How To Check If A Company Is Vat Registered In South Africa

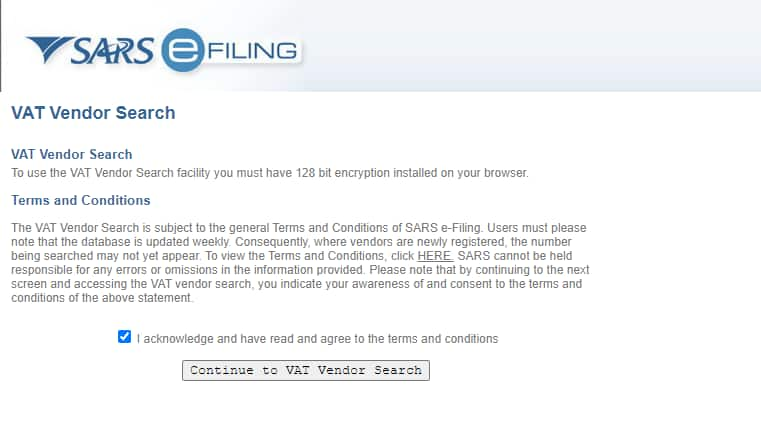

Select Notice of Registration 6. The VAT Vendor Search is designed to only verify a VAT registration number if the exact correct trading name has been entered.

A 3D Secure cheque or credit card that is enabled for online transactions.

How to check if a company is vat registered in south africa. A valid tax invoice must contain the words tax invoice and must display the correct VAT Number apart from certain other requirements. 28 March 2020 - VAT vendors can now request and obtain a VAT Notice of Registration on eFiling if they are registered on SARS eFiling. It can also be dissolved as result of liquidation.

According to SARS you can register once for all. Login to SARS eFiling 3. When your business has registered as a VAT vendor it is obliged to charge VAT or output tax at 15 on all.

Login on httpseservicescipccoza if you do not have a South African ID. Users must please note that the database is updated weekly. Select Notice of Registration 6.

The company name search South Africa costs R88 tax included. A list of up to four 4 proposed names for your company. A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000.

VAT vendors can also request and obtain a VAT Notice of Registration on eFiling. Login to SARS eFiling 3. If your company or close corporation ceases to operate you may deregister it with the Companies and Intellectual Property Commission CIPC.

A business generating an income exceeding R50 000 within a 12-month period may voluntary register for VAT. Click SARS Registered details on the side menu 5. If as a small business you feel youre ready to take advantage of the benefits proffered by being VAT registered including the rebates you can expect in dealing with foreign suppliers of electronic services simply visit the SARS site fill in the relevant documentation and ensure you have all the required proof with you when visiting your nearest branch.

Details of the directors. To confirm registration and to view your tax number please use the BizProfile funtionality under Services. Follow these easy steps.

The registration details of the firm. To conduct this company search you will enter the registration number of the organisation. Claiming input VAT.

It is required by the South African Revenue Services SARS that any business with an annual income that exceeded or is likely to exceed R1-million in any consecutive 12-month period should be registered for Value-Added Tax VAT. For this reason it is essential that SARS has the correct and updated trading name of an enterprise on record. The registered name of the firm.

It is designed for businesses to use but is nevertheless accurate. New companies as soon as the registration is completed as also instantly registered with SARS. Click SARS Registered details on the side menu 5.

VAT Number is a unique number which comprises of 10 digits and starts with the number 4. Go to the Organizations main menu 4. The effects of being a VAT vendor.

Deregistration implies that a business ceases to be registered as either a company or close corporation no legal persona or standing since it no longer. The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing. Consequently where vendors are newly registered the number being searched may not yet appear.

VAT is an indirect tax on the consumption of goods and services in the economy. Once you are VAT registered you must either get an accounting firm involved to make sure you keep your accounts and admin in order or have an. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million.

If you are suspicious about a firm you can find out if the VAT registration number it uses is genuine. The European Union has a website to check this. Go to the Organizations main menu 4.

On the up side for registered VAT vendors input VAT may be claimed on taxable supplies or services purchased from a VAT vendor for business purposes. Alternatively you can call HM Revenue and Customs HMRC during working hours to check on 0845 010 9000. VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors.

For director verification you need to have all directors identity documentscards and marriage certificates. Follow these easy steps. The search provides you with these details.

All companies that are already registered have been automatically registered for tax with the South African Revenue Service SARS.

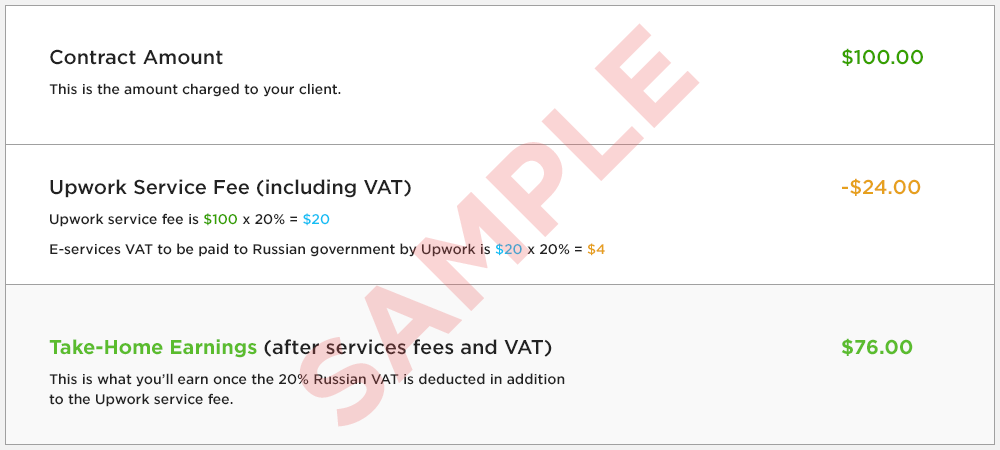

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

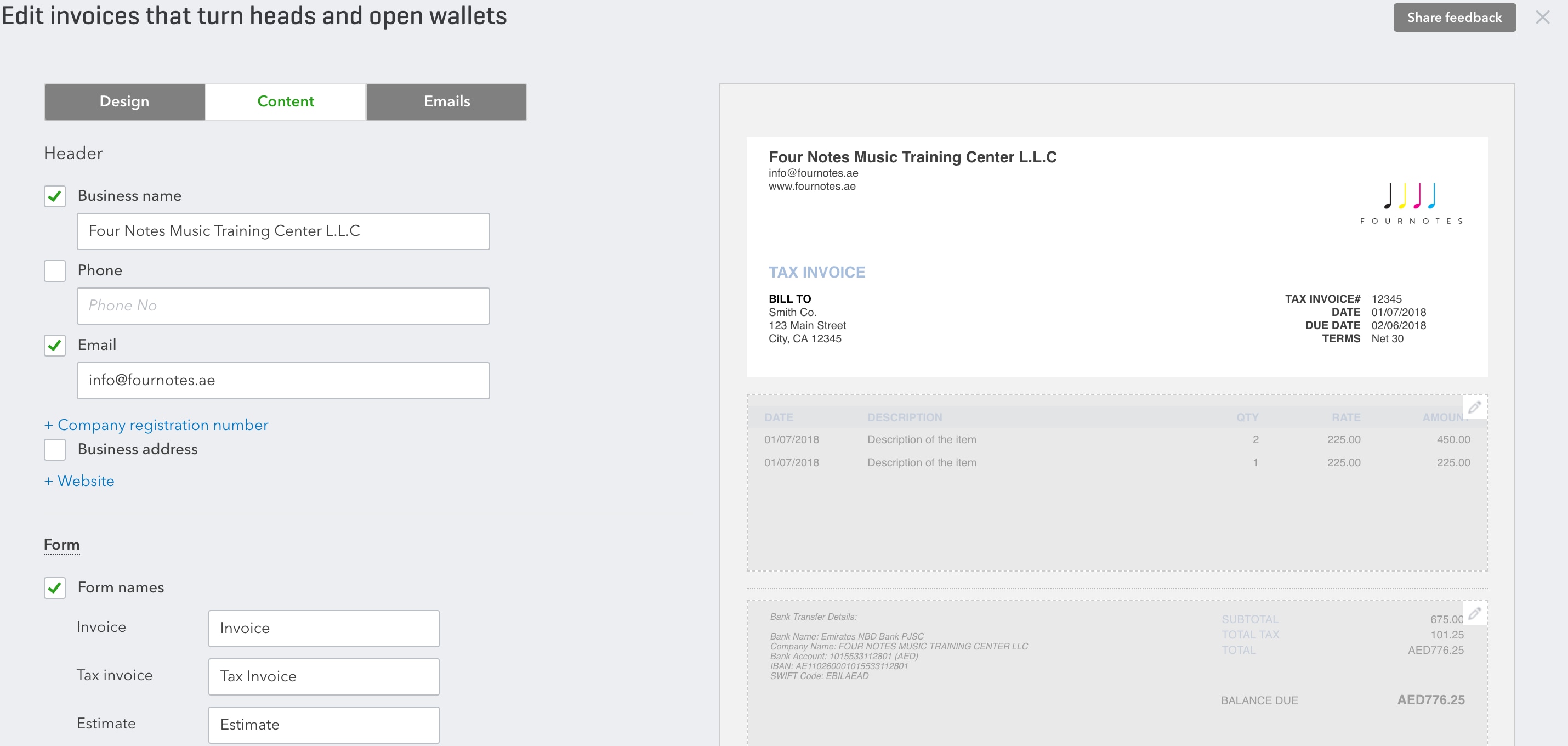

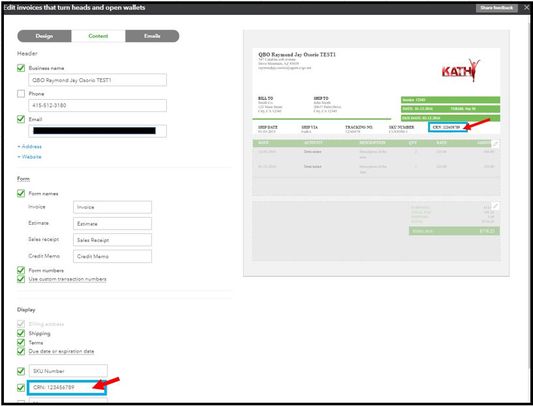

How Do I Add Vat Number To Invoice

How Do I Add Vat Number To Invoice

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Vat Number Search Simple Steps To Find The Vat Number Of A Business

Vat Number Search Simple Steps To Find The Vat Number Of A Business

Brexit Vat On Services To Eu Or Uk

Brexit Vat On Services To Eu Or Uk

How To Register For Vat On Efiling

How To Register For Vat On Efiling

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

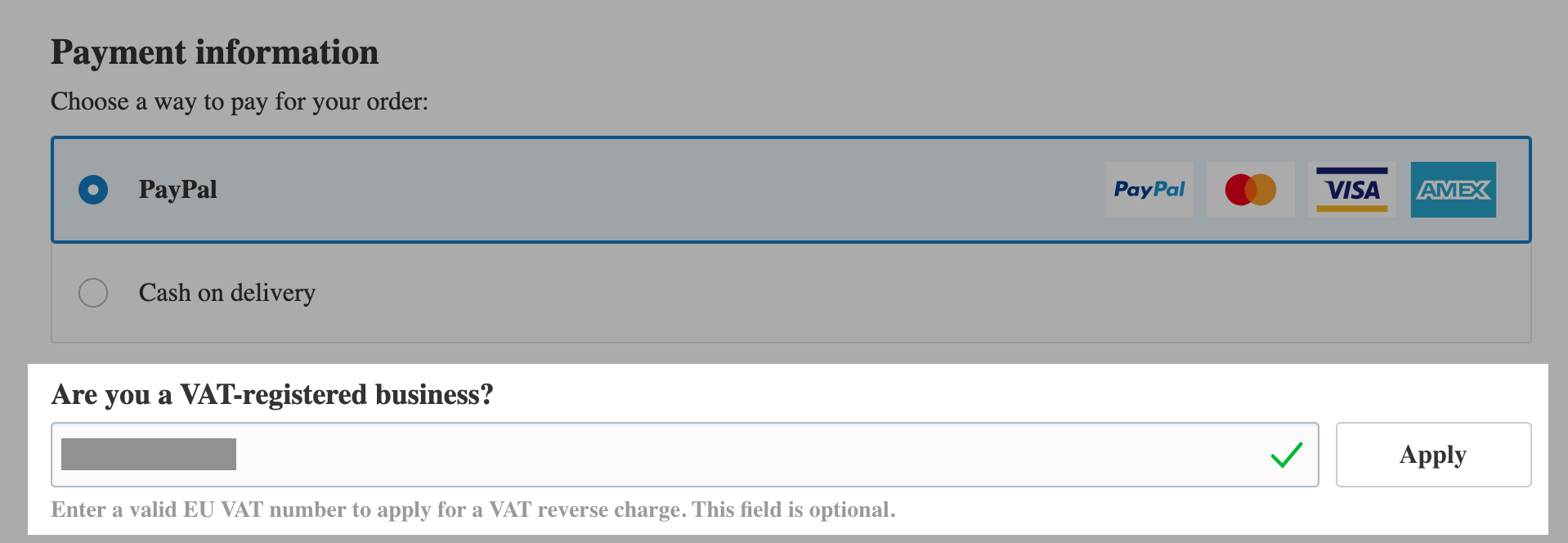

Eu Taxes Vat In Ecwid Ecwid Help Center

Eu Taxes Vat In Ecwid Ecwid Help Center

Vat Registration Requirements List In South Africa 2021

Vat Registration Requirements List In South Africa 2021

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Will I Be Charged Tax On My Purchases Of Flippingbook Products And Services Flippingbook

Will I Be Charged Tax On My Purchases Of Flippingbook Products And Services Flippingbook

Include And Validate Your Customers Vat Registration Numbers Sufio For Shopify

Include And Validate Your Customers Vat Registration Numbers Sufio For Shopify

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers South Africa Tin Pdf