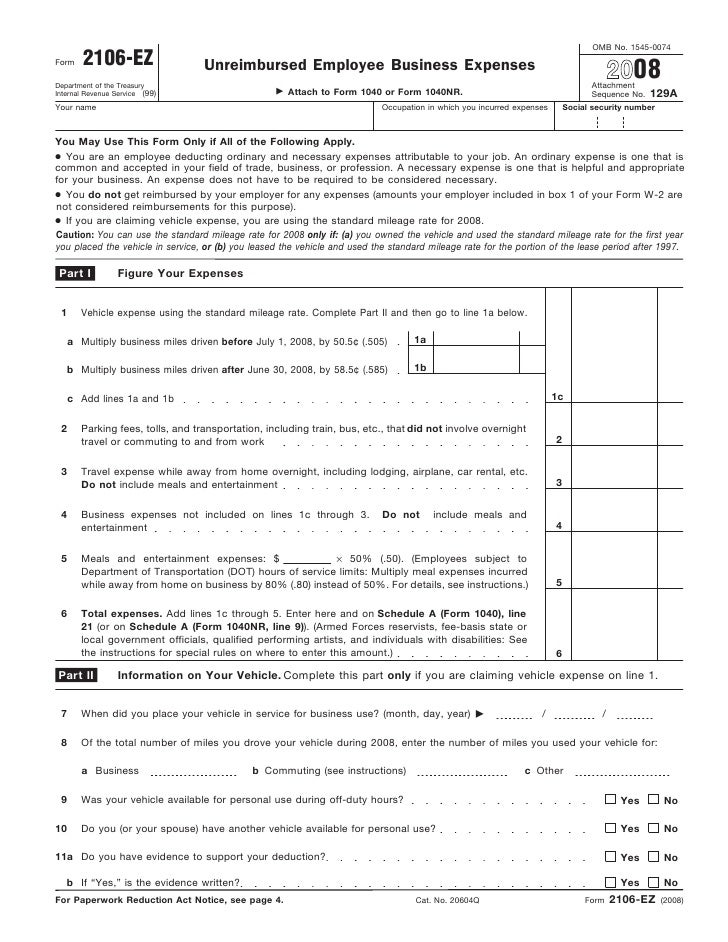

Unreimbursed Employee Business Expenses was a tax form issued by the Internal Revenue Service IRS for use by employees who wished to deduct ordinary and necessary expenses related. Limitations on the deduction depend on your worker classification and.

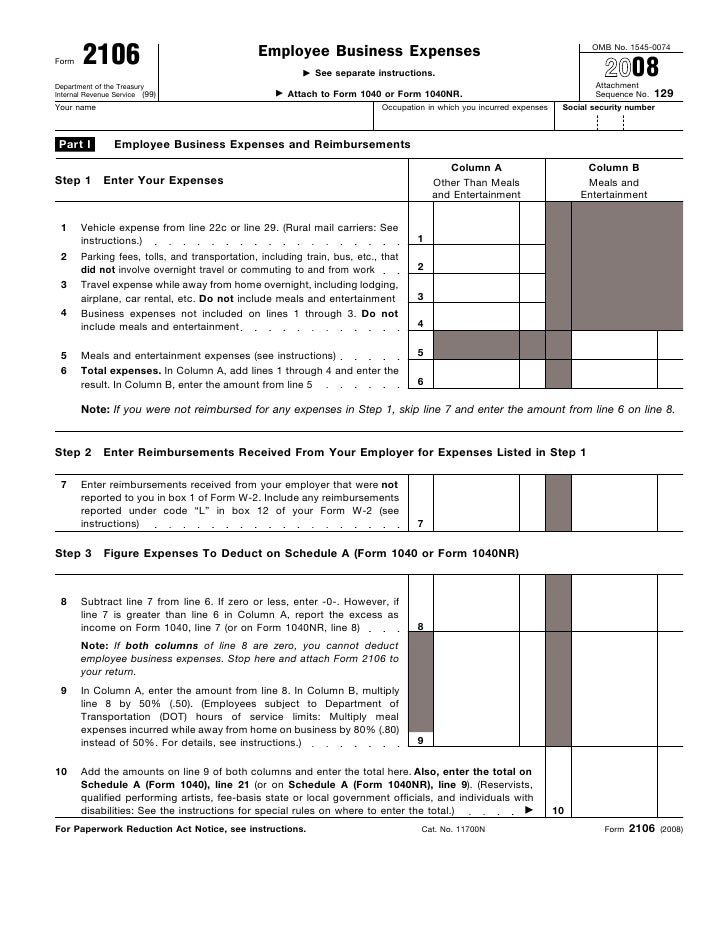

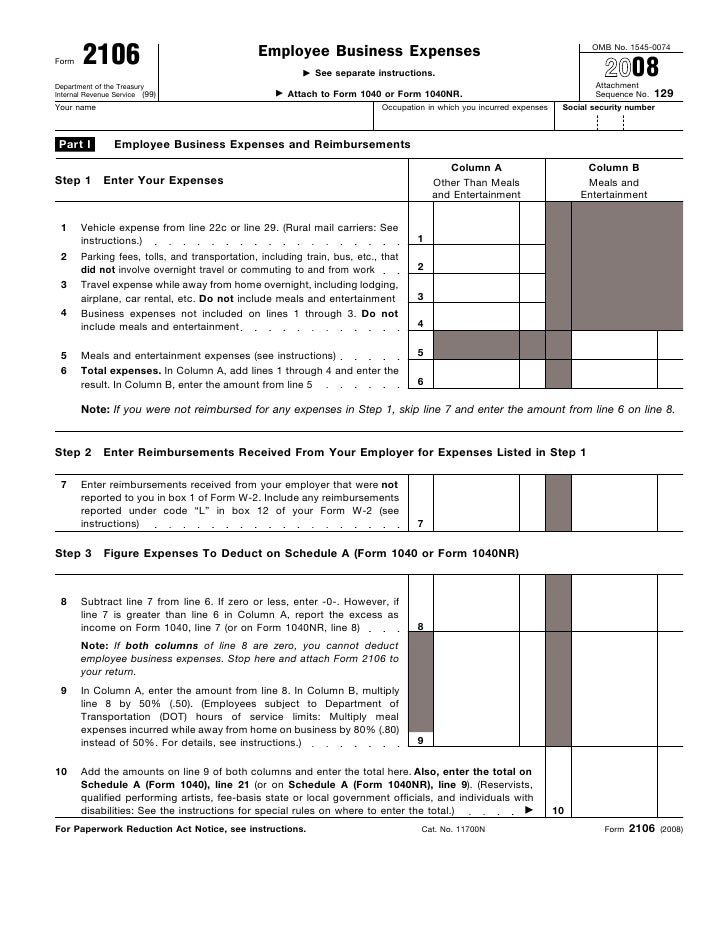

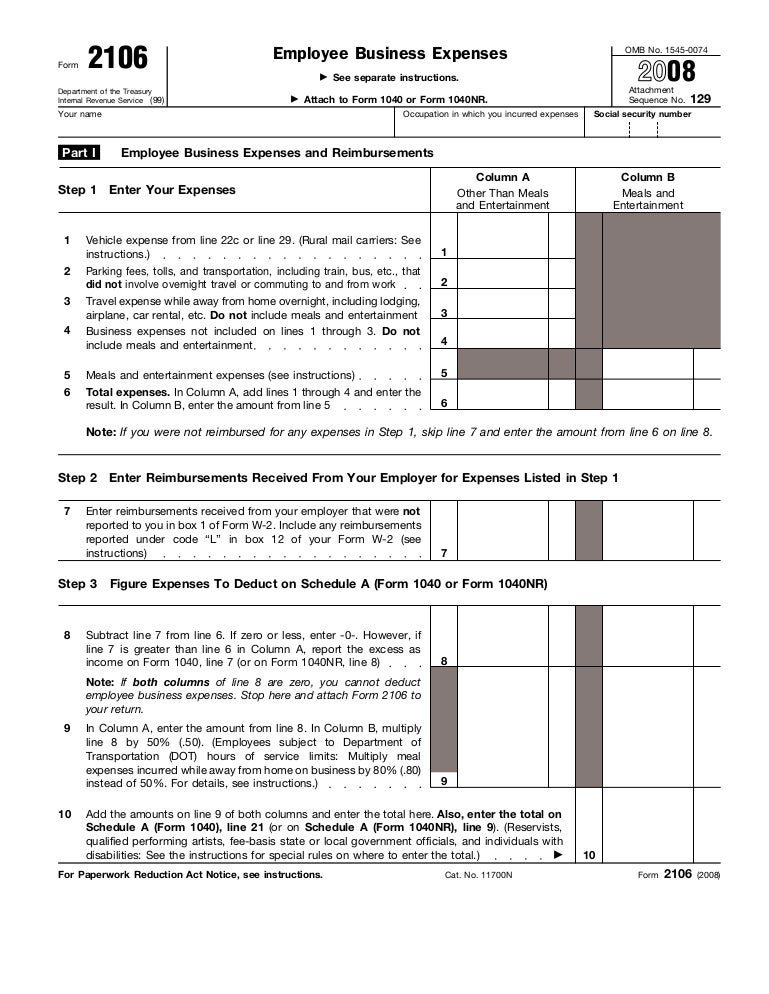

Form 2106 Employee Business Expenses

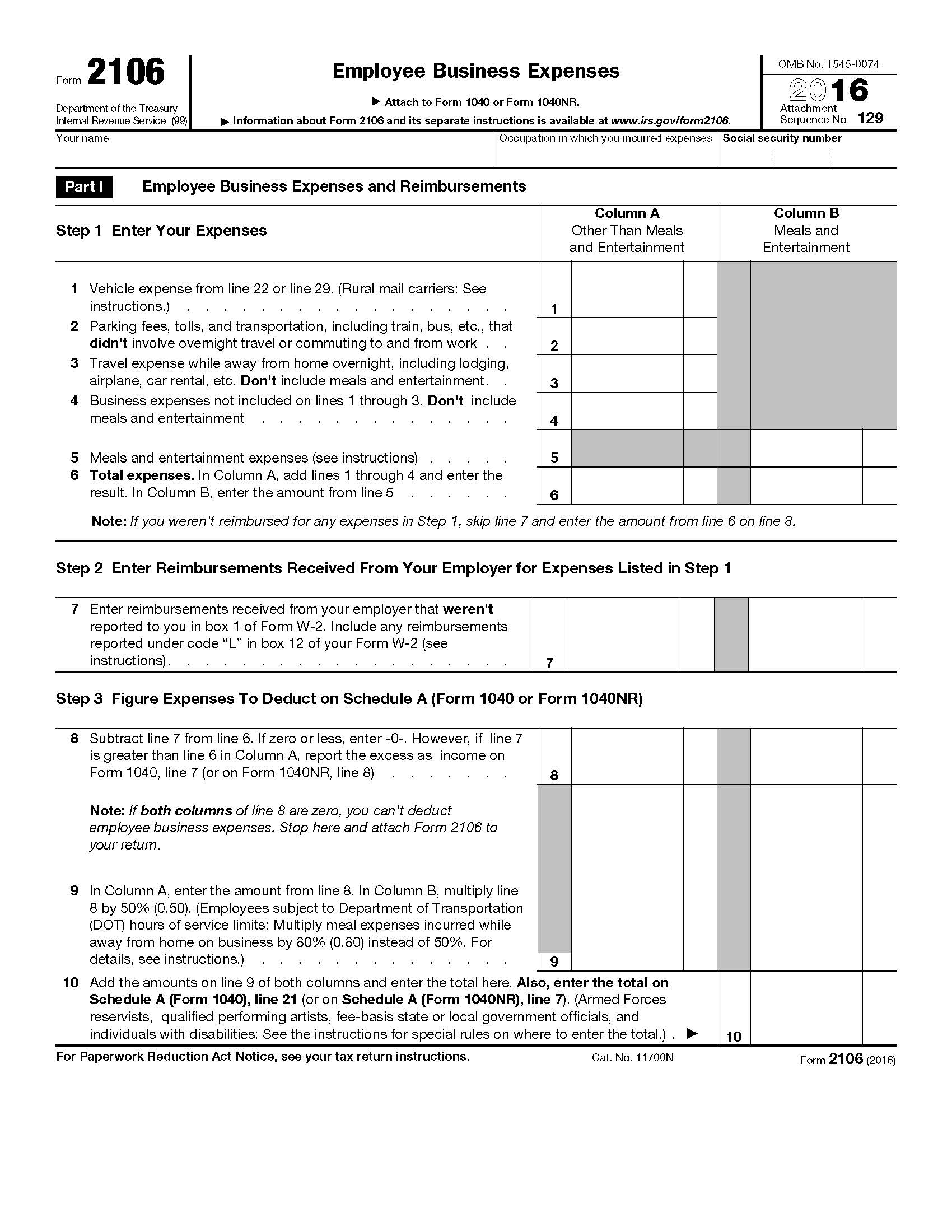

Form 2106 Employee Business Expenses

Unreimbursed moving expenses are deducted using Form 3903 Moving Expenses.

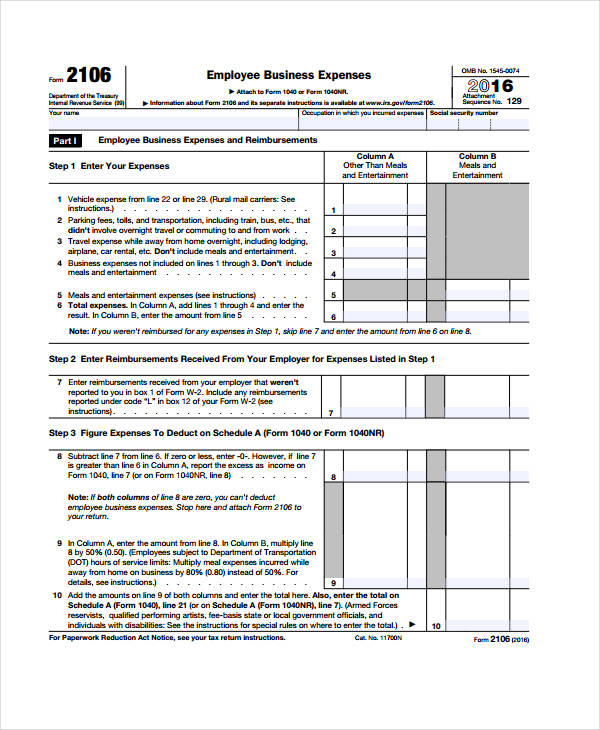

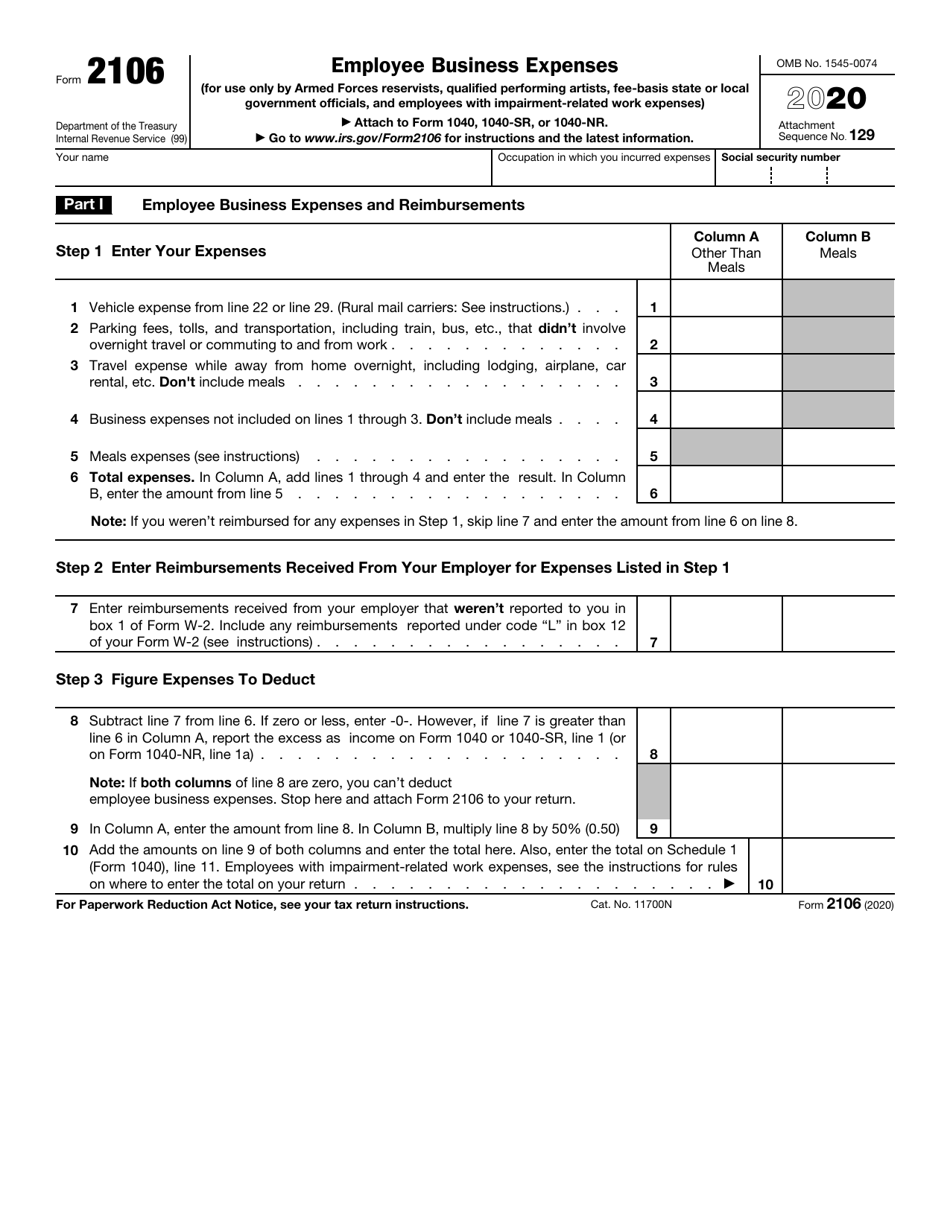

Unreimbursed business expenses form 2106. Employees file this form to deduct ordinary and necessary expenses for their job. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator. These expenses are used when calculating an automobile allowance and commission income when it is 25 or more of employment income.

2 days ago This article was published by the IRS. For tax years 2017 and prior. Armed Forces members receive a variety of moving reimbursements and allowances that must be considered when determining if the expenses are deductible.

Oct 06 2020 Members of the groups qualified to deduct unreimbursed business expenses should file Form 2106 with their personal tax returns. An expense doesnt have to be required to be considered necessary. Business expenses for Armed Forces reservists are deducted on Form 2106 Employee Business Expenses.

Information about Form 2106-EZ and its instructions is available at wwwirsgovform2106ez. Form 2106 2020 Employee Business Expenses for use only by Armed Forces reservists qualified performing artists fee-basis state or local government officials and employees with impairment-related work expenses Department of the Treasury Internal Revenue Service 99 Attach to Form 1040 1040-SR or 1040-NR. S Corporation Shareholders are viewed as employees of the S Corporation and as such unreimbursed expenses should be reported on Form 2106.

They must complete Form 2106 Employee Business Expenses. Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. F File Form 2106 see Notes below.

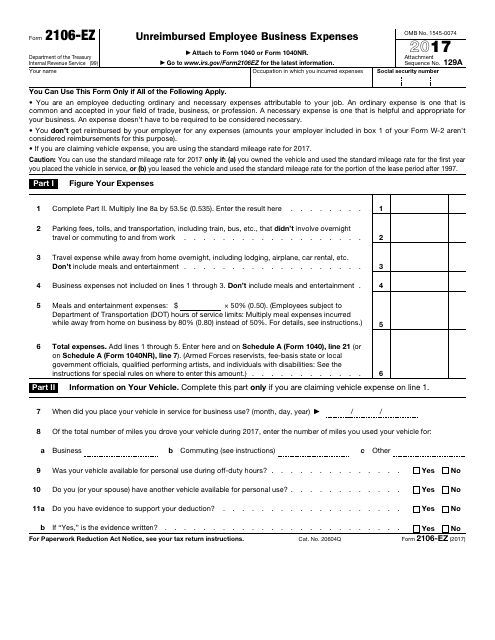

Complete page 2 of this form to calculate your deduction based on the miles you drove if you want to deduct your actual vehicle expenses. A necessary expense is one that is helpful and appropriate for your business. Unreimbursed Employee Business Expenses was a simplified version and was used by employees claiming a tax deduction because of unreimbursed expenses related to their jobs.

Use the standard mileage rate if claiming vehicle expense and Werent reimbursed by your. Jul 17 2020 If youre submitting an abatement or amended return for a tax year prior to 2018 youll need to include the following. Dec 04 2018 return IRS Form 2106 or IRS Form 1040 Schedule A or C.

If you qualify complete Form 2106 and include the part of the line 10 amount attributable to the expenses for travel more than 100 miles away from home in connection with your performance of services as a member of the reserves on Schedule 1 Form. Jan 03 2021 Claiming employee business expenses begins with completing Form 2106 to figure out the total amount of the deduction youre entitled to. Oct 01 2017 business.

Instead these expenses are reported on Form 2106. Feb 18 2021 About Form 2106 Employee Business Expenses. Information about Form 2106 and its separate instructions is available at wwwirsgovform2106.

Unreimbursed Employee Expenses - Vehicle Expenses Beginning in tax year 2018 you cannot claim auto expenses on form 2106 unless you are an Armed Forces reservist qualified performing artist fee-basis state or local government employee or employee with impairment-related work expenses. As a result of the tax law changes that will prevent lenders from being able to identify unreimbursed business expenses we are removing the requirements for IRS Form 2106. Occupation in which you incurred expenses.

Form 2106 - Employee Business Expenses or US. Form 2106 EZ - Unreimbursed Employee Business Expenses with US. Form 2106-EZ Department of the Treasury Internal Revenue Service 99 Unreimbursed Employee Business Expenses Attach to Form 1040 or Form 1040NR.

1040 Schedule A if the deduction was taken federally. You can file Form 2106-EZ Unreimbursed Employee Business Expenses provided you were an employee deducting ordinary and necessary expenses for your job and you. Form 2106-EZ Department of the Treasury Internal Revenue Service 99 Unreimbursed Employee Business Expenses Attach to Form 1040 or Form 1040NR.

Oct 01 2020 File Form 2106. Form 2106 may be used only by Armed Forces. Occupation in which you incurred expenses.

Since Supplemental Business Expenses SBE would be required to be shown as Unreimbursed Business Expenses UBE S Corporations do not report UBEs on Schedule E Page 2. Notes Armed Forces reservists quali ed performing artists fee-basis state or local government of cials and individuals with disabilities should see the instructions for line 10 to nd out where to deduct employee expenses. An ordinary expense is one that is common and accepted in your field of trade business or profession.

Although it has been almost a year since FNMA published more definitive guidelines on when to subtract unreimbursed business expenses lovingly known as 2106 expenses or URBEs in the industry the topic of To deduct or not to deduct is still a top question.

Form 2106 Ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106ez Unreimbursed Employee Business Expenses

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Prior I2106 2014 Pdf

Taxes From A To Z 2015 A Is For Actual Expense Method Tax Time Union Dues Tax

Taxes From A To Z 2015 A Is For Actual Expense Method Tax Time Union Dues Tax

2020 Form Irs 2106 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 2106 Fill Online Printable Fillable Blank Pdffiller

Https Www Irs Gov Pub Irs Prior F2106 1967 Pdf

Free 10 Business Expense Forms In Pdf Excel Ms Word

Free 10 Business Expense Forms In Pdf Excel Ms Word

Https Www Irs Gov Pub Irs Prior F2106 1964 Pdf

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

2106 Employee Business Expenses 2106 Schedule1

2106 Employee Business Expenses 2106 Schedule1

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Irs Form 2106 Ez Download Fillable Pdf Or Fill Online Unreimbursed Employee Business Expenses Templateroller

Form 2106 Employee Business Expenses

Form 2106 Employee Business Expenses

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Form 2106 Employee Business Expenses

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller

Irs Form 2106 Download Fillable Pdf Or Fill Online Employee Business Expenses 2020 Templateroller