What Type Of Business Organizations Are Required To Pay For Mcit

The MCIT Online program is designed as a cohort experience. A corporation shall be liable to pay MCIT computed as 2 of gross income revenue less cost of sales if it has negative taxable income or the MCIT is higher than 30 Regular Corporate Income Tax RCIT.

Minimum Corporate Income Tax Ppt Download

Minimum Corporate Income Tax Ppt Download

The corporation is in its 4th year of operations following the year of the start of the business.

What type of business organizations are required to pay for mcit. RCIT 30 of taxable income. Corporate income tax rates. The business structure you choose influences everything from day-to-day operations to taxes to how much of your personal assets are at risk.

You should choose a business structure that gives you the right balance of legal protections and benefits. Workers compensation may provide benefits for employees who are injured while on the job. A leave of absence may de-activate the students PennKey and PennCard.

A student who wishes to take a leave of absence must submit Leave Of Absence Form. The federal income tax is a pay-as-you-go tax. The MCIT shall be imposed whenever such corporation has zero or negative taxable income or whenever the amount of minimum-corporate income tax is greater than the normal income tax due from such corporation.

The MCIT covers domestic and resident foreign corporations which are subject to the regular income tax. Coverage for Workers Compensation. Being a minimum income tax a corporation should pay the MCIT whenever its regular normal income tax is lower than the MCIT or when the firm reports a net loss in its tax return.

MCIT 2 of gross income. Partnerships file an information return. But the business owner is also personally liable for all financial obligations and debts of the business.

A sole proprietorship is the most common form of business organization. Corporate income tax rates are determined primarily by the business corporate structure and nature of activity. The MCIT Board of Directors is made up of nine representatives from the MCIT membership and includes county commissioners auditorsauditor-treasurers and an administratorcoordinator.

The law provides the exclusive remedy for work-related injuries and limits the amount of compensation. Because the agency is required to make other decisions such as benefit category determinations whether there is an existing payment methodology and whether there is an existing code or establishing code for the MCIT eligible breakthrough device it would be impracticable to operationalize the MCIT rule on the March 15 2021 effective date. - The Secretary of Finance is hereby authorized to suspend the imposition of the minimum corporate income tax on any corporation which suffers losses on account of prolonged labor dispute or because of force majeure or because of legitimate business reverses.

Upon completion of the degree on-campus MCIT alumni have gone on to earn jobs with competitive salaries at leading technology companies such as Amazon Facebook Google Microsoft Oracle and Bloomberg. The types of advisory services available include. What makes this degree unique.

IAET 10 of the improperly accumulated taxable income. Domestic corporations are taxed at the following rates. Refer to Business Structures to find out which returns you must file based on the business entity established.

Its easy to form and offers complete control to the owner. Note that MCIT applies to corporation on its fourth year of operation after the year of its BIR registration. Contact the MCIT Online Student Affairs Team at online-learningseasupennedu for more information.

13 Who are covered by MCIT. When it comes to the provision of network support services MCIT HOUSTON have access to powerful technology that will keep your business going strong whilst being both tough and agileProviding a whole range of networking solutions and services to customers we work with organizations of all sizes empowering them to be in possession of IT services that are robust and resilient. The form you use depends on how your business is organized.

In addition to this MCIT can rely on its access to consulting resources from organisations such as Dell Microsoft SAP NCR Cisco and others to ensure that clients are provided with the proper advice and support based on their actual specific requirements. Generally the Minimum Corporate Income Tax or MCIT is a tax imposed on corporations in lieu of the regular income tax RCIT when both conditions are presentmet. Census data the majority of this businesses type are small businesses with less than 1000 employees 968 out of 1093 businesses have less than 500 employees.

A risk pool such as MCIT offers several membership benefits that are different from those of. During the first 4 years of MCIT we anticipate approximately 14 surgical and medical instrument manufacturers may participate and based off of US. 3 Relief from the Minimum Corporate Income Tax Under Certain Conditions.

The MCIT is an estimate of the income tax that us due a firm. As a sole proprietor you can operate any kind of business. If the regular income is higher than the MCIT then the corporation does not pay the MCIT but the amount of the regular income tax.

Continuous study is recommended. RCIT is lower than MCIT and. It is equal to two percent 2 of the gross income of a corporation at the end of the year.

Minnesotas workers compensation system represents a compromise between the interests of the employer and the employee. All businesses except partnerships must file an annual income tax return. The MCIT shall be imposed whenever such corporation has zero or negative taxable income or whenever the amount of minimum-corporate income tax is greater than the normal income tax due from such corporation.

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation For Corporate Taxpayers Prepared By

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The

Coursera Course Prices Copenhagen Business School Strategy Formulation Strategies Udemy Coupon Certificate Courses

Coursera Course Prices Copenhagen Business School Strategy Formulation Strategies Udemy Coupon Certificate Courses

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The

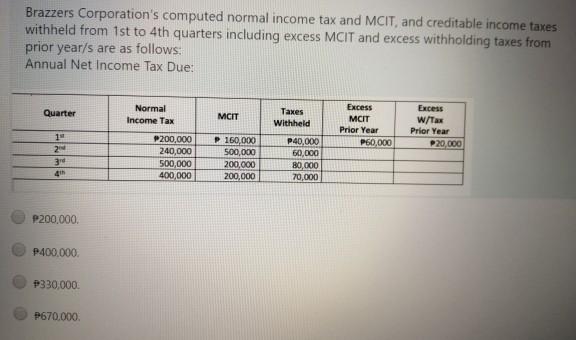

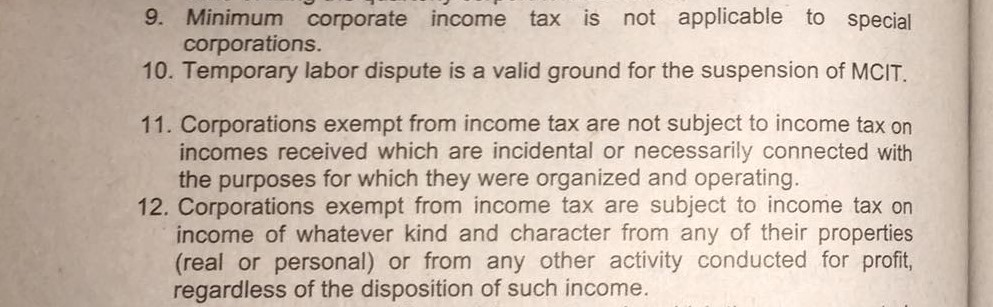

Solved True Or False If The Statement Is False Explain Chegg Com

Solved True Or False If The Statement Is False Explain Chegg Com

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation For Corporate Taxpayers Prepared By

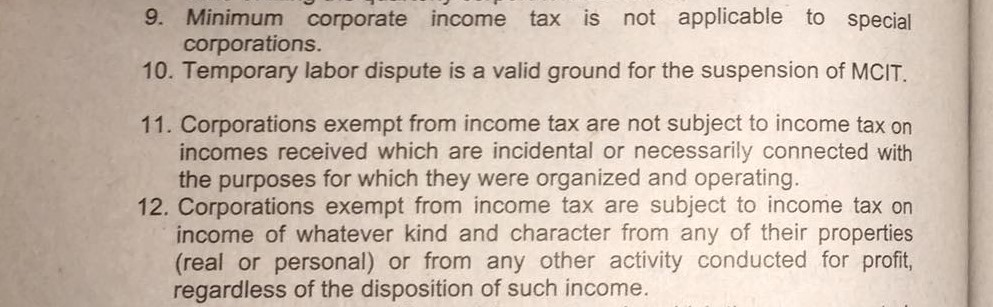

Problems Accounting Treatment Of Excess Mcit Salcedo Corporation A Domestic Corporation Has Been Operating Its Business Since 2003 The Corporation Course Hero

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

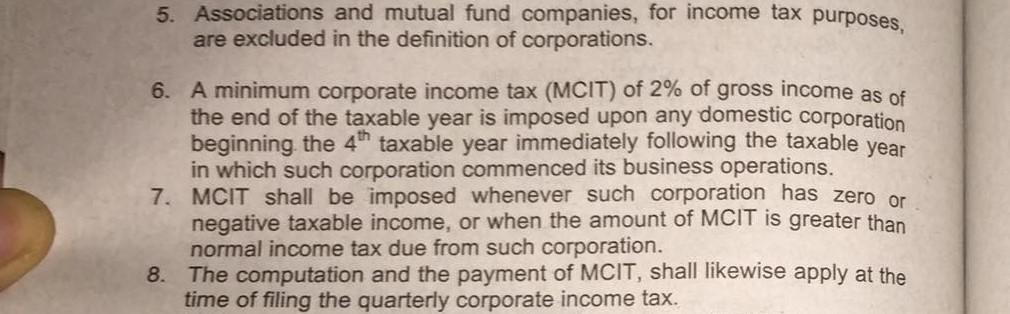

5 Associations And Mutual Fund Companies For Inc Chegg Com

5 Associations And Mutual Fund Companies For Inc Chegg Com

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax Mcit Sec 27 E And Sec 28 A 2 Ppt Download

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The

Minimum Corporate Income Tax What Is Mcit The