Where Do I Mail My 1099 Nec Forms To Irs

Bureau of Individual Taxes. IRS Tax Tip 2020-80 July 6 2020.

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Filer needs to send the IRS a request.

Where do i mail my 1099 nec forms to irs. State-Specific Guidance for Form 1099-NEC Filing Form 1099-NEC with the states may be different than you are used to though. Generally payers must file Form 1099-NEC by January 31. You can either file 1099-NEC electronically with the IRS using the IRS FIRE system or you can mail it to your local Department of the Treasury Internal Revenue Service Center.

The IRS provides an Attachment Sequence Number located on each form you need to submit to let you know the order in which to attach them. 4 rows Mailing Address for Form 1099-NEC. How do I send magnetic media to the State of Michigan.

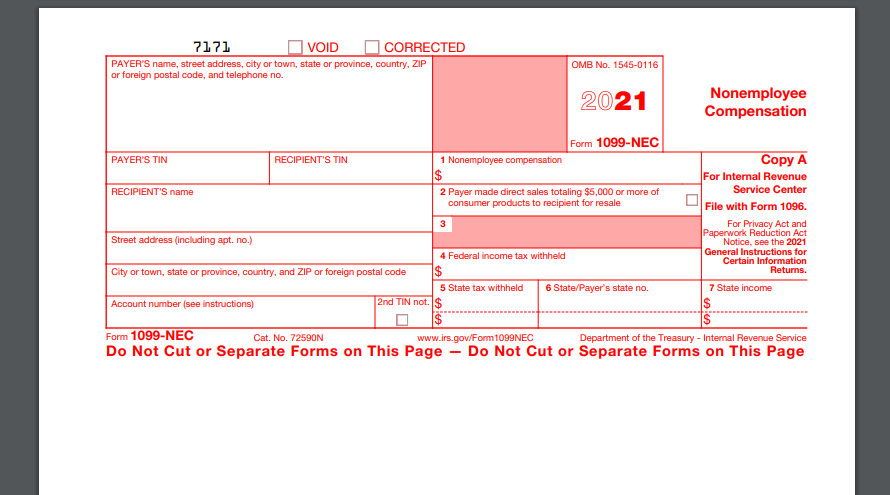

August 12 2019 1031. If the entity is issuing 9 or fewer paper 1099R with a premature distribution of a pension or profit-sharing plan or a 1099 MISCNEC that has zero PA withholdings the forms should be mailed to. There is a new Form 1099-NEC Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation.

Now the IRS provides a separate 1099-NEC Form for reporting non-employee payments. IRS does not provide a separate form for providing an extension to the recipient. Forms W-2 W-2C W-2G 1099-R 1099-MISC and 1099-NEC may be filed by magnetic media.

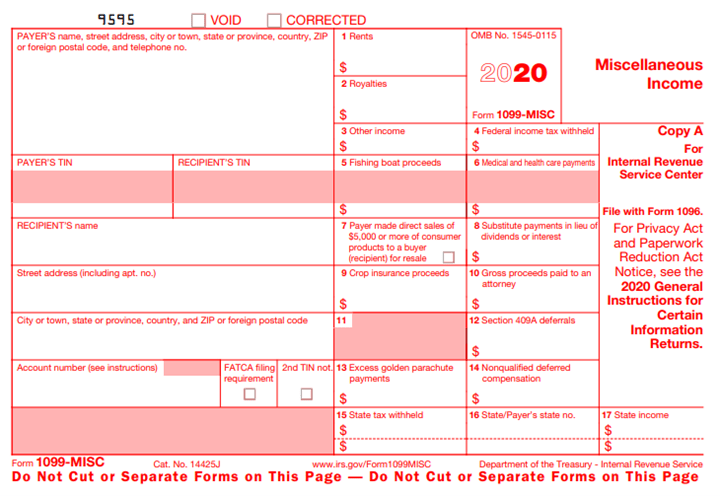

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. Do I have to submit 1099 forms with my state. The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used.

The 1099-NEC form has replaced what used to be recorded on Form 1099-MISC Box 7. Information returns may also be filed electronically using the IRS Filing Information Returns. Starting in tax year 2020 payers must complete this form to report any payment of 600 or more to a payee.

If you have 250 or more income statements you must use MTO to electronically send a magnetic media formatted file. You will complete and send a 1099-NEC form to any independent contractors or businesses to whom you paid over 600 in fees commissions prizes awards or other forms of compensation for services performed for your business. 201 accelerated the due date for filing Form 1099 that includes nonemployee compensation NEC from February.

Depending on where your business is located 1099 firms should be submitted with your. Extension for Sending 1099-Misc Forms to Recipients. Whether or not you must attach a copy of your federal Form 1099 to your tax return depends on if you had any federal taxes withheld during the year.

Mail or hand in the corrected Form 1099-NEC to your independent contractor. The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Whats New Form 1099-NEC.

Mail the corrected Form 1099-NEC and 1096 to the IRS and any required state tax departments. PA Department of Revenue. The PATH Act PL.

What to Do With the 1099-NEC Form You Received. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in. This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

3 rows Check out the mailing address of IRS Form 1099-MISC to mail your returns to the IRS. Click on Employer and Information Returns and well mail you the forms you request and their instructions as well as any publications you may order. The IRS and all other applicable copies of the form visit wwwIRSgovorderforms.

If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676. This tax season millions of independent workers will receive Form 1099-NEC in the mail for the first time. Also the IRS provides only 30 days extension for filing 1099-NEC for certain reasons.

Forms 1099-MISC and 1099-NEC and their instructions such as legislation enacted after they were published go to IRSgovForm1099MISC or IRSgovForm1099NEC. Updated on December 18 2020 - 1030 AM by Admin. Examples of this include freelance work or driving for DoorDash or Uber.

In An Effort To Make Things Easier For Taxpayers And Tax Forms Issuers The Internal Revenue Service Irs Is Bringing B Irs Tax Forms Internal Revenue Service

In An Effort To Make Things Easier For Taxpayers And Tax Forms Issuers The Internal Revenue Service Irs Is Bringing B Irs Tax Forms Internal Revenue Service

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Efile Form 1099 Nec Online 2020 Online Efile Irs Forms

Efile Form 1099 Nec Online 2020 Online Efile Irs Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

1099 Nec Free 1099 Tax Form 1099 Nec Reporting Tax Forms 1099 Tax Form Irs Forms

1099 Nec Free 1099 Tax Form 1099 Nec Reporting Tax Forms 1099 Tax Form Irs Forms

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

New Irs Form 1099 Nec Used To Report Payments To Nonemployee Service Providers

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

What Is Form 1099 Nec Nonemployee Compensation

What Is Form 1099 Nec Nonemployee Compensation

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

New 2020 Form 1099 Nec Non Employee Compensation Virginia Cpa

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

1099 Nec Form Copy A Federal Discount Tax Forms

1099 Nec Form Copy A Federal Discount Tax Forms