How To Determine 1099 Vendors In Quickbooks

For an Existing Vendor. Click Prepare 1099s then select Continue your 1099s.

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

Select Print sample on blank paper to see its preview then click Print at the bottom.

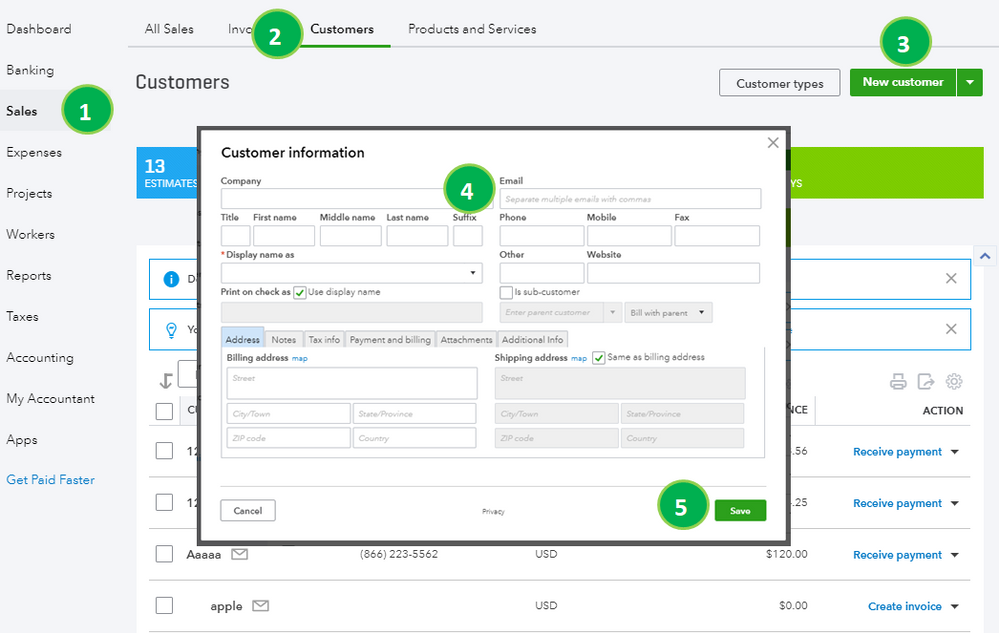

How to determine 1099 vendors in quickbooks. At the upper right select Edit. You will need to provide a 1099 to any vendor who is a. Mark the Track payments for 1099 checkbox.

You can also fill in their address email and EIN numbers in this window. From the left menu select Reports. Choose Finish preparing 1099s then select Print and mail.

QuickBooks will start tracking all of their payments behind the scenes. From the RowsColumns drop-down menu select Change columns. Only those contractors you paid above the threshold usually 600 get a 1099.

Select the Track 1099 checkbox. Payments to Report A Form 1099 MISC must be filed for each. Edit the Vendor Card over in the Expenses Vendors list.

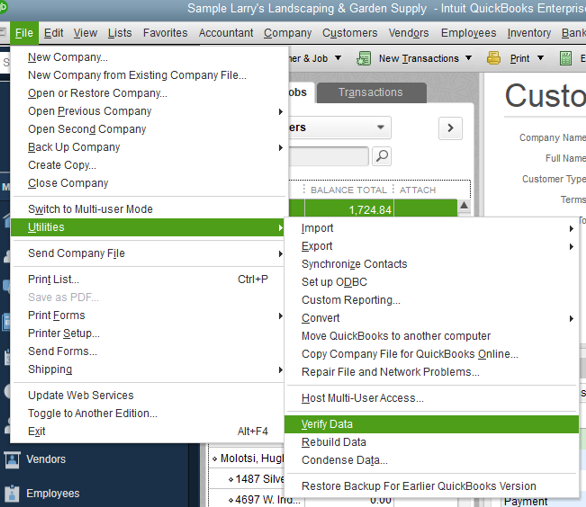

First you will upload the Vendor Contact Report. Make sure your payments to this vendor meet the threshold. Set Up an Established Vendor As a 1099 Payee.

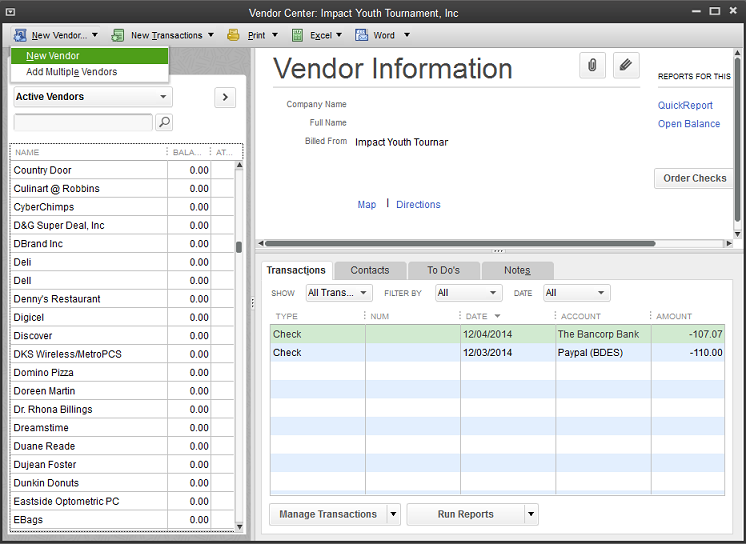

Click the New Vendor drop-down menu and select Add New Vendor. Search for Vendor Contact List and open the report. Print a 1099 Vendor.

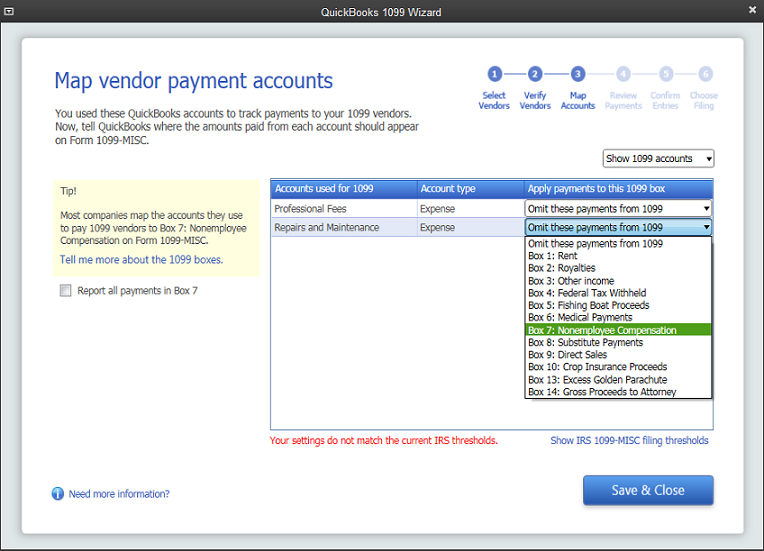

And then choose which accounts you want to track these payments. From the left menu select Expenses then Vendors. Heres how to get the report that lists all of your 1099 vendors.

Search for Vendor Contact List and open the report. The QuickBooks Vendors Payables Reports give you data about how much money your company owes. You can see which vendors dont meet the threshold.

From the Sort by drop-down menu select Track 10. Double-click the name of the vendor on. When youre done select OK.

Once you have this list of vendors figured out even if there are still some youre unsure of figure out HOW you have paid them. Select the Sort drop-down menu. From the RowsColumns drop-down menu select Change columns.

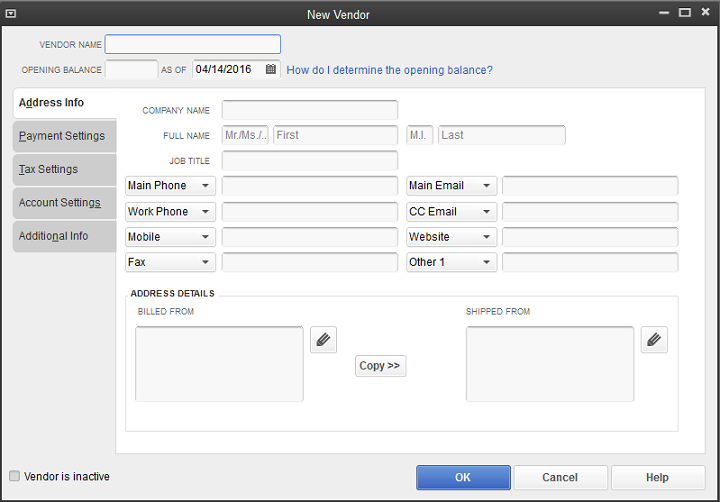

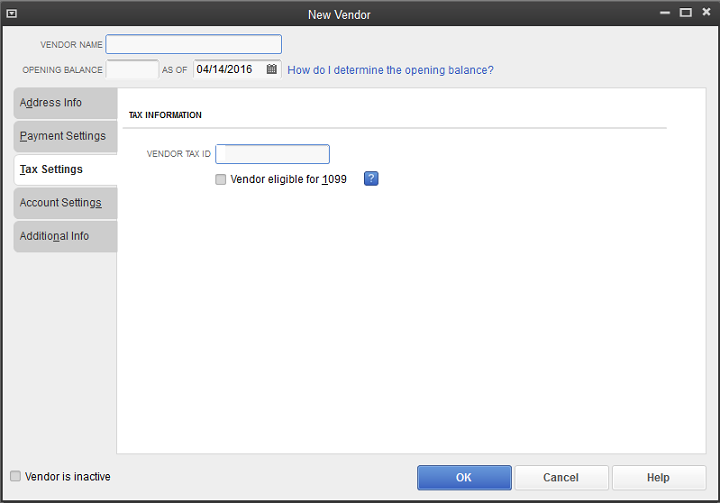

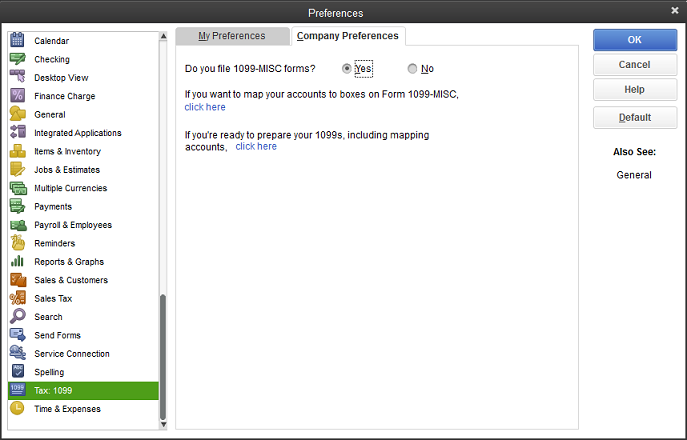

Go to ImportsQuickbooks Desktop S croll down until you see the 3rd option labeled QuickBooks 1099 Excel Import Then you will see the two options to upload the Vendor Contact Report and the Vendor Summary Report. Enter the vendors tax identification number in the Vendor Tax ID field. Log in to your QuickBooks Online QBO account.

In the What You Owe box you can select reports for 1099 Contractor Balance Detail and 1099 Balance Summary. If you want to sort the report by 1099 vendors. I always confuse Vendor Name Company Name First Last Name and what is listed on address.

Ex Joe Smith dba Smith Landscaping. How to find and produce 1099 reports in Quickbooks Heres how to get the report that lists all of your 1099 vendors. Select the vendor you want to convert.

Select the Track 1099 checkbox. Either scroll to the vendor you are updating or click on the search bar and search for their name. Whats the rules in QB vendor to have 1099 print correctly to match TIN and name per IRS records.

Here are some guidelines to help determine if a vendor needs to be set up as a 1099 vendor. Select the Sort drop-down menu. Thus personal payments arent reportable.

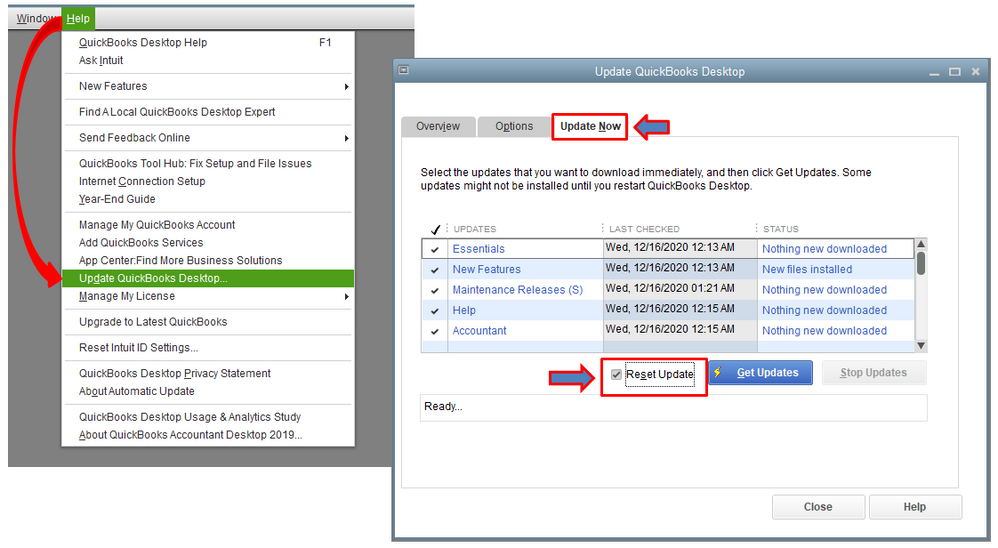

Check off Track Payments for 1099 on the bottom right. Open QuickBooks on your computer. When youre ready to file your 1099s you can easily add the tracked payments to the form.

If you want to sort the report by 1099 vendors. Once this is checked off the Vendor will also. LLC and has not taken the S Corp election LLP.

A person is engaged in business if he or she operates for profit. How to Do a 1099 on QuickBooks Add a 1099 Vendor. 1099 Rules Regulations Who must file.

Persons engaged in a trade or business must file Form 1099 MISC when certain payments are made. Open QuickBooks on your computer. IRS match is Joe Smith 111-22-3333.

How to Run a 1099 Vendor Summary Report in QuickBooks If your vendors in QuickBooks are properly flagged as Eligible for 1099 running a 1099 Summary Report for the prior year is simple. Select the Additional Info tab and enter the vendors tax ID number which they must have furnished. Once you find them click on their Name which will bring you to their vendor file.

To add a 1099 vendor click the Vendor Center icon and select the New Vendor option in the upper left corner and enter the name contact information and opening balance if any in the spaces provided in the resulting entry fields. When preparing 1099-MISC forms for your contractors or 1099 vendors you must report the total payments in the correct boxes. Select and check the Vendor eligible for 1099.

Go to the Expenses menu then select Vendors. Click on the top right Edit Fill out any of the missing fields as suggested previously in the New Vendor section of this tutorial. Click Reports in the left-hand tab.

These QuickBooks reports will help you manage your payables to ensure that you pay your vendors timely forecast your cash outflows and determine which vendors cost you the most money for the goods and services they provide to your company. Learn how to use accounts to track 1099 payments. Did you pay your vendor via check bank draft debit card PayPal or credit card.

In this article well show you how to do that.

Setting Up Sales Tax In Quickbooks Bookkeeper Know How

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Print 1099s In Quickbooks Online

How To Print 1099s In Quickbooks Online

How To Setup Vendors For 1099 In Quickbooks For Windows

How To Setup Vendors For 1099 In Quickbooks For Windows

Tracking 1099 Vendor Payments In Quickbooks Online Youtube

Tracking 1099 Vendor Payments In Quickbooks Online Youtube

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

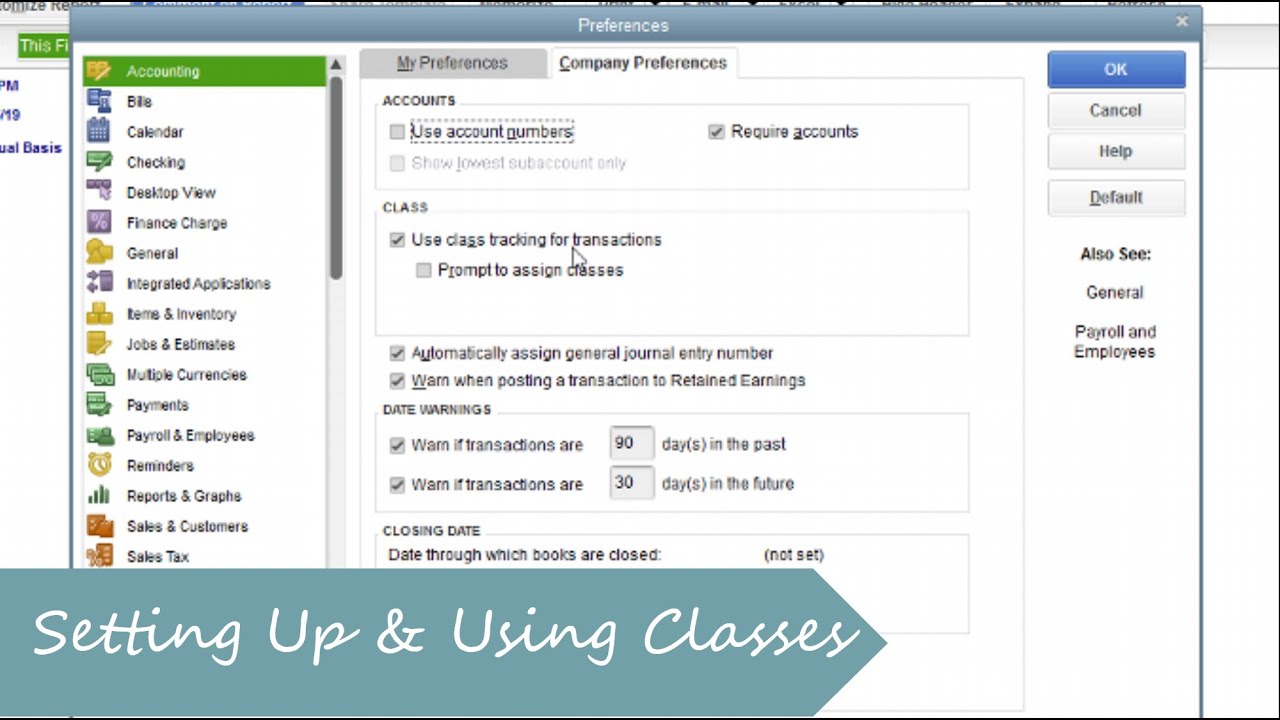

How To Setup And Use Classes In Quickbooks Youtube

How To Setup And Use Classes In Quickbooks Youtube

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center

How To Run A 1099 Vendor Summary Report In Quickbooks Asap Help Center