In Which Form Of Business Ownership Are The Owners Called Members

In other LLCs there are at least some members who are not actively involved in running the business. A business that is owned and operated by two or more people -- and the least used form of business organization in the United States.

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

Its owners called members rather than shareholders are not personally liable for debts of the company and its earnings are taxed only once at the personal level thereby eliminating double taxation.

In which form of business ownership are the owners called members. What are the owners of an LLC called. LLC owners are called members. It is a legal business entity that offers limited liability to all of its owners who are called stockholders.

In a limited-liability company owners called members rather than shareholders are not personally liable for debts of the company and its earnings are taxed only once at the personal level thereby eliminating double taxation. Insurance firms and banks are not allowed to be owners of an LLC. Single-member LLC owners are considered to be sole proprietors for tax purposes so they take a draw like a sole proprietor.

The owners of an LLC are called members A member can be an individual partnership corporation trust and any other legal or commercial entity. The people who run an LLC are called managers. Owners of limited liability companies LLCs called members are not considered employees and do not take a salary as an employee.

A member of an LLC can be a corporation or individual. However the organizational documents can change this terminology. Generally the liability of the members is limited to their investment and they may enjoy the pass-through tax treatment afforded to partners in a partnership.

A limited liability company LLC is a unique form of business entity. A form of business ownership in which the owners share the risk of loss and the chance for profit. In some LLCs the business is operated or managed by its members.

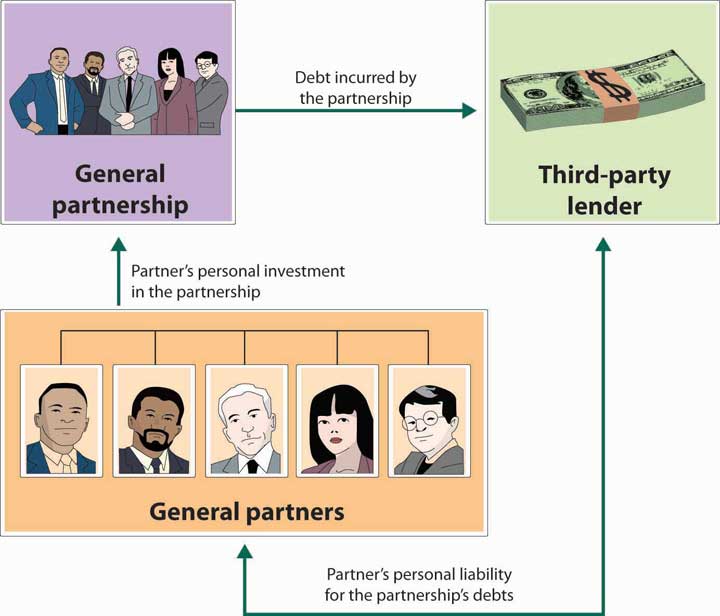

If you own all or part of an LLC you are known as a member LLCs can have one member or many members. The time limit can be continued if desired by a. In a general partnership all partners have unlimited liability while in a limited partnership at least one partner has liability limited only to his or her investment while at least one other partner has full liability.

Sole proprietorship 9 In this form of business owners called members are not personally liable for the business debts. An owner within a limited liability company is usually referred to as a member. When you form an LLC and become an owner you put money into the business to get it started.

McDonalds Holiday Inn and Ford are examples of businesses that offer _____ to others. The owners are members and the duration of the LLC is usually determined when the organization papers are filed. An owner of an LLC is called a member and the owner is not an employee.

It is a form of business ownership in which two or more members act. There are two basics forms of partnerships general and limited. We have touted the benefits of limited liability protection for an LLC.

In many ways a limited-liability company looks a lot like an S-corporation. Your contribution to the LLC as a member is called your capital contribution your contribution to the ownership.

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

Business Plan Tutorial Types Of Business Ownership Livecareer

Business Plan Tutorial Types Of Business Ownership Livecareer

4 Types Of Partnership In Business Limited General More

4 Types Of Partnership In Business Limited General More

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

9 Steps To Form A Llc Business Llc Business Small Business Tips Small Business Finance

9 Steps To Form A Llc Business Llc Business Small Business Tips Small Business Finance

Small Business Legal Forms Bill Of Sale Cease And Desist Letter Legal Form Templates Operating Agreement Business Contracts Form Legal Forms Small Business Agreement

Small Business Legal Forms Bill Of Sale Cease And Desist Letter Legal Form Templates Operating Agreement Business Contracts Form Legal Forms Small Business Agreement

Sales And Marketing Agreement Sample Template Sales And Marketing Marketing Business Template

Sales And Marketing Agreement Sample Template Sales And Marketing Marketing Business Template

Affidavit Of Ownership Form Property Vehicle Ownership Affidavit Sample Template Online Entrepreneur Agreement Templates

Affidavit Of Ownership Form Property Vehicle Ownership Affidavit Sample Template Online Entrepreneur Agreement Templates

Types Of Business Structures Sole Proprietorship Llc More

Types Of Business Structures Sole Proprietorship Llc More

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Llc Membership Certificate Template Word 1 With Regard To Llc Membership Certificate Template Wor Certificate Templates Free Certificate Templates Certificate

Llc Membership Certificate Template Word 1 With Regard To Llc Membership Certificate Template Wor Certificate Templates Free Certificate Templates Certificate

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

Business Ownership Structure Types Business Structure Business Checklist Business Ownership

Business Ownership Structure Types Business Structure Business Checklist Business Ownership

Limited Liability Company Llc Definition Limited Liability Company Liability Llc Business

Limited Liability Company Llc Definition Limited Liability Company Liability Llc Business

The Tax Implications Of An Llc Differ From Those Of Corporations Llcs Use Pass Through Taxation Which Means Th Business Tax Small Business Tax Paying Taxes

The Tax Implications Of An Llc Differ From Those Of Corporations Llcs Use Pass Through Taxation Which Means Th Business Tax Small Business Tax Paying Taxes

Browse Our Example Of Owner Operator Agreement Template For Free Business Card Template Design Event Planning Quotes Business Proposal Template

Browse Our Example Of Owner Operator Agreement Template For Free Business Card Template Design Event Planning Quotes Business Proposal Template

One Person Company Registration In Jaipur Sole Proprietorship Legal Services Public Limited Company

One Person Company Registration In Jaipur Sole Proprietorship Legal Services Public Limited Company

Business Structures Business Structure Business Business Development

Business Structures Business Structure Business Business Development